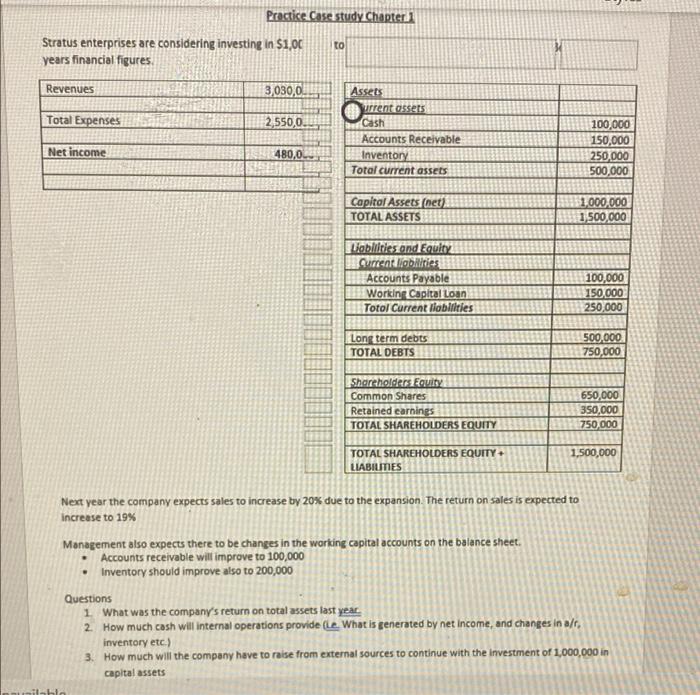

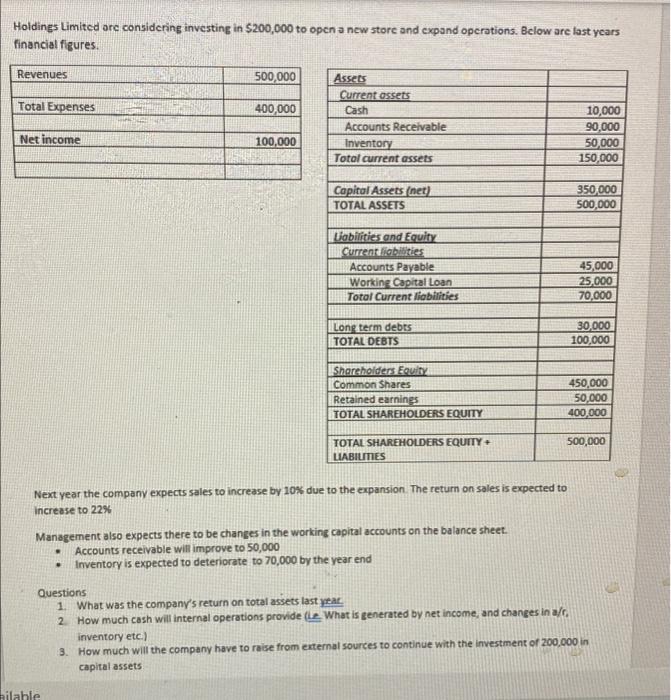

Practice Case study Chapter 1 Stratus enterprises are considering investing in $1,00 years financial figures to Revenues 3,030,0. Total Expenses 2,550,0 Assets current assets Cash Accounts Receivable Inventory Total current assets Net income 480,0 100,000 150,000 250,000 500,000 Capital Assets (net) TOTAL ASSETS 1.000.000 1,500,000 Liablities and Eculty Qument liabilities Accounts Payable Working Capital Loan Totol Current liabilities 100,000 150.000 250,000 Long term debts TOTAL DEBTS 500,000 750,000 Shareholders Equity Common Shares Retained earnings TOTAL SHAREHOLDERS EQUITY 650,000 350,000 750,000 1,500,000 TOTAL SHAREHOLDERS EQUITY LIABILITIES Next year the company expects sales to increase by 20% due to the expansion. The return on sales is expected to increase to 19% Management also expects there to be changes in the working capital accounts on the balance sheet Accounts receivable will improve to 100,000 Inventory should improve also to 200,000 Questions 1 What was the company's return on total assets last year 2. How much cash will internal operations provide le. What is generated by net Income, and changes in a/r. inventory etc.) 3. How much will the company have to raise from external sources to continue with the investment of 1,000,000 in capital assets nilahla Holdings Limited orc considering investing in $200,000 to open a new store and expand operations. Bclow arc last years financial figures. Revenues 500,000 Total Expenses 400,000 Assets Current assets Cash Accounts Receivable Inventory Total current assets Net income 10,000 90,000 50,000 150,000 100,000 Capital Assets (net) TOTAL ASSETS 350,000 500,000 Liabilities and Equity Current liabilities Accounts Payable Working Capital Loan Total Current liabilities 45,000 25,000 70.000 Long term debts TOTAL DEBTS 30,000 100,000 Shareholders Equity Common Shares Retained earnings TOTAL SHAREHOLDERS EQUITY 450,000 50,000 400,000 500,000 TOTAL SHAREHOLDERS EQUITY LIABILITIES Next year the company expects sales to increase by 10% due to the expansion. The return on sales is expected to increase to 22% Management also expects there to be changes in the working capital accounts on the balance sheet. Accounts receivable will improve to 50,000 Inventory is expected to deteriorate to 70,000 by the year end . Questions 1. What was the company's return on total assets last year. 2. How much cash will internal operations provide (Le. What is generated by net income, and changes in a/c inventory etc.) 3. How much will the company have to raise from external sources to continue with the