Answered step by step

Verified Expert Solution

Question

1 Approved Answer

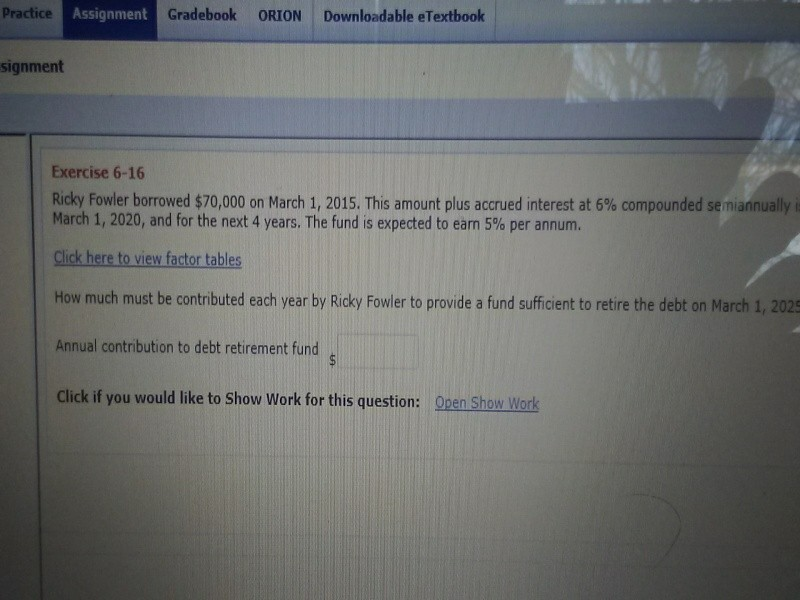

Practice Assignment Gradebook ORION Downloadable eTextbook signment Exercise 6-16 Ricky Fowler borrowed $70,000 on March 1, 2015, This amount plus accrued interest at 6% compounded

