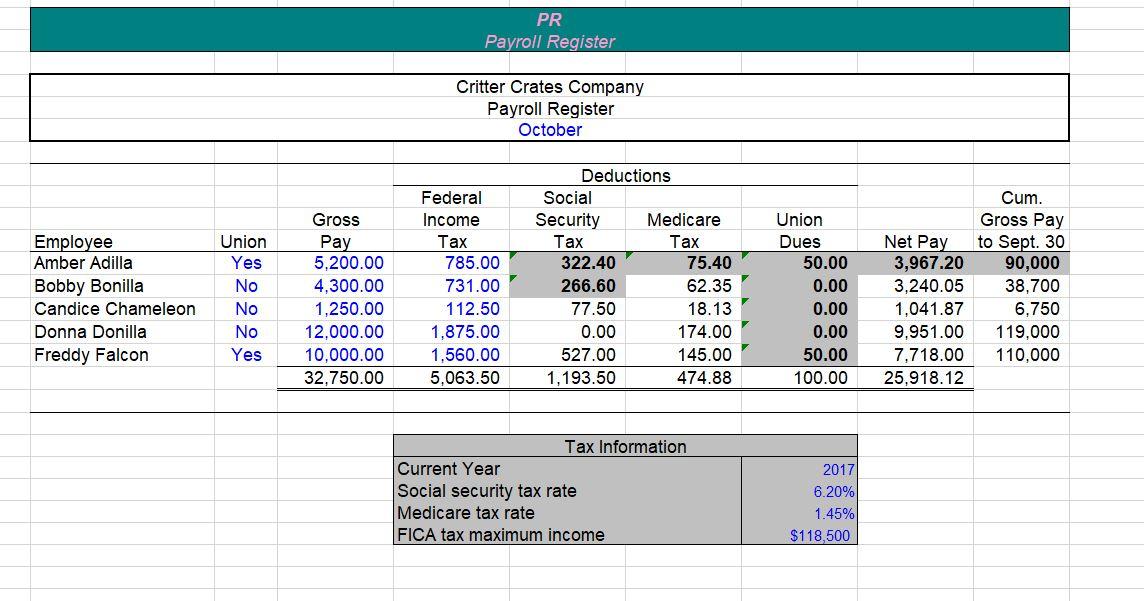

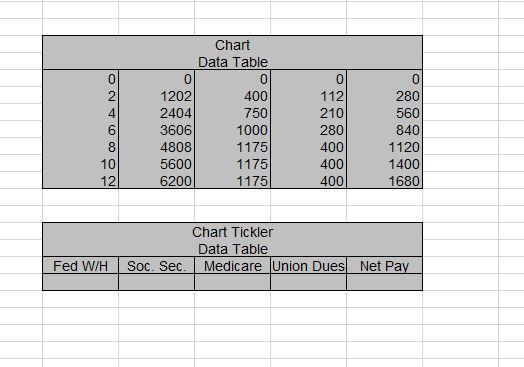

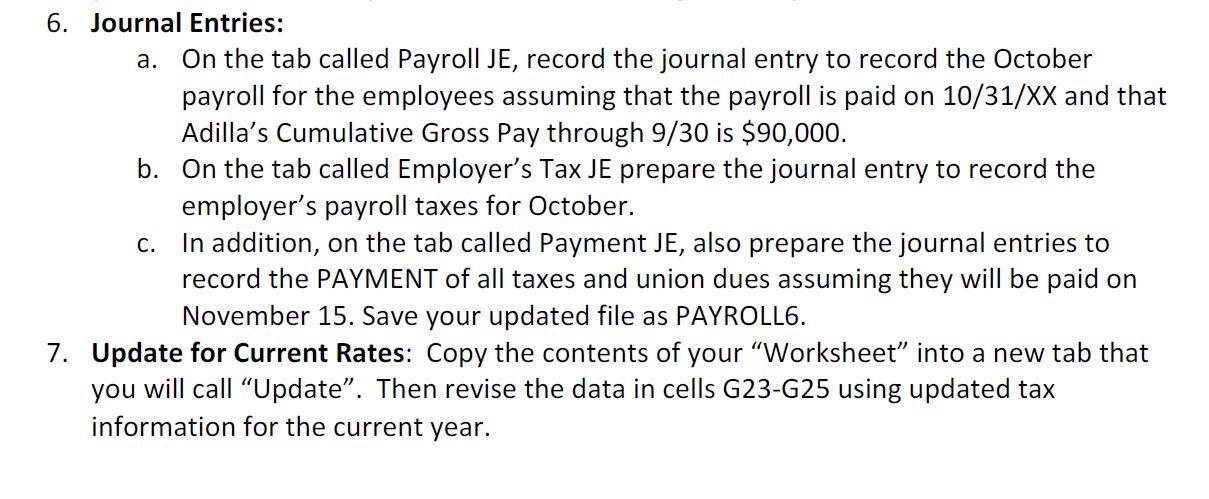

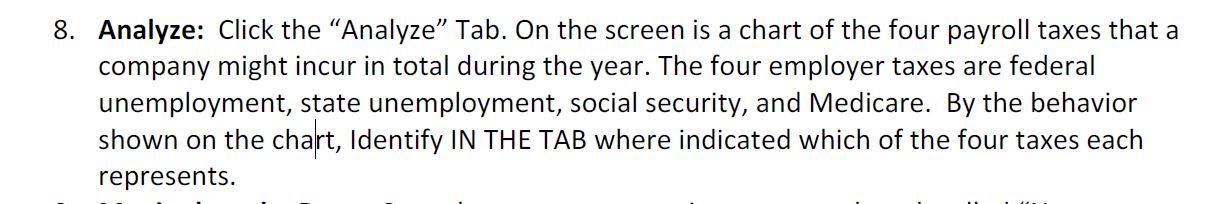

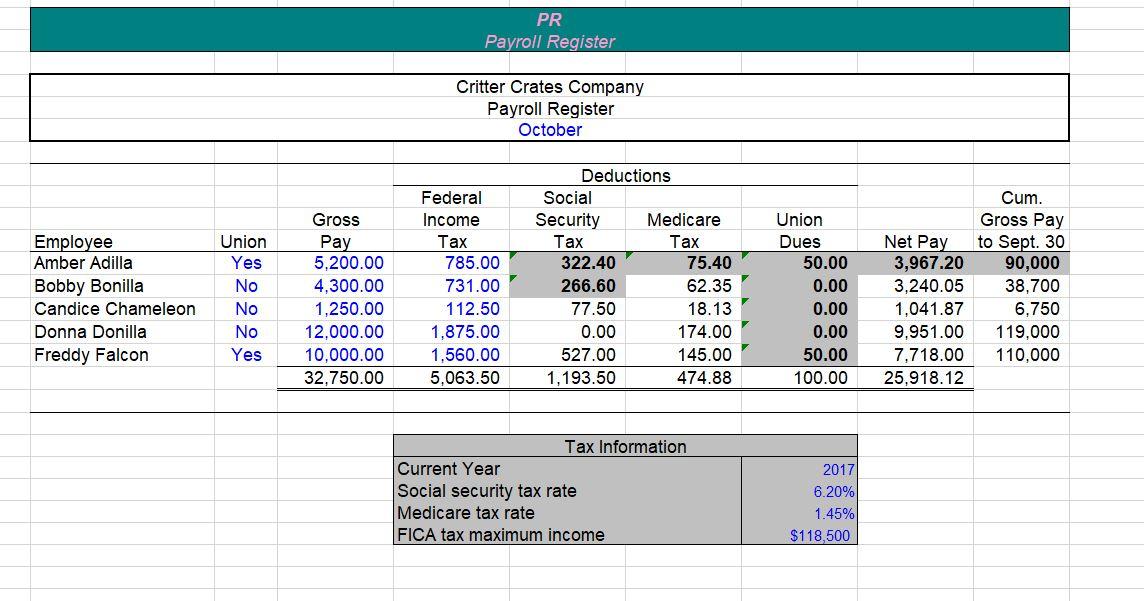

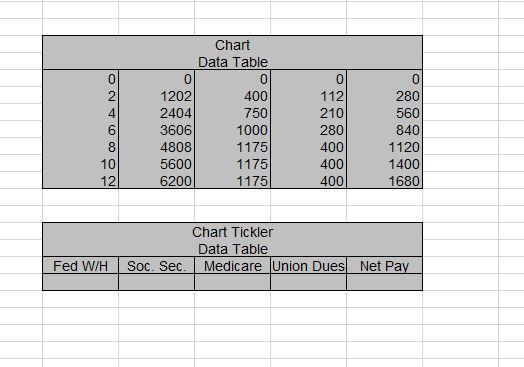

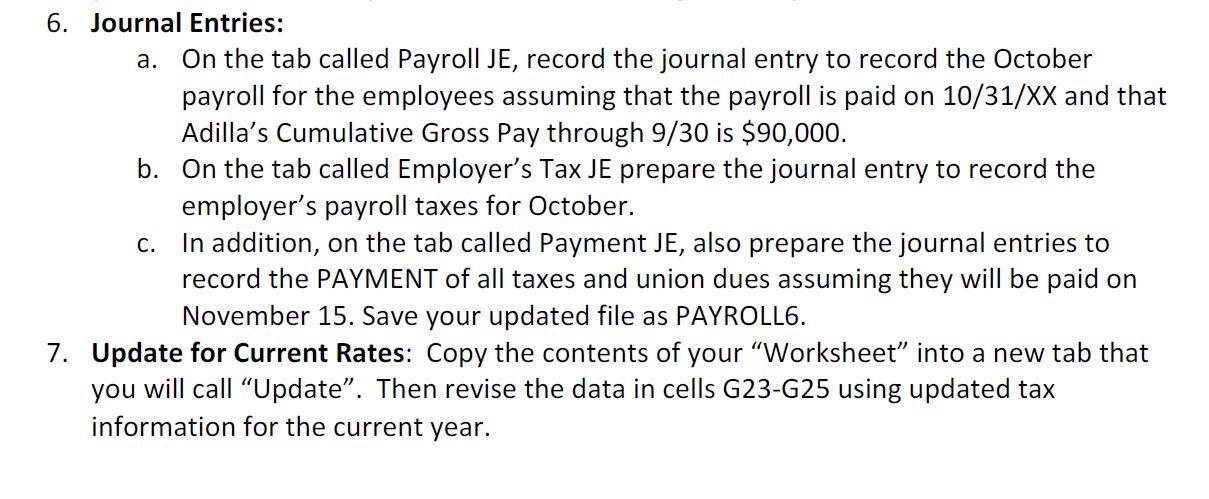

PR Payroll Register Critter Crates Company Payroll Register October Federal Income Tax Tax Net Pay Employee Amber Adilla Bobby Bonilla Candice Chameleon Donna Donilla Freddy Falcon Union Yes No No No Yes Gross Pay 5.200.00 4,300.00 1.250.00 12,000.00 10,000.00 32,750.00 785.00 731.00 112.50 1,875.00 1,560.00 5,063.50 Deductions Social Security Medicare Tax 322.40 75.40 266.60 62.35 77.50 18.13 0.00 174.00 527.00 145.00 1,193.50 474.88 Union Dues 50.00 0.00 0.00 0.00 50.00 100.00 3,967.20 3,240.05 1.041.87 9,951.00 7,718.00 25,918.12 Cum. Gross Pay to Sept. 30 90,000 38,700 6,750 119,000 110,000 Tax Information Current Year Social security tax rate Medicare tax rate FICA tax maximum income 2017 6.20% 1.45% $118,500 O OO 01 ANO Chart Data Table 0 0 1202 400 2404 750 3606 1000 4808 1175 5600 1175 6200 1175 6 8 10 12 112 210 280 400 400 400 0 280 560 840 1120 1400 1680 Chart Tickler Data Table Medicare Union Dues Net Pay Fed W/H Soc. Sec. 6. Journal Entries: a. On the tab called Payroll JE, record the journal entry to record the October payroll for the employees assuming that the payroll is paid on 10/31/XX and that Adilla's Cumulative Gross Pay through 9/30 is $90,000. b. On the tab called Employer's Tax JE prepare the journal entry to record the employer's payroll taxes for October. In addition, on the tab called Payment JE, also prepare the journal entries to record the PAYMENT of all taxes and union dues assuming they will be paid on November 15. Save your updated file as PAYROLL6. 7. Update for Current Rates: Copy the contents of your Worksheet" into a new tab that you will call Update". Then revise the data in cells G23-G25 using updated tax information for the current year. C. 8. Analyze: Click the "Analyze Tab. On the screen is a chart of the four payroll taxes that a company might incur in total during the year. The four employer taxes are federal unemployment, state unemployment, social security, and Medicare. By the behavior shown on the chart , Identify IN THE TAB where indicated which of the four taxes each represents. PR Payroll Register Critter Crates Company Payroll Register October Federal Income Tax Tax Net Pay Employee Amber Adilla Bobby Bonilla Candice Chameleon Donna Donilla Freddy Falcon Union Yes No No No Yes Gross Pay 5.200.00 4,300.00 1.250.00 12,000.00 10,000.00 32,750.00 785.00 731.00 112.50 1,875.00 1,560.00 5,063.50 Deductions Social Security Medicare Tax 322.40 75.40 266.60 62.35 77.50 18.13 0.00 174.00 527.00 145.00 1,193.50 474.88 Union Dues 50.00 0.00 0.00 0.00 50.00 100.00 3,967.20 3,240.05 1.041.87 9,951.00 7,718.00 25,918.12 Cum. Gross Pay to Sept. 30 90,000 38,700 6,750 