PR.15-01. BLANKSHEET.ALGO

Soto Industries Inc.

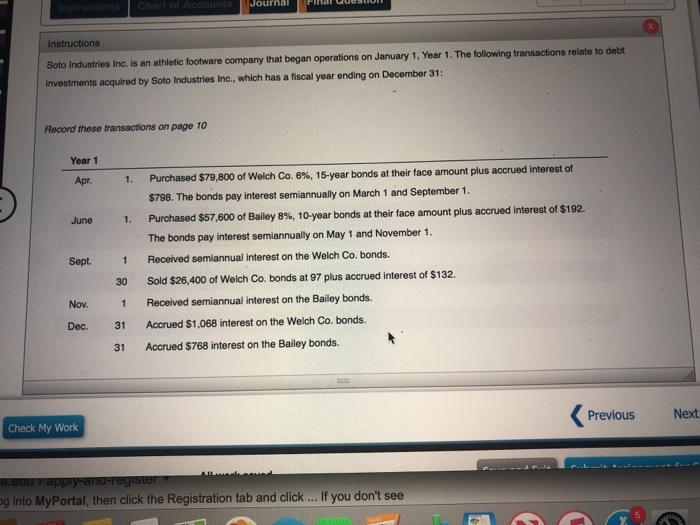

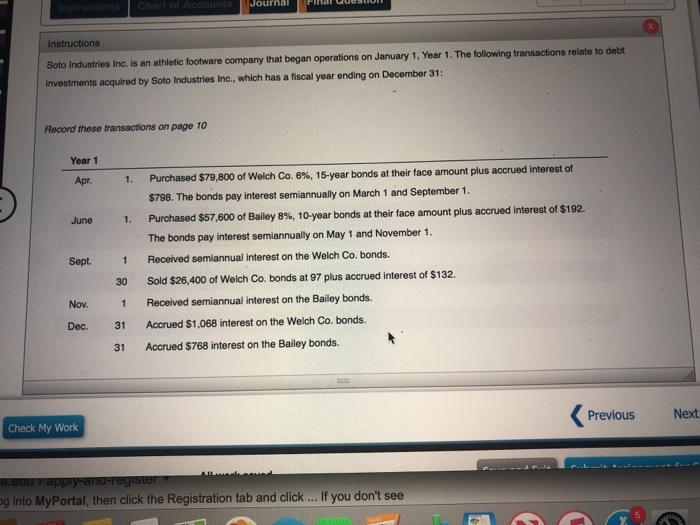

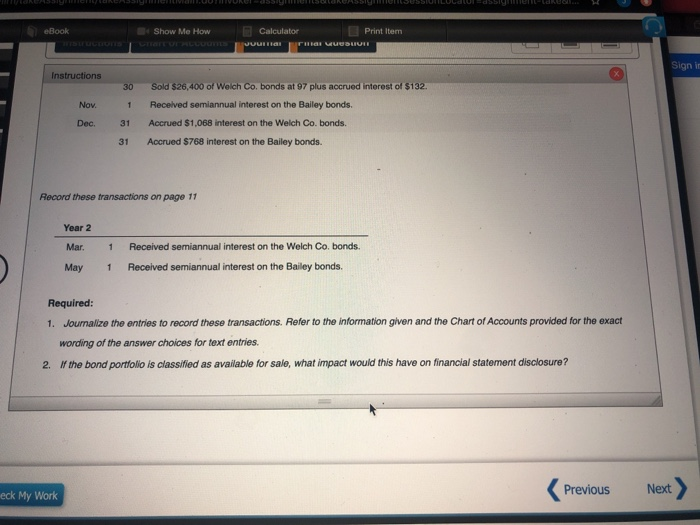

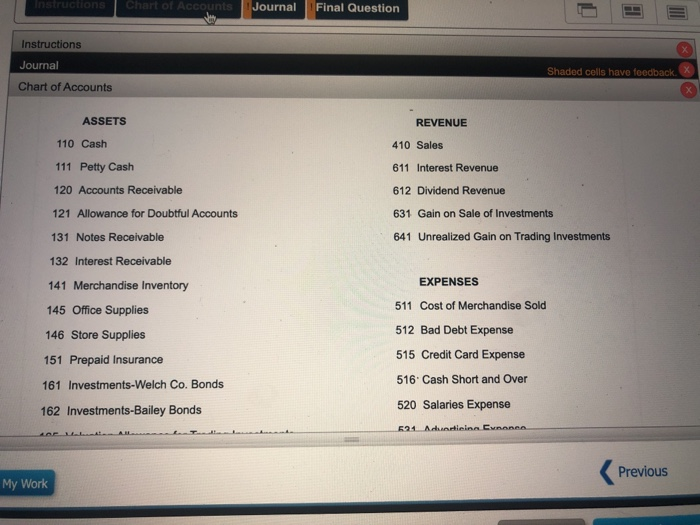

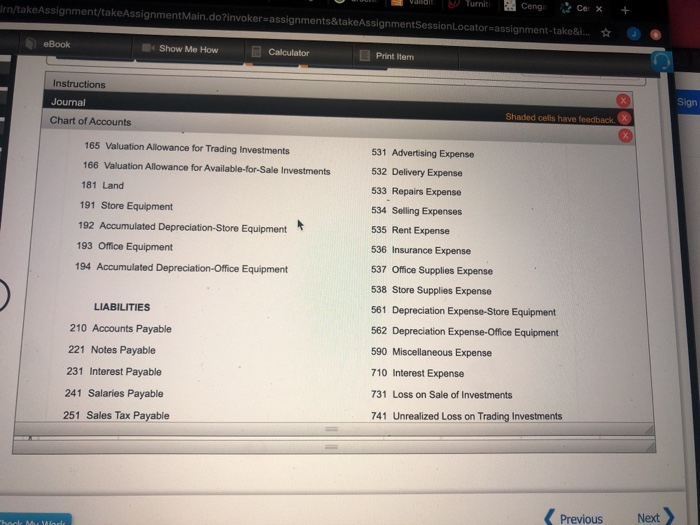

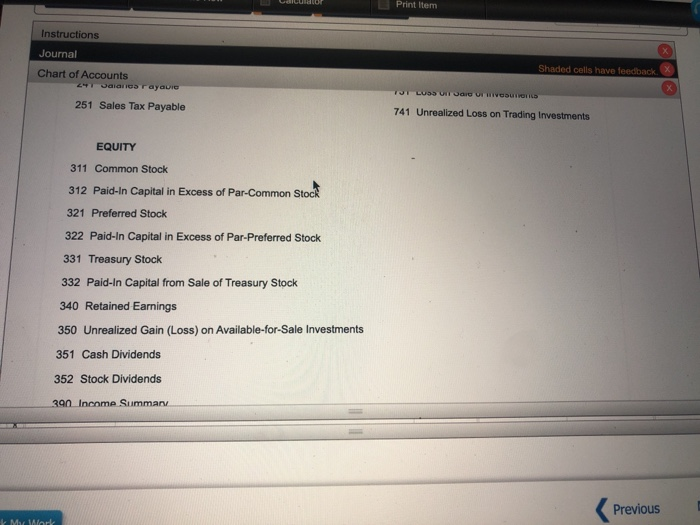

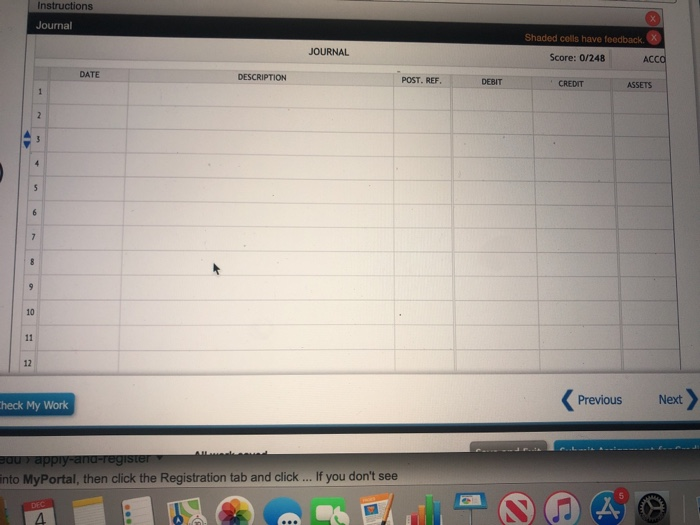

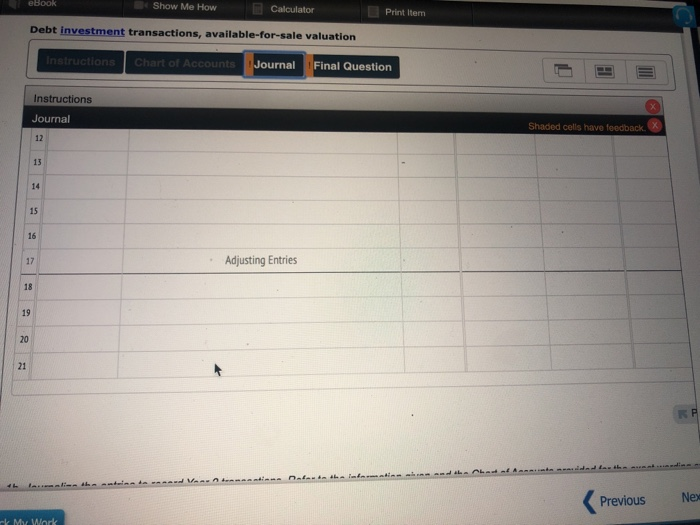

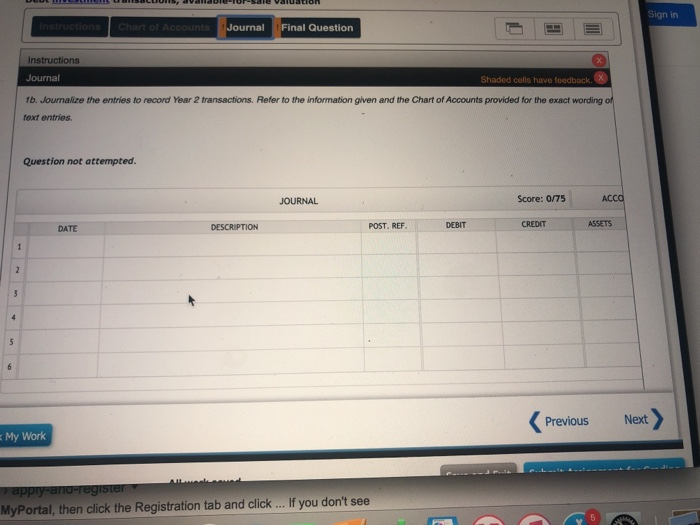

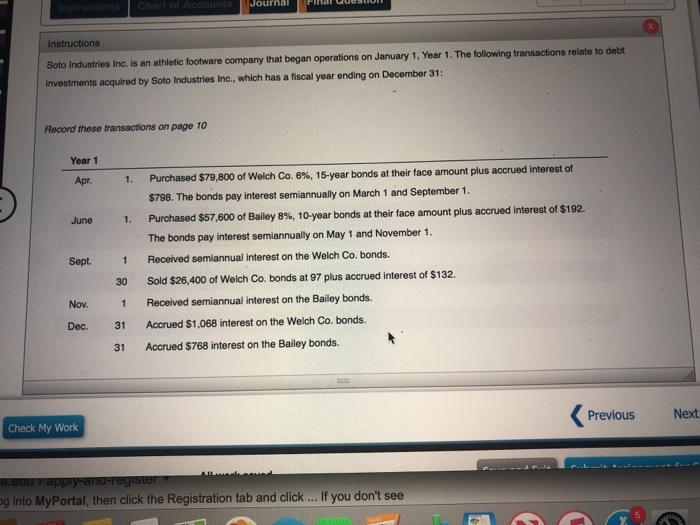

Journal Pinal Chart of Accounts Instructions Instructions Soto Industries Inc. is an athletic footware company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Soto Industries Inc., which has a fiscal year ending on December 31: Record these transactions on page 10 Year 1 Purchased $79,800 of Welch Co. 6%, 15-year bonds at their face amount plus accrued interest of p. 1. $798. The bonds pay interest semiannually on March 1 and September 1. Purchased $57,600 of Bailey 8%, 10-year bonds at their face amount plus accrued interest of $192. 1. June The bonds pay interest semiannually on May1 and November 1. Received semiannual interest on the Welch Co. bonds. Sept. Sold $26,400 of Welch Co. bonds at 97 plus accrued interest of $132. 30 Received semiannual interest on the Bailey bonds. Nov. Accrued $1,068 interest on the Welch Co. bonds. 31 Dec. Accrued $768 interest on the Bailey bonds. 