Practice problem 1 (20%)

The Alberta Historical Resources Foundation (AHRF) is an other government organization standards, explain why the AHRF is an other government organization, and not a government organization, a government business enterprise, a government not-for-profit organization, a government partnership or a government business partnership.

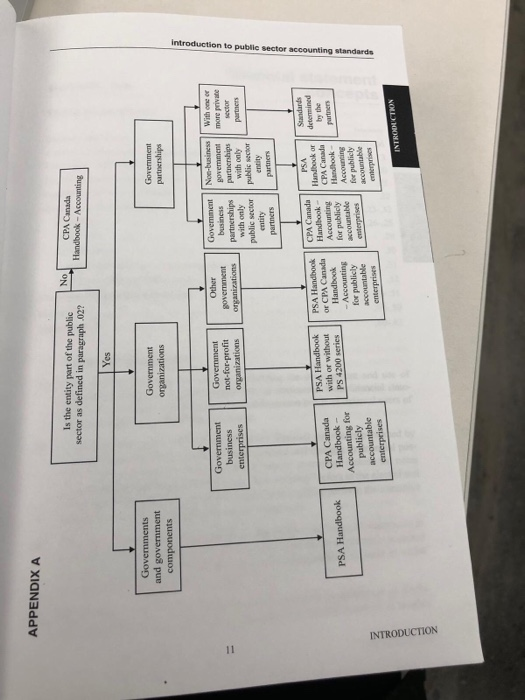

introduction to public sector accounting standards December 2014 AUTHORITY 01 The Public Sector Accounting Board (PSAB) issues standards and guidance with respect to matters of accounting in the public sector. PSAB issues such stan- dards and guidance to serve the publie interest by strengthening accountability in the public sector through developing, recommending and gaining acceptance of accounting and financial reporting standards of good practice. 02 "Public sector" refers to governments, government components, government organizations and government partnerships. Each of these entities is a "public sector entity 03 PSAB's rules of membership and Terms of Reference are approved by the Accounting Standards Oversight Council. DEFINITIONS A government component is an integral part of government, such as a depart- ment, ministry or fund. It is not a separate entity with the power to contract in its own name and that can sue and be sued. 04 A government organization is any organization controlled by a government that is a separate entity with the power to contract in its own name and that can sue and be sued. (Control is explained in GoVERNMENT REPORTING ENTITY, paragraphs PS 1300.07-24.) 05 A government business enterprise is a government organization that has all of the following characteristics: 06 It is a separate entity with the power to contract in its own name and that can sue and be sued (a) (b) It has been delegated the financial and operational authority to carry on a (e) It sells goods and services to individuals and organizations outside of the (d) It can, in t business. govenment reporting entity as its principal activity he normal course of its operations, maintain its operations and meet its liabilities from revenues received from sources outside of the govemment reporting entity (These characteristies are explained in GOVERNMENT REPORTING ENTITY, para- graphs PS 1300.29-.31.) Introduction to public sector accounting standards 07 A goverament not-for-profit organization is a goverm nization is a govemment organization has all of the following characteristics with the power to contract in its own name and (a) It is a separate entity (These ch PS 3060. sue and be sued. (b) It has counterparts outside the publie sector as defined in APPLIC transferable ownership interests. It is an entity normally without 11 These sta cial state (a) spec (b) limi When : where t is an entity organized and operated exclusively for social, ed fessional, religious, health, charitable or any other not-for profit (e) Its members, contributors and other resource providers do not, in such capac. that has all of name and that cas ity, receive any financial return directly from the An other government organization is a government organization the following characteristics: (a) It is a separate entity with the power to contract in its own 08 12 Gener sue and be sued (b) Itis neither a government business enterprise nor a govemment not-for-pro cial in organization. in ac 09 A goverament partnership is not a government organization but is a conractut arrangement between the government or a government organization and a party or parties outside of the reporting entity that has all of the following characteristics (a) The partners co-operate toward achieving significant, clearly defined com- of th 13 In c fina mon goals. (b) The partners make a financial investment in the government (c) The partners share control of decisions related to the financial and pur policies of the government partnership on an ongoing basis. d) The partners share, on an equitable basis, the significant risks and benetits po 14 Fo ap .15 F associated with the operations of the govemment partnership (These characteristics are explained in GOVERNMENT PARTNERSHIPS, paragraphs PS 3060.11-28.) 16 F A government business partnership is a government partnership that has all of the following characteristics: 10 (a) It is a separate entity with the power to contract in its own name and that can sue and be sued. (b) It has been delegated the financial and operational authority to carry (c) It sells goods and services to individuals and organizations other than (d) Itcan, in the nomal course of'its operations, maintain its operations and met on a partners as its principal activity its liabilities from revenues received from sources other than the partners. INTRODUCTION ation that introduction to public sector accounting standards (These characteristies are explained in GoVERNMENT PARTNERSHPS pargraghs PS 3060.11-.22, PS 3060.27-28 and PS 3060.33.) that can APPLICATION These standards apply to all public sector entities that issue general prose finan- cial statements unless al, pro- (a) specifically directed or permitted to use altemative standards by PSAB, or (b) limited in applicability as outlined in the individual Sections When applying the CPA Canada Public Sector Accounting (PSA) Handbook where the standards are silent on an issue, public sector entities should apply GENERALLY ACCEPTED ACCOUNTING PRINCIPLES, Section PS 1150 all of General purpose financial statements are financial statements prepared in accor- dance with a financial reporting framework designed to meet the common finan- cial information needs of a wide range of users. Not all public sector entities issas general purpose financial statements. Public sector entities that issue general pur pose financial statements should comply with the applicable accounting standards in accordance with this Introduction. For purposes of the PSA Handbook, the use of the tennfinancial statements" means general purpose financial statements. 