investment of 200,000 in capital assets hilable Practice Case study Chapter 1 Stratus enterprises are considering investing in $1,00 years financial figures to Revenues 3,030,0. Total Expenses 2,550,0 Assets current assets Cash Accounts Receivable Inventory Total current assets Net income 480,0 100,000 150,000 250,000 500,000 Capital Assets (net) TOTAL ASSETS 1.000.000 1,500,000 Liablities and Eculty Qument liabilities Accounts Payable Working Capital Loan Totol Current liabilities 100,000 150.000 250,000 Long term debts TOTAL DEBTS 500,000 750,000 Shareholders Equity Common Shares Retained earnings TOTAL SHAREHOLDERS EQUITY 650,000 350,000 750,000 1,500,000 TOTAL SHAREHOLDERS EQUITY LIABILITIES Next year the company expects sales to increase by 20% due to the expansion. The return on sales is expected to increase to 19% Management also expects there to be changes in the working capital accounts on the balance sheet Accounts receivable will improve to 100,000 Inventory should improve also to 200,000 Questions 1 What was the company's return on total assets last year 2. How much cash will internal operations provide le. What is generated by net Income, and changes in a/r. inventory etc.) 3. How much will the company have to raise from external sources to continue with the investment of 1,000,000 in capital assets nilahla Holdings Limited orc considering investing in $200,000 to open a new store and expand operations. Bclow arc last years financial figures. Revenues 500,000 Total Expenses 400,000 Assets Current assets Cash Accounts Receivable Inventory Total current assets Net income 10,000 90,000 50,000 150,000 100,000 Capital Assets (net) TOTAL ASSETS 350,000 500,000 Liabilities and Equity Current liabilities Accounts Payable Working Capital Loan Total Current liabilities 45,000 25,000 70.000 Long term debts TOTAL DEBTS 30,000 100,000 Shareholders Equity Common Shares Retained earnings TOTAL SHAREHOLDERS EQUITY 450,000 50,000 400,000 500,000 TOTAL SHAREHOLDERS EQUITY LIABILITIES Next year the company expects sales to increase by 10% due to the expansion. The return on sales is expected to increase to 22% Management also expects there to be changes in the working capital accounts on the balance sheet. Accounts receivable will improve to 50,000 Inventory is expected to deteriorate to 70,000 by the year end . Questions 1. What was the company's return on total assets last year. 2. How much cash will internal operations provide (Le. What is generated by net income, and changes in a/c inventory etc.) 3. How much will the company have to raise from external sources to continue with the investment of 200,000 in capital assets hilable