119,000 110,000 Tax Information Current Year Social security tax rate Medicare tax rate FICA tax maximum income 2017 6.20% 1.45% $118,500 O OO 01 ANO Chart Data Table 0 0 1202 400 2404 750 3606 1000 4808 1175 5600 1175 6200 1175 6 8 10 12 112 210 280 400 400 400 0 280 560 840 1120 1400 1680 Chart Tickler Data Table Medicare Union Dues Net Pay Fed W/H Soc. Sec. 6. Journal Entries: a. On the tab called Payroll JE, record the journal entry to record the October payroll for the employees assuming that the payroll is paid on 10/31/XX and that Adilla's Cumulative Gross Pay through 9/30 is $90,000. b. On the tab called Employer's Tax JE prepare the journal entry to record the employer's payroll taxes for October. In addition, on the tab called Payment JE, also prepare the journal entries to record the PAYMENT of all taxes and union dues assuming they will be paid on November 15. Save your updated file as PAYROLL6. 7. Update for Current Rates: Copy the contents of your Worksheet" into a new tab that you will call Update". Then revise the data in cells G23-G25 using updated tax information for the current year. C. 8. Analyze: Click the "Analyze Tab. On the screen is a chart of the four payroll taxes that a company might incur in total during the year. The four employer taxes are federal unemployment, state unemployment, social security, and Medicare. By the behavior shown on the chart , Identify IN THE TAB where indicated which of the four taxes each represents