Answered step by step

Verified Expert Solution

Question

1 Approved Answer

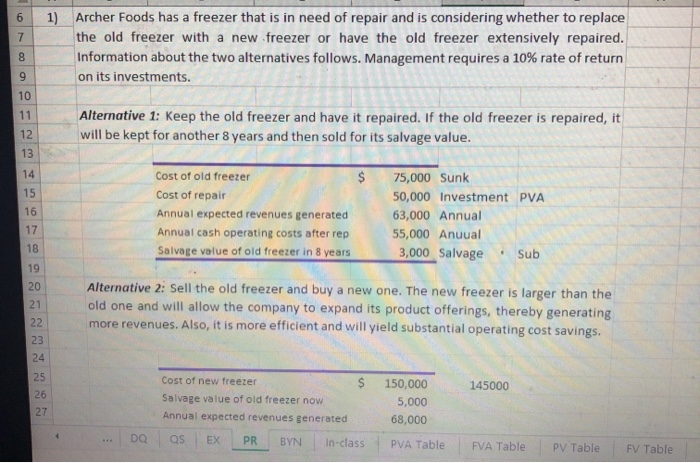

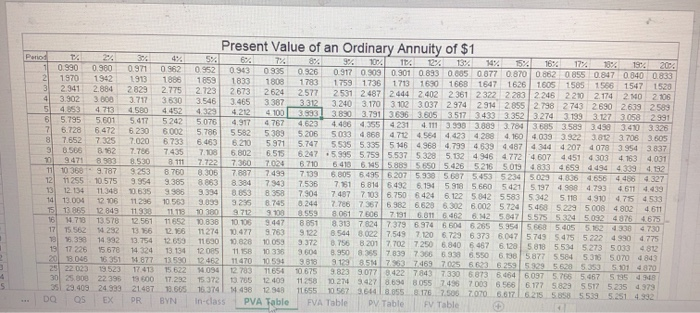

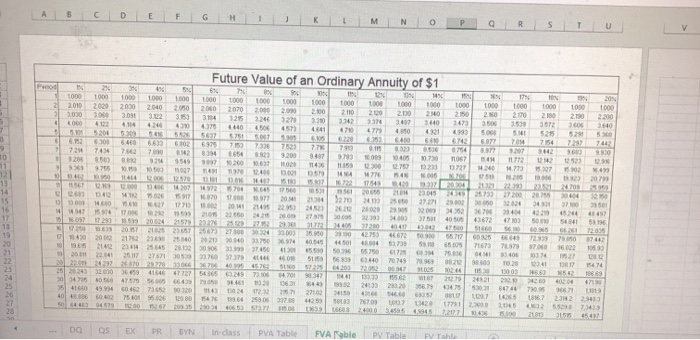

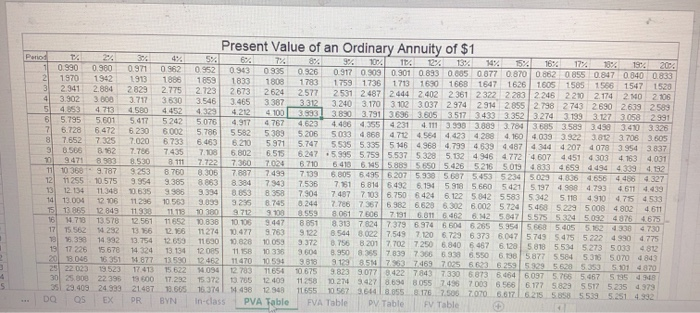

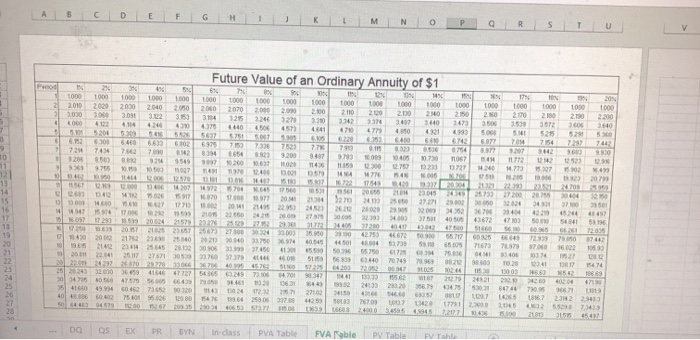

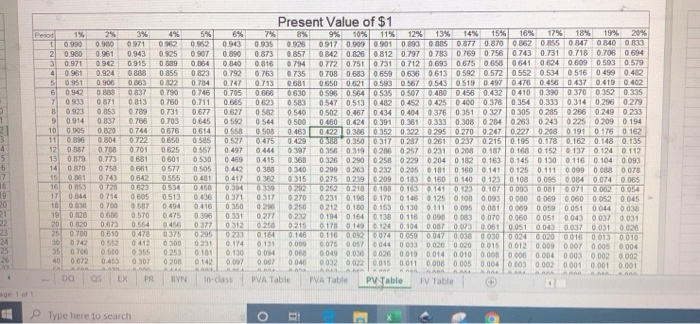