12 t can rofit tual y or ics: In contrast, special purpose financial statements are financial statements prepared in accordance with a financial reporting framework that is designed to meet the financial information needs of specifie users. The broad distribution of special purpose financial statements does not make these financial statements general purpose. The PSA Handbook is not required for the preparation of special pur- pose financial statements. 13 14 For purposes of preparing general purpose financial statements, govemments 15 For purposes of preparing general purpose financial statements, government 16 For purposes of determining the appropriate standards, a govemment organiza- ng apply the standards for govemments in the PSA Handbook. ts components' apply the standards for govenments in the PSA Handbook. tion may be classified as: (a) a govemment business enterprise: (b) a govemment not-for-profit organization; or (c) an other government organization. Government components that adopt the standards issued by the Public Sector Accounting Board should do so for fiscal periods beginning on or after January 1, 2017. Earlier adoption is permited. Govem- ment components that expect to change their basis of accounting should disclose this fact in the periods preceding the period the change becomes effective. The adoption of the standards should be accounted for by retroactive application with restatement of prior periods in accordance with FIRST-TIME ADCRTION Section PS 2125. INTRODUCTION introduction to public sector accounting standa For purposes of preparing general purpose financial ness enterprises apply the standards for publicly of the CPA Canada Handbook- Accounting 17 cly accountabilc enterprises in For purposes of preparing general purpose financial for-profit organizations apply the standards otments, for-profit organizations in t purodorot-t withou Sections Ps 4 factors would indicat Part I of the CPA C 1S PSA Handbook or the standards in the PSA Handbook w For purposes of pa partnerships betwe .21 to PS 4270 (the PS 4200 series).2 For purposes of preparing general purpose financial s ment statements, other gven the PSA Handboo users' needs, the st of the CPA Cans consider in asses determined to be 19 ions would normally apply the standards for ernments in the PSA Handbook. When these standards do not meet th determined to be most appropriate should be disclosed anda users' needs, in addition to those outlined in FINANCIAL STATEMENTCNSg users' needs, the standards applicable to pub of the CPA Canada Handbook-Accounting should besi licly accountable considered. The standands 22 For purposes of business partner dards for public ty Determining the most appropriate standards for other requires the application of professional judgment. Factors to 20 The standards nerships with Handbook bu 23 Section PS 1000, include, but are not limited to, whether an organization (a) has issued, or is in the process of issuing, debt or equity instruments the or will be, outstanding and traded in a public market (for example, a domesti or foreign stock exchange or an over-the-counter market, including local and 24 The chart ins applying the regional markets); 25 GUNERALLY describes th use of the non-italici assets in a fiduciary capacity for a broad group of outsiders as one of ts pimary (c) has commercial-type operations and substantially derives its revenue from these activities; and SIGNIFI d) receives limited government assistance on an ongoing basis The degree of importance of these factors further depends on the particular cir- cumstances in cach case, including the nature of an organization's mandate and considering its purpose, objectives and limitations. In some situations, a particular factor may provide a high degree of evidence of the appropriateness of a particu- lar set of standards whereas, in other situations, the importance of the same factor may not be as significant. Positive responses to one or a combination of these 26 These sta matters. 27 In devel can be may ar 3 Governmer Sandards for not-for-profis ceganizations in the PSA Handbook include Sections PS 4200 to PS 4270 pyemment noe-for profit organizations are permitted to follow these Sections, Govemmet nd foe-profit organizations should adogs the standards for not-for-profit organizations or the sandards in the PSA Handbock without Sections PS 4200 to PS 4270 for fiscal periods beginning on ot after January 2012. Government for-profit organizations dat change their basis of i a also do so ment part in the PSA Handbook Sector A periods i ing should disclose this fact is the periods proceding the period the change becomes effective Ihe tion of the standards for nct-foe-profit organizations in the PSA Handhook or the standards in the Handbook without Sections PS 420 to PS 4270 should be accounted for by retrcactive application restacmet of prior periads in accordance with FIRST -TIME ADOPTION, Section PS 2125. 