31 Next Previous Check My Work a.edu appiy-and-register og into MyPortal, then click the Registration tab and click.. If you don't see eBook Show Me How Calculator Print Item FHISUUC ons CTIBIE OP ACCOumS EHIGI MUUDUVIL Sign in Instructions Sold $26,400 of Welch Co. bonds at 97 plus accrued interest of $132. 30 Nov. Received semiannual interest on the Bailey bonds. Accrued $1,068 interest on the Welch Co. bonds. Dec. 31 Accrued $768 interest on the Bailey bonds. 31 Record these transactions on page 11 Year 2 Received semiannual interest on the Welch Co. bonds. Mar. Received semiannual interest on the Bailey bonds. May Required: 1. Journalize the entries to record these transactions. Refer to the information given and the Chart of Accounts provided for the exact wording of the answer choices for text entries. 2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure? Previous Next eck My Work Instructions Chart of Accounts Journal Final Question Instructions Journal Shaded cells have feedback. Chart of Accounts ASSETS REVENUE 110 Cash 410 Sales 111 Petty Cash 611 Interest Revenue 120 Accounts Receivable 612 Dividend Revenue 121 Allowance for Doubtful Accounts 631 Gain on Sale of Investments Unrealized Gain on Trading Investments 131 Notes Receivable 641 132 Interest Receivable EXPENSES 141 Merchandise Inventory 511 Cost of Merchandise Sold 145 Office Supplies 512 Bad Debt Expense 146 Store Supplies 515 