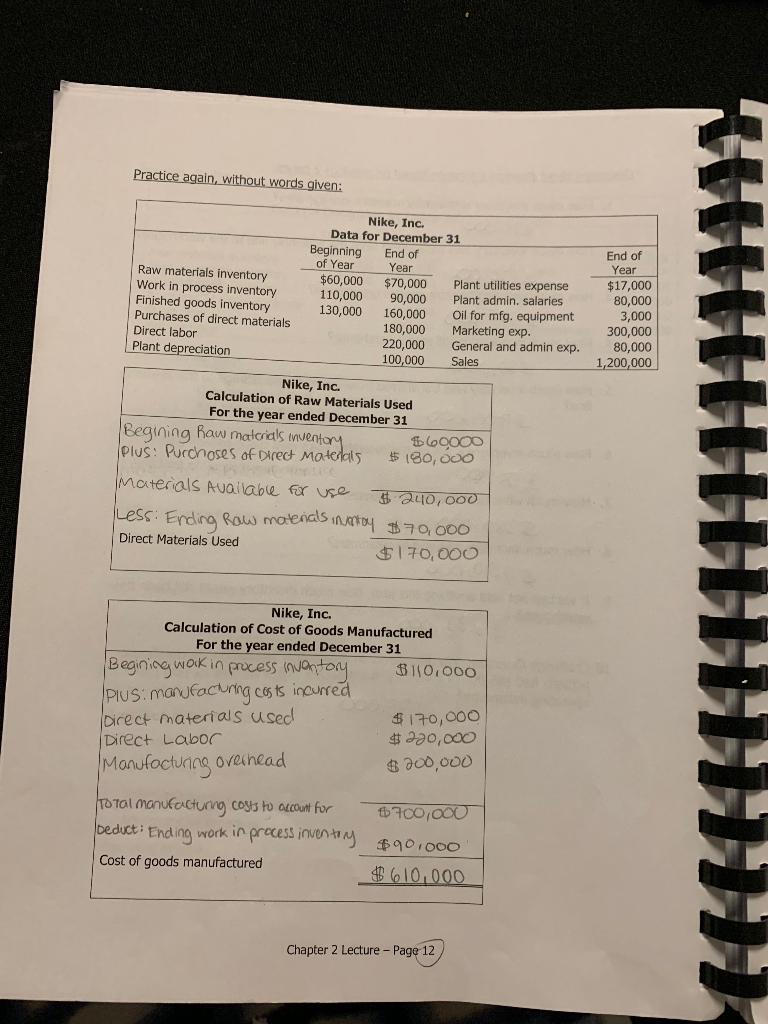

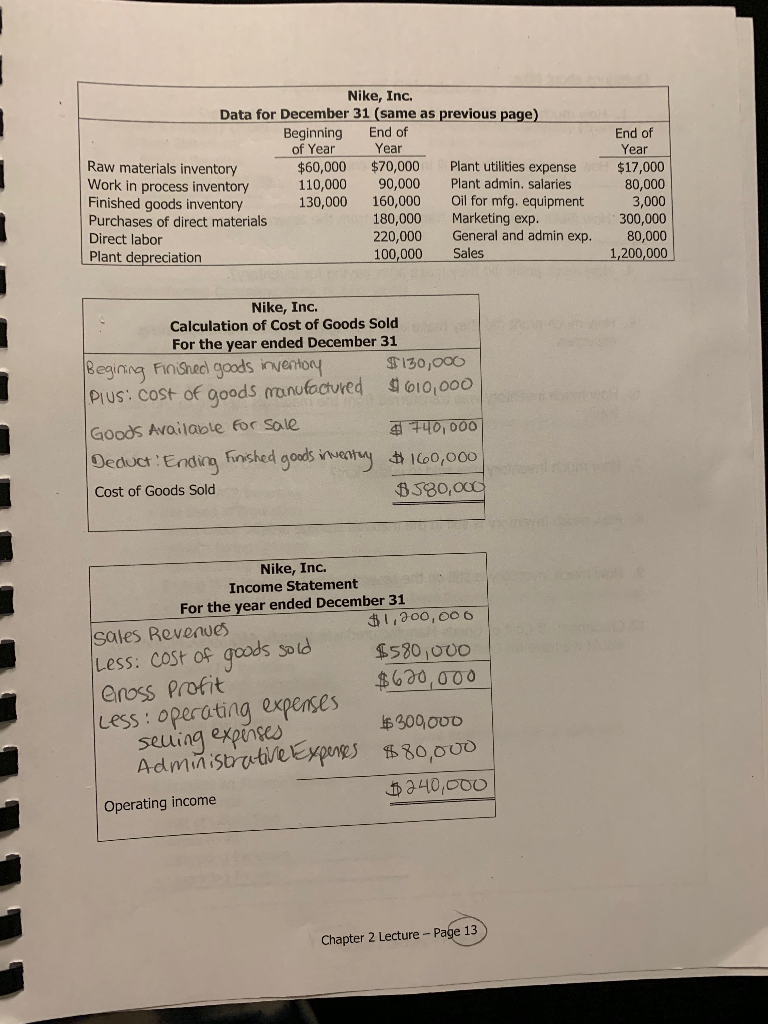

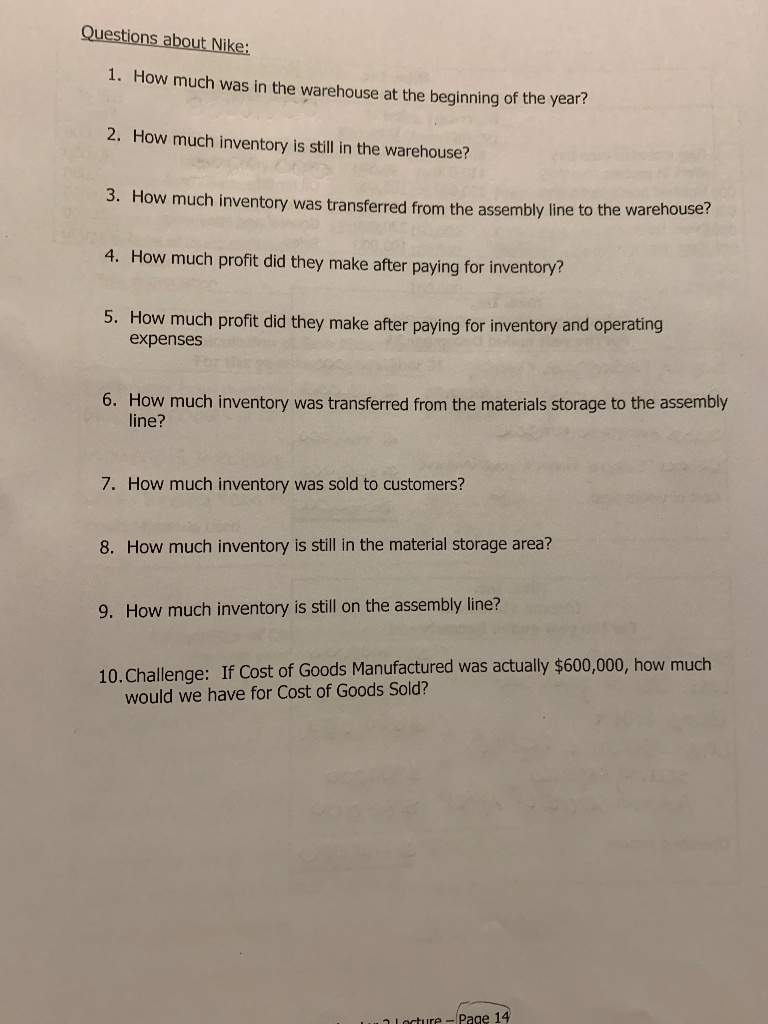

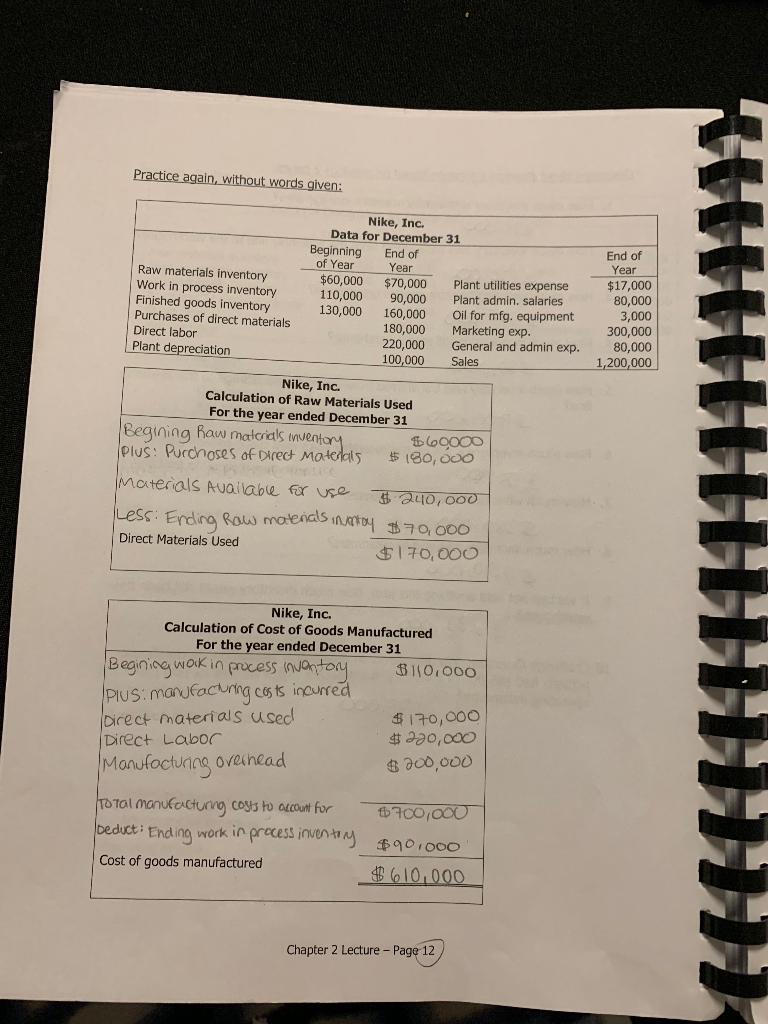

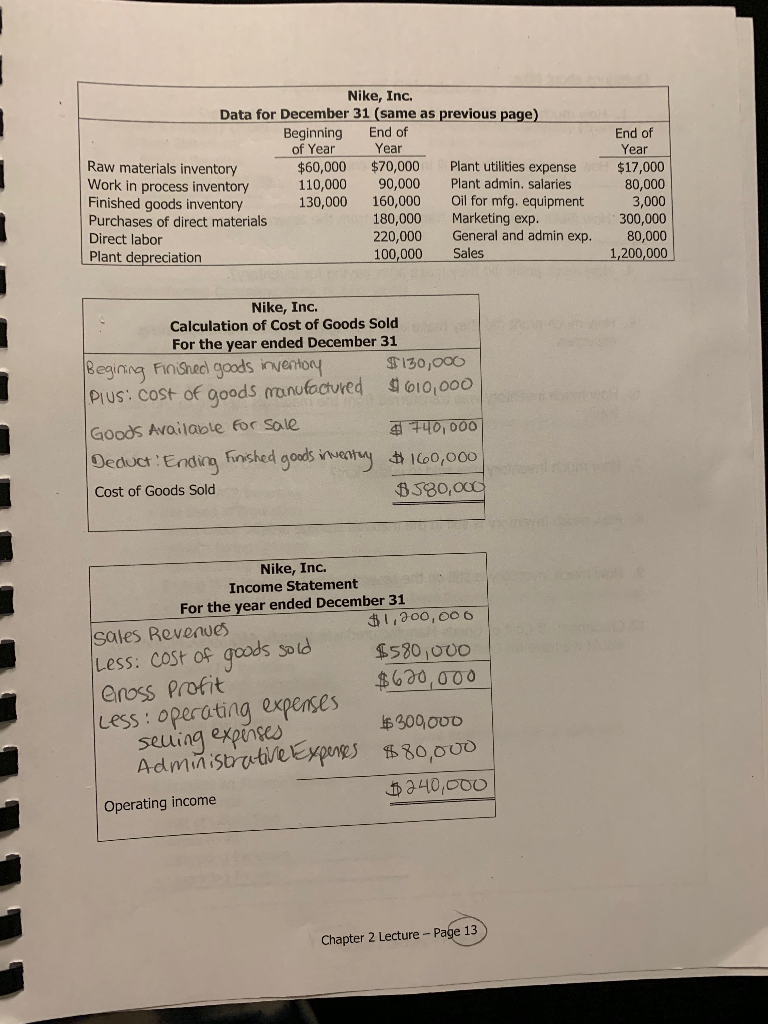

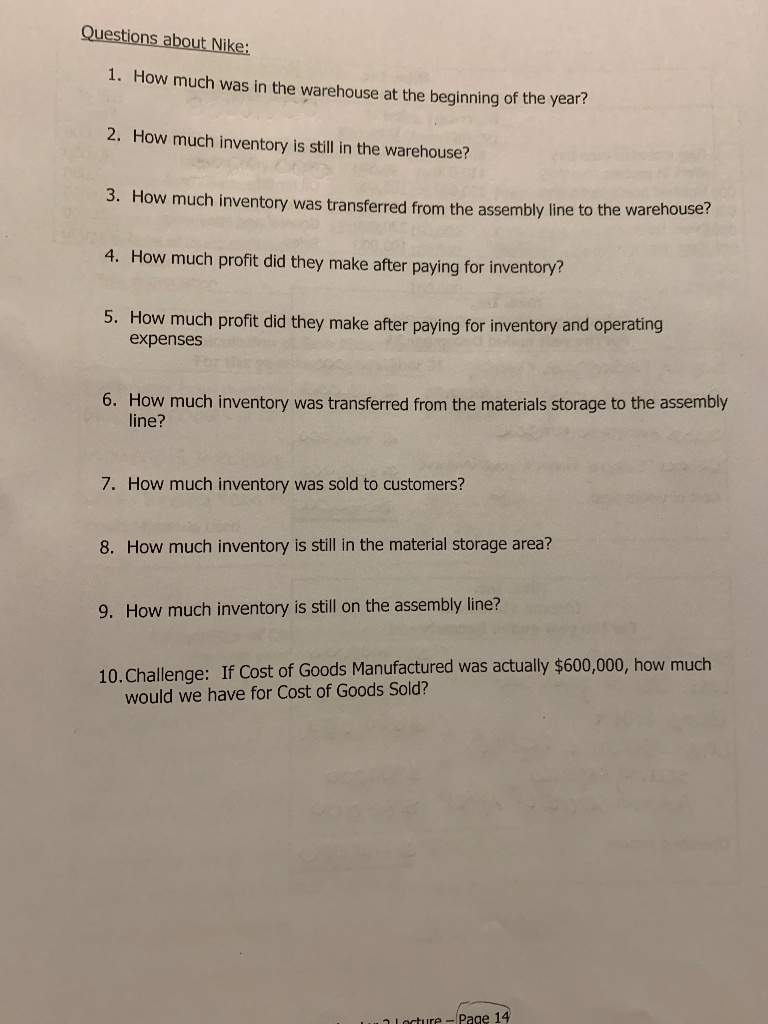

Practice again, without words given: Raw materials inventory Work in process inventory Finished goods inventory Purchases of direct materials Direct labor Plant depreciation Nike, Inc. Data for December 31 Beginning End of of Year Year $60,000 $70,000 Plant utilities expense 110,000 90,000 Plant admin. salaries 30,000 160,000 Oil for mfg. equipment 180,000 Marketing exp. 220,000 General and admin exp. 100,000 Sales End of Year $17,000 80,000 3,000 300,000 80,000 1,200,000 Nike, Inc. Calculation of Raw Materials Used For the year