4 Govenv should emme the per INTRODUCTION t bust introduction to public sector accounting standards Part factors would indicate standards applicable to publicly accountable enterprises in Part I of the CPA Canada Handbook- Accounting may be more appropriate. t not in the 4200 For purposes of preparing general purpose financial statements, governmem erships between two or more public sector entities) except for govemment business partnerships, would normally apply the standards for govemments in the PSA Handbook. When these standards do not meet their financial statemen users' needs, the standards applicable to publicly accountable enterprises in Part of the CPA Canada Handbook Accounting should be considered. Factors to consider in assessing users' needs are included in paragraph .20. The standards determined to be most appropriate should be disclosed and consistently applied. n the art I ied. ons 22 For purposes of preparing gemeral purpose financial statements, government business partnerships between two or more public sector entities apply the stan- dards for publicly accountable enterprises in Part I of the CPA Canada Handbook Accounting The standards used by govenment partnerships and government business part- nerships with Handbook but, instead, determined by the partners. 23 one or more private sector partners is not specified by the PSA The chart inc applying the appropriate standards to various types of public sector entities. luded as Appendix A to this Introduction is intended to assist in stic and 24 describes the relationship between italicized and non-italicized paragraphs. The use of the term "standards" in the PSA Handbook refers to both italicized and non-italicized paragraphs. 25 GENERALLY ACCEPTED ACCOUNTING PRINCIPLES, paragraph PS 1150.14, its SIGNIFICANCE AND JUDGMENT 26 These standards are not intended to apply to immaterial or insignificant items or In developing its standards, PSAB recognizes that no rule of general application can be phrased to suit all circumstances or combinations of circumstances that may arise, nor is there any substitute for the exercise of professional judgment matters 27 ar Govemment partnerships that detcrmine standards applicable to publicly accountable enterprises are most appropriate for their partnership should do so for fiscal periods beginning on or after Janury 1, 3017, Govemment partnerships that adopt the standards issued by the Public Sector Accounting Board should also do so for fiscal periods beginning on or after January 1, 2017. Earlier adoption is perimined. Goven ment partnerships that expect to change their basis of accounting should disclose this fact in the periods preceding the period the change becomes effective. The adoption of the standards issued by the Public Sector Accounting Board should be accounted for by retroactive application with restatement of prie periods in accordance with FIRST-TIME ADOPTION, Section PS 2125. should do so for fiscal periods beginning on or after January 1,2017. Earlicr adoption is permitied. Gov emment business partnerships that expect to change their basis of accounting should disclose this fact in the periods preceding the period the change becomes effective. Govenment business partnerships that adopt the standands applicable to publicdy accountable enterprises INTRODUCTION introduction to public sector accounting standarde presentation or good in the determination of what constitutes fair particular case. EFFECTIVE DATE dated to s Italicized paragraphs issued before February 2002 PSAB PSABencournges the dotion of its standardions 28 were approved by PSAB. PSAB encourages t as practicable Italicized paragraphs issued after February 2002 have e compliance with the principles expressed therein is required. indicated, standards are effective with respect to financial issued after February 2002 have effective dates ao 29 Unless otherwise cial reports relating to years commecing on or after the first of the as nd beside the italicized paragraph. Standards being amended the effective date of the amendments. In many cases, however remain in force a adopt new or amended standards before the effective date.Pepaer NEUTRALITY IN STANDARD SETTING Neutrality in accounting has a greater significance for those who set standards than for those who have to apply those standards in reports, but the concept has substantially the same meaning for the two accounting .30 and both will maintain neutrality in the same way. Neutrality means that eithe in formulating or implementing standards, the primary concern should be the te evance and reliability of the information that results, not the effect that the e ule may have on a particular interest. As a matter of policy, PSAB assesses the merits of proposed standards from a position of neutrality. That is, the sound- ness of standards is not evaluated on the grounds of their possible impact on behaviour. PSAB does not choose standards according to the kinds of behaviour it wishes to promote and the kinds it wishes to discourage. At the same time, it is admitted that some standards will often have the effect of influencing behaviour and PSAB is alert to the economic impact of the standards that it promulgates. However, the justification for standards is conceptual and not in terms of their impact ADDITIONS AND REVISIONS Establishing standards for the public sector is an evolutionary process bui this process evolves, standards will be developed to respond to changing informa 31 on research, widespread experimentation, practical experience and consensus. As tion needs. There will also be periodic review and amendment of material prevh ously issued. The approval of at least two-thirds of the members of PSAB is required for new standards and for changes in existing standards. PSAB issues public exposure 32 drafts to ensure that those affected have t standards before they are approved by PSAB the opportunity to comment on proposed 0 INTRODUCTION 10 introduction to public sector accounting standards 2. 