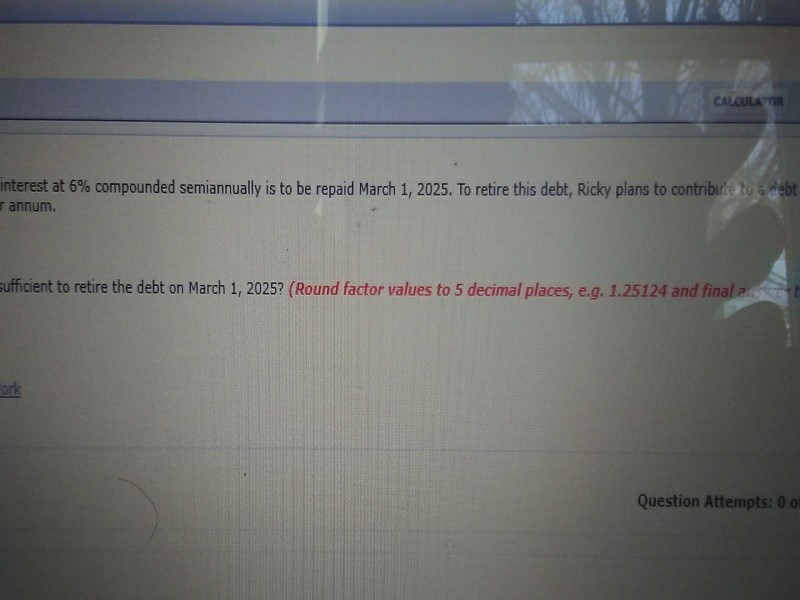

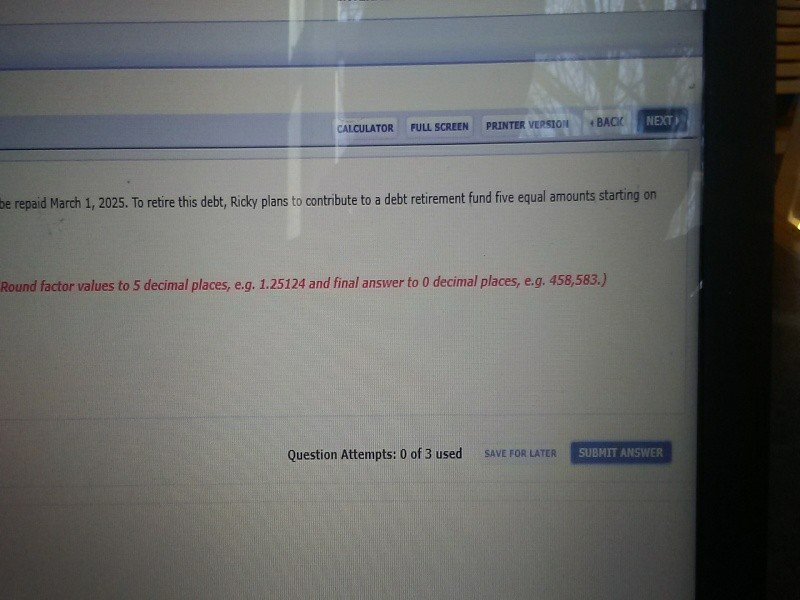

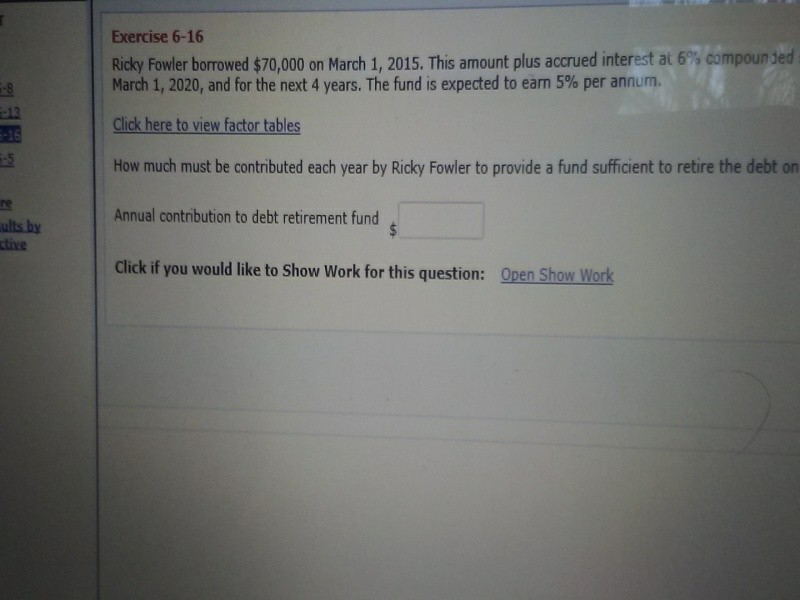

Practice Assignment Gradebook ORION Downloadable eTextbook signment Exercise 6-16 Ricky Fowler borrowed $70,000 on March 1, 2015, This amount plus accrued interest at 6% compounded se nannually i March 1, 2020, and for the next 4 years. The fund is expected to earn 5% per annum. Click here to view factor tables How much must be contributed each year by Ricky Fowler to provide a fund sufficient to retire the debt on March 1, 2025 Annual contribution to debt retirement fund Click if you would like to Show Work for this question: Open Show Work nterest at 6% compounded semiannually is to be repaid March 1, 2025. To retire this debt, Ricky plans to contribute to a debt r annum. sufficient to retire the debt on March 1, 2025? (Round factor values to 5 decimal places, e.g. 1.25124 and final ork Question Attempts: 0 o CALCULATOR FULL SCREEN PRINTER VERSION BACK NEXT be repaid March 1, 2025. To retire this debt, Ricky plans to contribute to a debt retirement fund five equal amounts starting on Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,583.) Question Attempts: 0 of 3 used SAVE FOR LATER SUBMIT ANSWER Exercise 6-16 Ricky Fowler borrowed $70,000 on March 1, 2015. This amount plus accrued interest at 6% compounded March 1, 2020, and for the next 4 years. The fund is expected to earn 5% per annum. Click here to view factor tables How much must be contributed each year by Ricky Fowler to provide a fund sufficient to retire the debt on re Annual contribution to debt retirement fund ults by ctive Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started