ended December 31 Begining Raw materials inventory 169000 Plus: Purchoses of Direct Materials $180,000 Materials Available for use Less: Endling Raw materials incontoy Direct Materials Used $ 240,000 $70,000 $170,000 Nike, Inc. Calculation of Cost of Goods Manufactured For the year ended December 31 Begining work in process inventory Plus: manufacturing costs incurred lorect materials used $170,000 Direct Labor $220,000 Manufacturing overhead $200,000 Total manufacturing costs to occount for Deduct. Ending work in process inventory ng Cost of goods manufactured $700,000 490 $90,000 $610.000 Chapter 2 Lecture Page 12 Nike, Inc. Data for December 31 (same as previous page) Beginning End of of Year Year Raw materials inventory $60,000 $70,000 Plant utilities expense Work in process inventory 110,000 90,000 Plant admin. salaries Finished goods inventory 130,000 160,000 Oil for mfg. equipment Purchases of direct materials 180,000 Marketing exp. Direct labor 220,000 General and admin exp. Plant depreciation 100,000 Sales End of Year $17,000 80,000 3,000 300,000 80,000 1,200,000 Nike, Inc. Calculation of Cost of Goods Sold For the year ended December 31 Begining Finished goods inventory $130,000 PIUS: COSt of goods manufactured $610,000 Goods Available for sale 740,000 Deduct! Ending finished goods inventory #160,000 Cost of Goods Sold $580,000 Nike, Inc. Income Statement For the year ended December 31 Sales Revenues $1,200,000 Less: cost of goods sold $580,000 Gross Profit $630,000 Less: operating expenses sening expenses $300,000 Administrative Experies $80,000 Operating income $240,000 Chapter 2 Lecture - Page 13 Questions about Nike: 1. How much was in the warehouse at the beginning of the years 2. How much inventory is still in the warehouse? 3. How much inventory was transferred from the assembly line to the warehouse 4. How much profit did they make after paying for inventory? 5. How much profit did they make after paying for inventory and operating expenses 6. How much inventory was transferred from the materials storage to the assembly line? 7. How much inventory was sold to customers? 8. How much inventory is still in the material storage area? 9. How much inventory is still on the assembly line? 10. Challenge: If Cost of Goods Manufactured was actually $600,000, how much would we have for Cost of Goods Sold? Lecture - Page 14