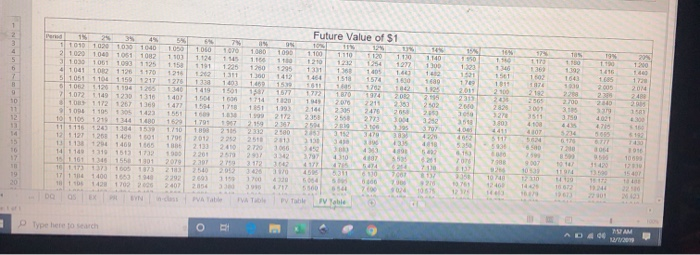

PR HELP. provided are the PVA,FVA,PV,FV tables needsd to conplete the problem. Archer Foods has a freezer that is in need of repair and is

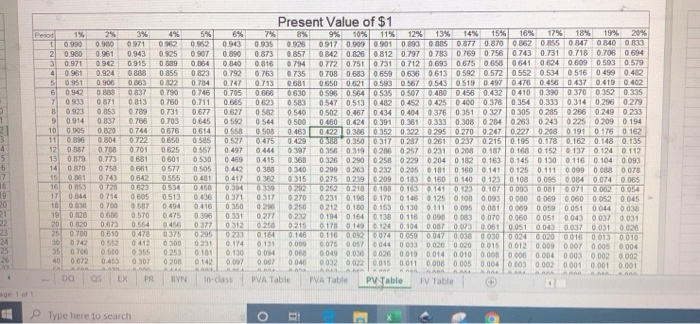

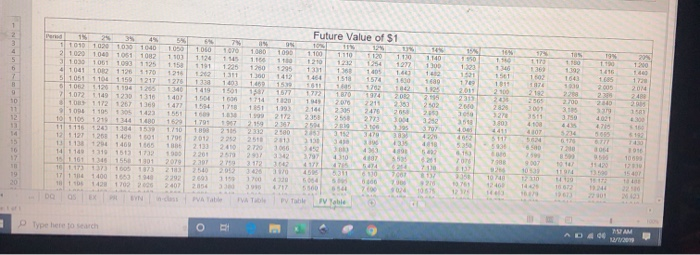

PR HELP. provided are the PVA,FVA,PV,FV tables needsd to conplete the problem.

