Question

practice- 1. (a) Which of the following projects would be acceptable with a cutoff of 4 years? a.Projects 2, 4, and 5 are the only

practice-

1.

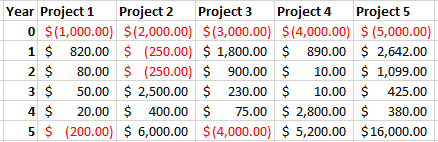

(a) Which of the following projects would be acceptable with a cutoff of 4 years?

a.Projects 2, 4, and 5 are the only acceptable projects.

b.Projects 1 & 3 are the only acceptable projects.

c.All of these projects are acceptable.

d.Projects 2 and 3 are the only acceptable projects.

e.Projects 1, 4, and 5 are the only acceptable projects.

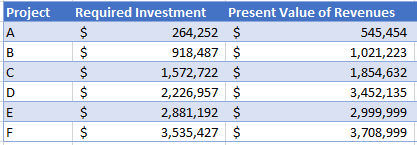

(b) You have 6 projects available to choose between and a fixed budget of $5 million.

Use the profitability index to choose the best possible combination of projects.

a.There is not enough information here to make a recommendation.

b.Option F yields the highest present value of revenues and is therefore the best option.

c.Anything with over $3,000,000 of revenues is generally a good bet and those projects should be recommended first.

d.Projects C and F will be the best use of the investment funds.

e.Projects A, B, C, and D will be the best use of the investment funds.

(c) A group of bankers is evaluating a failing toy business named 'The Toy Brick' that is going to shut down next year, and the bankers would like to determine if they should buy it this year.

The bankers are trying to determine the value of the business, so they can know what they should pay for it.

'The Toy Brick' Company will make a one time liquidation payment of $77,894 in one year to the owner and then it will shut down.

Determine the simple valuation for what amount of money should the bankers offer for the business in order to acquire the one time payment next year?

Assume that banks are offering a 1.24% rate of return on deposits.

a.~$62,817

b.~$96,588

c.~$76,939

d.None of these

e.~$965

Year Project 1 Project 2 Project 3 Project 4 Project 5 0 $(1,000.00) $12,000.00) $ (3,000.00) $(4,000.00) $ (5,000.00) 1 $ 820.00 $ (250.00) $ 1,800.00 $ 890.00 $ 2,642.00 2 $ 80.00 $ (250.00) $ 900.00 $ 10.00 $ 1,099.00 3 $ 50.00 $ 2,500.00 $ 230.00 $ 10.00 $ 425.00 4 $ 20.00 $ 400.00 $ 75.00 $ 2,800.00 $ 380.00 5 $ (200.00) $ 6,000.00 $(4,000.00) $5,200.00 $ 16,000.00 Project B C Required Investment Present Value of Revenues $ 264,252 $ 545,454 $ 918,487 $ 1,021,223 $ 1,572,722 $ 1,854,632 $ 2,226,957 $ 3,452,135 $ 2,881,192 $ 2,999,999 $ 3,535,427 $ 3,708,999 D E FStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started