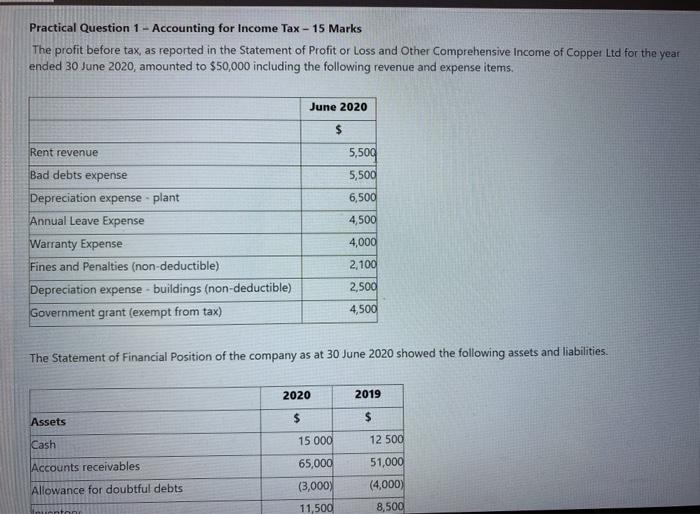

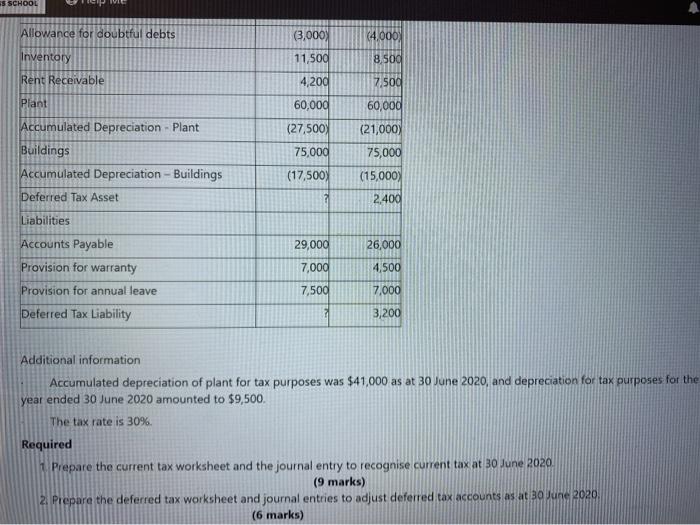

Practical Question 1 - Accounting for Income Tax - 15 Marks The profit before tax, as reported in the Statement of Profit or Loss and Other Comprehensive Income of Copper Ltd for the year ended 30 June 2020, amounted to $50,000 including the following revenue and expense items. June 2020 $ Rent revenue Bad debts expense Depreciation expense - plant Annual Leave Expense Warranty Expense Fines and Penalties (non-deductible) Depreciation expense -buildings (non-deductible) Government grant (exempt from tax) 5,500 5,500 6,500 4,500 4,000 2,100 2,500 4,500 The Statement of Financial Position of the company as at 30 June 2020 showed the following assets and liabilities. 2020 2019 Assets $ $ Cash 15 000 12 500 Accounts receivables Allowance for doubtful debts 65,000 (3,000) 11,500 51,000 (4,000) 8,500 inton 55 SCHOOL CPC Allowance for doubtful debts (3,000) (4.000 Inventory 11,500 8.500 Rent Receivable 4,200 7 500 Plant 60,000 60,000 (27,500) 75,000 Accumulated Depreciation - Plant Buildings Accumulated Depreciation - Buildings Deferred Tax Asset (21,000) 75,000 (15,000) (17,500) 2.400 Liabilities 29,000 26,000 7,000 4,500 Accounts Payable Provision for warranty Provision for annual leave Deferred Tax Liability 7,500 7,000 7 3,200 Additional information Accumulated depreciation of plant for tax purposes was $41,000 as at 30 June 2020, and depreciation for tax purposes for the year ended 30 June 2020 amounted to $9,500. The tax rate is 30% Required Prepare the current tax worksheet and the journal entry to recognise current tax at 30 June 2020 (9 marks) 2. Prepare the deferred tax worksheet and journal entries to adjust deferred tax accounts as at 30 June 2020, (6 marks) Practical Question 1 - Accounting for Income Tax - 15 Marks The profit before tax, as reported in the Statement of Profit or Loss and Other Comprehensive Income of Copper Ltd for the year ended 30 June 2020, amounted to $50,000 including the following revenue and expense items. June 2020 $ Rent revenue Bad debts expense Depreciation expense - plant Annual Leave Expense Warranty Expense Fines and Penalties (non-deductible) Depreciation expense -buildings (non-deductible) Government grant (exempt from tax) 5,500 5,500 6,500 4,500 4,000 2,100 2,500 4,500 The Statement of Financial Position of the company as at 30 June 2020 showed the following assets and liabilities. 2020 2019 Assets $ $ Cash 15 000 12 500 Accounts receivables Allowance for doubtful debts 65,000 (3,000) 11,500 51,000 (4,000) 8,500 inton 55 SCHOOL CPC Allowance for doubtful debts (3,000) (4.000 Inventory 11,500 8.500 Rent Receivable 4,200 7 500 Plant 60,000 60,000 (27,500) 75,000 Accumulated Depreciation - Plant Buildings Accumulated Depreciation - Buildings Deferred Tax Asset (21,000) 75,000 (15,000) (17,500) 2.400 Liabilities 29,000 26,000 7,000 4,500 Accounts Payable Provision for warranty Provision for annual leave Deferred Tax Liability 7,500 7,000 7 3,200 Additional information Accumulated depreciation of plant for tax purposes was $41,000 as at 30 June 2020, and depreciation for tax purposes for the year ended 30 June 2020 amounted to $9,500. The tax rate is 30% Required Prepare the current tax worksheet and the journal entry to recognise current tax at 30 June 2020 (9 marks) 2. Prepare the deferred tax worksheet and journal entries to adjust deferred tax accounts as at 30 June 2020, (6 marks)