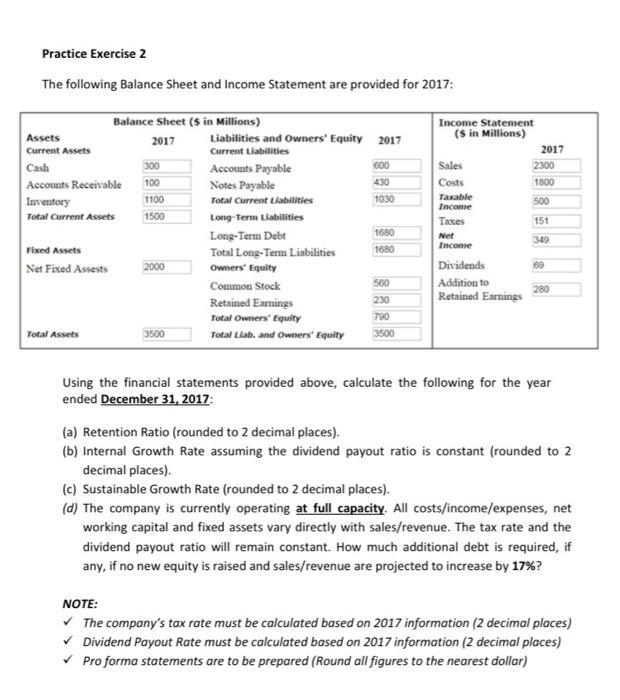

Practice Exercise 2 The following Balance Sheet and Income Statement are provided for 2017: Income Statement (s in Millions) 2017 Sales 2300 Costs 1800 Taxable 500 Income Taxes 151 Net 349 Income Balance Sheet ($ in Millions) Assets 2017 Liabilities and Owners' Equity 2017 Current Assets Current Liabilities Cash 300 Accounts Payable 600 Accounts Receivable 100 430 Notes Payable Inventory Total Current Liabilities 1030 Total Current Assets 1500 Long-Term Liabilities Long-Term Debt 1680 Fixed Assets Total Long-Term Liabilities 1680 Net Fixed Assets 2000 Owners' Equity Common Stock 560 Retained Earnings 230 Total Owners Equity 790 Total Assets Total Liab, and Owners' Equity 3500 1100 69 Dividends Addition to Retained Earnings 280 3500 Using the financial statements provided above, calculate the following for the year ended December 31, 2017: (a) Retention Ratio (rounded to 2 decimal places). (b) Internal Growth Rate assuming the dividend payout ratio is constant (rounded to 2 decimal places). (c) Sustainable Growth Rate (rounded to 2 decimal places). (d) The company is currently operating at full capacity. All costs/income/expenses, net working capital and fixed assets vary directly with sales/revenue. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required, if any, if no new equity is raised and sales/revenue are projected to increase by 17%? NOTE: The company's tax rate must be calculated based on 2017 information (2 decimal places) Dividend Payout Rate must be calculated based on 2017 information (2 decimal places) Pro forma statements are to be prepared (Round all figures to the nearest dollar) Practice Exercise 2 The following Balance Sheet and Income Statement are provided for 2017: Income Statement (s in Millions) 2017 Sales 2300 Costs 1800 Taxable 500 Income Taxes 151 Net 349 Income Balance Sheet ($ in Millions) Assets 2017 Liabilities and Owners' Equity 2017 Current Assets Current Liabilities Cash 300 Accounts Payable 600 Accounts Receivable 100 430 Notes Payable Inventory Total Current Liabilities 1030 Total Current Assets 1500 Long-Term Liabilities Long-Term Debt 1680 Fixed Assets Total Long-Term Liabilities 1680 Net Fixed Assets 2000 Owners' Equity Common Stock 560 Retained Earnings 230 Total Owners Equity 790 Total Assets Total Liab, and Owners' Equity 3500 1100 69 Dividends Addition to Retained Earnings 280 3500 Using the financial statements provided above, calculate the following for the year ended December 31, 2017: (a) Retention Ratio (rounded to 2 decimal places). (b) Internal Growth Rate assuming the dividend payout ratio is constant (rounded to 2 decimal places). (c) Sustainable Growth Rate (rounded to 2 decimal places). (d) The company is currently operating at full capacity. All costs/income/expenses, net working capital and fixed assets vary directly with sales/revenue. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required, if any, if no new equity is raised and sales/revenue are projected to increase by 17%? NOTE: The company's tax rate must be calculated based on 2017 information (2 decimal places) Dividend Payout Rate must be calculated based on 2017 information (2 decimal places) Pro forma statements are to be prepared (Round all figures to the nearest dollar)