Question

PR.10-06B PR.10-06.ALGO SS--MC.10-01 SS-MC.10-02 SS-MC. 10-03 SS-MC.10-04 SS-MC. 10-05 SS-MC. 10-06 SS-MC.10-07 SS-MC. 10-08 . DE. 10-09 DE. 10-11 MP.10-01.BLANKSHEET.... SA 10-4:

PR.10-06B\ PR.10-06.ALGO\ SS--MC.10-01\ SS-MC.10-02\ SS-MC. 10-03\ SS-MC.10-04\ SS-MC. 10-05\ SS-MC.

10-06\ SS-MC.10-07\ SS-MC. 10-08 .\ DE.

10-09\ DE.

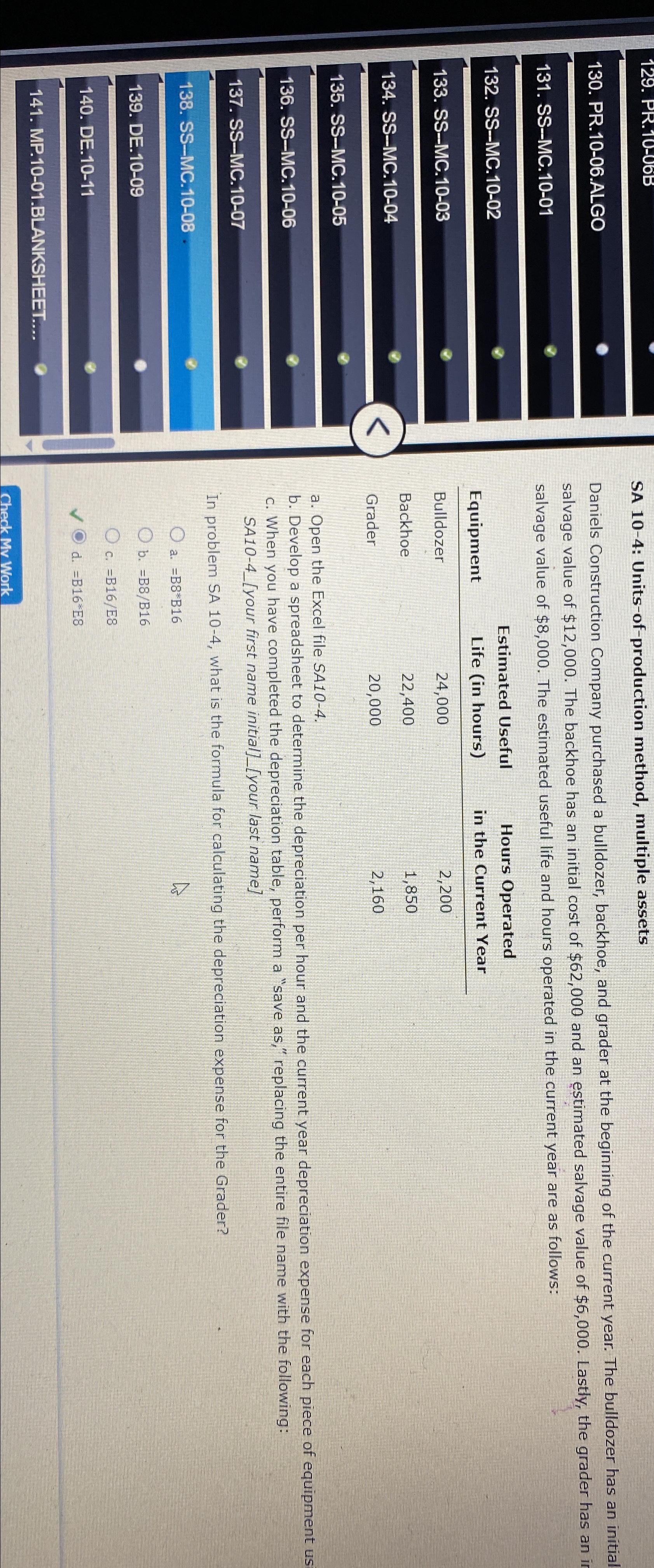

10-11\ MP.10-01.BLANKSHEET....\ SA 10-4: Units-of-production method, multiple assets\ Daniels Construction Company purchased a bulldozer, backhoe, and grader at the beginning of the current year. The bulldozer has an initial salvage value of

$12,000. The backhoe has an initial cost of

$62,000and an estimated salvage value of

$6,000. Lastly, the grader has an in salvage value of

$8,000. The estimated useful life and hours operated in the current year are as follows:\ \\\\table[[Equipment,\\\\table[[Estimated Useful],[Life (in hours)]],\\\\table[[Hours Operated],[in the Current Year]]],[Bulldozer,24,000,2,200],[Backhoe,22,400,1,850],[Grader,20,000,2,160]]\ a. Open the Excel file SA10-4.\ b. Develop a spreadsheet to determine the depreciation per hour and the current year depreciation expense for each piece of equipment us\ c. When you have completed the depreciation table, perform a "save as," replacing the entire file name with the following: SA10-4_[your first name initial]_[your last name]\ In problem

5A10-4, what is the formula for calculating the depreciation expense for the Grader?\ a.

=B8**B16\ .

=B(8)/(B)16\ c.

=B(16)/(E)8\ d.

=B16^(**)E8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started