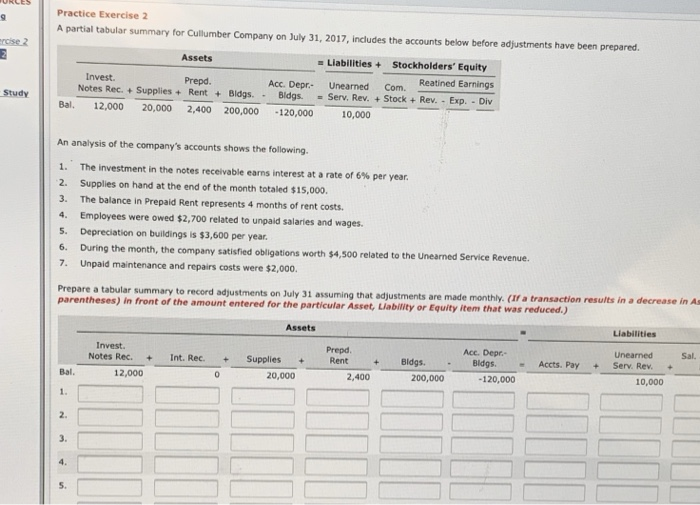

Practice Exercise 2 A partial tabular summary for Cullumber Company on July 31, 2017, includes the accounts below before adjustments have been prepared Assets Liabilities + Stockholders' Equity Reatined Earnings Notes Rec.Supplies+ RentBldgs.Bidgs.-Serv. Rev. + Stock+Rev. . Exp.- Div Invest. Prepd Acc. Depr Unearned Com Study Bal. 12,000 20,000 2,400 200,000 120,000 10,000 An analysis of the company's accounts shows the following. | . 1. 2. Supplies on hand at the end of the month totaled $15,00o. 3. The balance in Prepaid Rent represents 4 months of rent costs. 4. Employees were owed $2,700 related to unpaid salaries and wages. 5. Depreciation on buildings is $3,600 per year 6. During the month, the company satisfied obligations worth $4,500 related to the Unearned Service Revenue. 7. Unpaid maintenance and repairs costs were $2,000. The investment in the notes receivable earns interest at a rate of 6% per year. summary to record adjustments on July 31 assuming that adjustments are made monthly. (If a transaction results in a decrease in As parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Liabilities Unearned +Serv. Rev.+ Assets Sal. Acc. Depr Bldgs- Accts. Pay Prepd. Invest. Notes Rec. +Int. Rec.+ + SuppliesRentBldgs. B Bal. 12,000 20,000 2,400 200,000 -120,000 10,000 3. S. Practice Exercise 2 A partial tabular summary for Cullumber Company on July 31, 2017, includes the accounts below before adjustments have been prepared Assets Liabilities + Stockholders' Equity Reatined Earnings Notes Rec.Supplies+ RentBldgs.Bidgs.-Serv. Rev. + Stock+Rev. . Exp.- Div Invest. Prepd Acc. Depr Unearned Com Study Bal. 12,000 20,000 2,400 200,000 120,000 10,000 An analysis of the company's accounts shows the following. | . 1. 2. Supplies on hand at the end of the month totaled $15,00o. 3. The balance in Prepaid Rent represents 4 months of rent costs. 4. Employees were owed $2,700 related to unpaid salaries and wages. 5. Depreciation on buildings is $3,600 per year 6. During the month, the company satisfied obligations worth $4,500 related to the Unearned Service Revenue. 7. Unpaid maintenance and repairs costs were $2,000. The investment in the notes receivable earns interest at a rate of 6% per year. summary to record adjustments on July 31 assuming that adjustments are made monthly. (If a transaction results in a decrease in As parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Liabilities Unearned +Serv. Rev.+ Assets Sal. Acc. Depr Bldgs- Accts. Pay Prepd. Invest. Notes Rec. +Int. Rec.+ + SuppliesRentBldgs. B Bal. 12,000 20,000 2,400 200,000 -120,000 10,000 3. S