Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Practice B D E F G 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

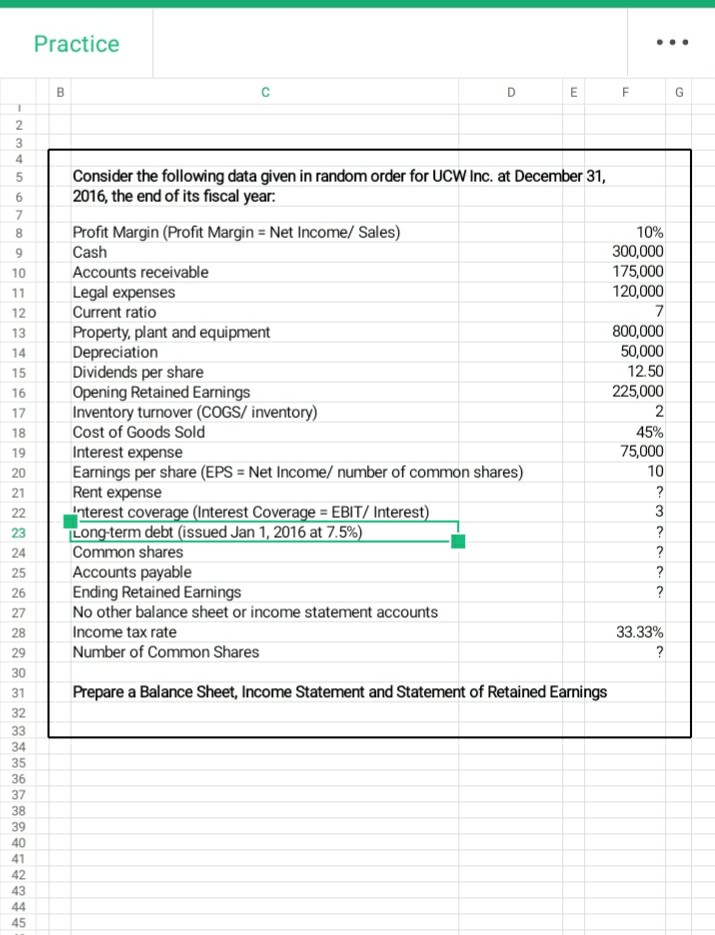

Practice B D E F G 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Consider the following data given in random order for UCW Inc. at December 31, 2016, the end of its fiscal year: Profit Margin (Profit Margin = Net Income/ Sales) 10% Cash 300,000 Accounts receivable 175,000 Legal expenses 120,000 Current ratio 7 Property, plant and equipment 800,000 Depreciation 50,000 Dividends per share 12.50 Opening Retained Earnings 225,000 Inventory turnover (COGS/ inventory) 2 Cost of Goods Sold 45% Interest expense 75,000 Earnings per share (EPS = Net Income/ number of common shares) 10 Rent expense ? Interest coverage (Interest Coverage = EBIT/ Interest) 3 Long-term debt (issued Jan 1, 2016 at 7.5%) Common shares Accounts payable Ending Retained Earnings No other balance sheet or income statement accounts Income tax rate 33.33% Number of Common Shares ? ? ? ? ? Prepare a Balance Sheet, Income Statement and Statement of Retained Earnings 32 33 34 35 36 37 38 39 40 41 42 43 44 45

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started