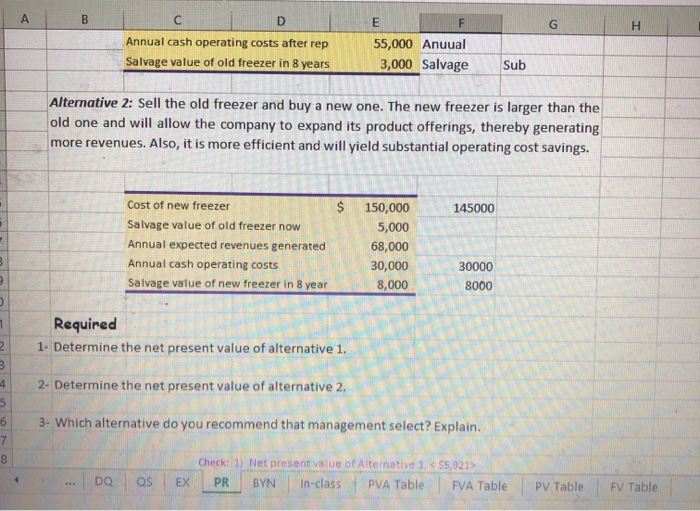

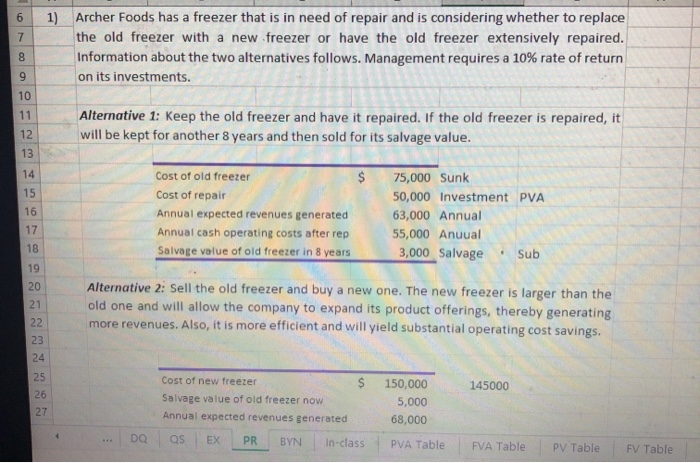

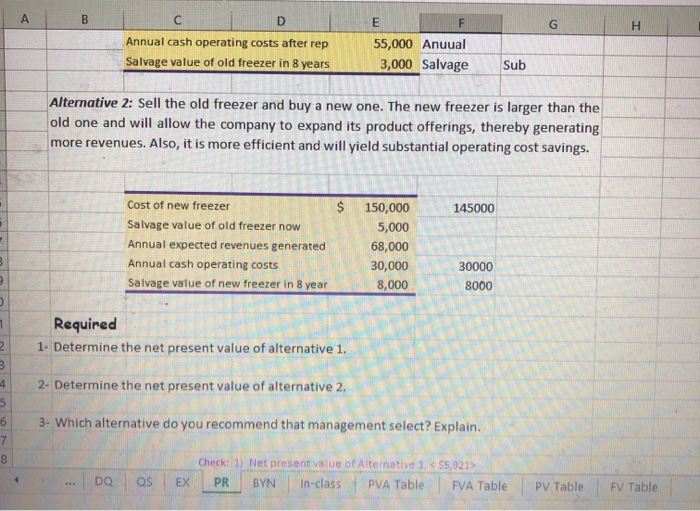

Archer Foods has a freezer that is in need of repair and is considering whether to replace the old freezer with a new freezer or have the old freezer extensively repaired. Information about the two alternatives follows. Management requires a 10% rate of return on its investments. Alternative 1: Keep the old freezer and have it repaired. If the old freezer is repaired, it will be kept for another 8 years and then sold for its salvage value. Cost of old freezer Cost of repair Annual expected revenues generated Annual cash operating costs after rep Salvage value of old freezer in 8 years 75,000 Sunk 50,000 Investment PVA 63,000 Annual 55,000 Anual 3,000 Salvage Sub Alternative 2: Sell the old freezer and buy a new one. The new freezer is larger than the old one and will allow the company to expand its product offerings, thereby generating more revenues. Also, it is more efficient and will yield substantial operating cost savings. 145000 Cost of new freezer $ Salvage value of old freezer now Annual expected revenues generated OS EX PRBYN in-class 150,000 5,000 68,000 PVA Table ... DQ FVA Table PV Table FV Table Annual cash operating costs after rep Salvage value of old freezer in 8 years 5 5,000 Anuual 3,000 Salvage Sub Alternative 2: Sell the old freezer and buy a new one. The new freezer is larger than the old one and will allow the company to expand its product offerings, thereby generating more revenues. Also, it is more efficient and will yield substantial operating cost savings. $ 145000 Cost of new freezer Salvage value of old freezer now Annual expected revenues generated Annual cash operating costs Salvage value of new freezer in 8 year 150,000 5,000 68,000 30,000 30000 8,000 8000 Required 1. Determine the net present value of alternative 1. 2- Determine the net present value of alternative 2. 3. Which alternative do you recommend that management select? Explain. ... DQ os Check: 1) Net present value of Alternative 1,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started