Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PR 7-41 (Static) CVP Graph; Cost Structure; Operating Leverage (LO 7-2, 7-3, 7-4, 7-8) [The following information applies to the questions displayed below.] Athletico Incorporated

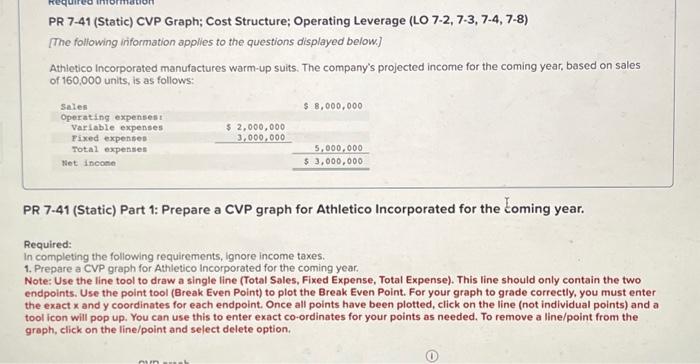

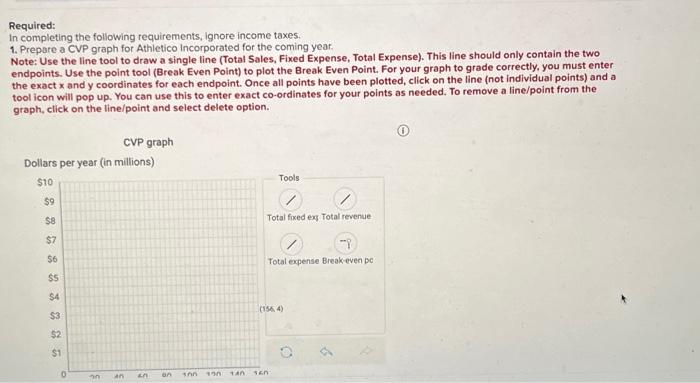

PR 7-41 (Static) CVP Graph; Cost Structure; Operating Leverage (LO 7-2, 7-3, 7-4, 7-8) [The following information applies to the questions displayed below.] Athletico Incorporated manufactures warm-up suits. The company's projected income for the coming year, based on sales of 160,000 units, is as follows: Sales Operating expenses: Variable expenses Fixed expenses Total expenses Net income $ 2,000,000 3,000,000 $ 8,000,000 5,000,000 $ 3,000,000 PR 7-41 (Static) Part 1: Prepare a CVP graph for Athletico Incorporated for the coming year. Required: In completing the following requirements, ignore income taxes. 1. Prepare a CVP graph for Athletico Incorporated for the coming year. Note: Use the line tool to draw a single line (Total Sales, Fixed Expense, Total Expense). This line should only contain the two endpoints. Use the point tool (Break Even Point) to plot the Break Even Point. For your graph to grade correctly, you must enter the exact x and y coordinates for each endpoint. Once all points have been plotted, click on the line (not individual points) and a tool icon will pop up. You can use this to enter exact co-ordinates for your points as needed. To remove a line/point from the graph, click on the line/point and select delete option.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started