Credit Card Expense 151 Prepaid Insurance 516 Cash Short and Over 161 Investments-Welch Co. Bonds 520 Salaries Expense 162 Investments-Bailey Bonds F31 Adueticina Eunone Previous My Work * Ce x Irn/takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignmentSessionLocator=assignment-take&i. Turniti Ceng eBook Show Me How Calculator Print Item Instructions Sign Journal Shaded cells have feedback Chart of Accounts 165 Valuation Allowance for Trading Investments 531 Advertising Expense 166 Valuation Allowance for Available-for-Sale Investments 532 Delivery Expense 181 Land 533 Repairs Expense 191 Store Equipment 534 Selling Expenses 535 Rent Expense 192 Accumulated Depreciation-Store Equipment 536 Insurance Expense 193 Office Equipment 537 Office Supplies Expense 194 Accumulated Depreciation-Office Equipment 538 Store Supplies Expense 561 Depreciation Expense-Store Equipment LIABILITIES 562 Depreciation Expense-Office Equipment 210 Accounts Payable 590 Miscellaneous Expense 221 Notes Payable 710 Interest Expense 231 Interest Payable 731 Loss on Sale of Investments 241 Salaries Payable 741 Unrealized Loss on Trading Investments 251 Sales Tax Payable Next Previous Thock Mu 1Morlk Caiculator Print Item Instructions Journal Shaded cells have feedback. X Chart of Accounts 241 0aiariesrayauie 251 Sales Tax Payable 741 Unrealized Loss on Trading Investments EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par-Common Stock 321 Preferred Stock 322 Paid-In Capital in Excess of Par-Preferred Stock 331 Treasury Stock 332 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 350 Unrealized Gain (Loss) on Available-for-Sale Investments 351 Cash Dividends 352 Stock Dividends 390 Income Summany Previous k My Work Instructions Journal Shaded cells have feedback. JOURNAL Score: 0/248 ACCO DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS 4. 10 11 12 Previous Next Check My Work sau y appiy-ana-register into MyPortal, then click the Registration tab and click . If you don't see DEC eBook Show Me How Calculator Print Item Debt investment transactions, available-for-sale valuation Instructions Chart of Accounts Journal Final Question Instructions Journal Shaded cells have feedback. 12 13 14 15 16 Adjusting Entries 17 18 19 20 21 KP Chert s Annnunta ddedterthe une Nex Previous k My Work Sign in Instructions Chart of Accounts Journal Final Question Instructions Journal Shaded cells have feedback. 1b. Journalize the entries to record Year 2 transactions. Refer to the information given and the Chart of Accounts provided for the exact wording of text entries. Question not attempted. ACCO Score: 0/75 JOURNAL ASSETS CREDIT POST, REF. DEBIT DESCRIPTION DATE Next Previous E My Work ppy-an-gister MyPortal, then click the Registration tab and click.. If you don't see