0 INTRODUCTION introduction to public sector accounting standards December 2014 AUTHORITY 01 The Public Sector Accounting Board (PSAB) issues standards and guidance with respect to matters of accounting in the public sector. PSAB issues such stan- dards and guidance to serve the publie interest by strengthening accountability in the public sector through developing, recommending and gaining acceptance of accounting and financial reporting standards of good practice. 02 "Public sector" refers to governments, government components, government organizations and government partnerships. Each of these entities is a "public sector entity 03 PSAB's rules of membership and Terms of Reference are approved by the Accounting Standards Oversight Council. DEFINITIONS A government component is an integral part of government, such as a depart- ment, ministry or fund. It is not a separate entity with the power to contract in its own name and that can sue and be sued. 04 A government organization is any organization controlled by a government that is a separate entity with the power to contract in its own name and that can sue and be sued. (Control is explained in GoVERNMENT REPORTING ENTITY, paragraphs PS 1300.07-24.) 05 A government business enterprise is a government organization that has all of the following characteristics: 06 It is a separate entity with the power to contract in its own name and that can sue and be sued (a) (b) It has been delegated the financial and operational authority to carry on a (e) It sells goods and services to individuals and organizations outside of the (d) It can, in t business. govenment reporting entity as its principal activity he normal course of its operations, maintain its operations and meet its liabilities from revenues received from sources outside of the govemment reporting entity (These characteristies are explained in GOVERNMENT REPORTING ENTITY, para- graphs PS 1300.29-.31.) Introduction to public sector accounting standards 07 A goverament not-for-profit organization is a goverm nization is a govemment organization has all of the following characteristics with the power to contract in its own name and (a) It is a separate entity (These ch PS 3060. sue and be sued. (b) It has counterparts outside the publie sector as defined in APPLIC transferable ownership interests. It is an entity normally without 11 These sta cial state (a) spec (b) limi When : where t is an entity organized and operated exclusively for social, ed fessional, religious, health, charitable or any other not-for profit (e) Its members, contributors and other resource providers do not, in such capac. that has all of name and that cas ity, receive any financial return directly from the An other government organization is a government organization the following characteristics: (a) It is a separate entity with the power to contract in its own 08 12 Gener sue and be sued (b) Itis neither a government business enterprise nor a govemment not-for-pro cial in organization. in ac 09 A goverament partnership is not a government organization but is a conractut arrangement between the government or a government organization and a party or parties outside of the reporting entity that has all of the following characteristics (a) The partners co-operate toward achieving significant, clearly defined com- of th 13 In c fina mon goals. (b) The partners make a financial investment in the government (c) The partners share control of decisions related to the financial and pur policies of the government partnership on an ongoing basis. d) The partners share, on an equitable basis, the significant risks and benetits po 14 Fo ap .15 F associated with the operations of the govemment partnership (These characteristics are explained in GOVERNMENT PARTNERSHIPS, paragraphs PS 3060.11-28.) 16 F A government business partnership is a government partnership that has all of the following characteristics: 10 (a) It is a separate entity with the power to contract in its own name and that can sue and be sued. (b) It has been delegated the financial and operational authority to carry (c) It sells goods and services to individuals and organizations other than (d) Itcan, in the nomal course of'its operations, maintain its operations and met on a partners as its principal activity its liabilities from revenues received from sources other than the partners. INTRODUCTION ation that introduction to public sector accounting standards (These characteristies are explained in GoVERNMENT PARTNERSHPS pargraghs PS 3060.11-.22, PS 3060.27-28 and PS 3060.33.) that can APPLICATION These standards apply to all public sector entities that issue general prose finan- cial statements unless al, pro- (a) specifically directed or permitted to use altemative standards by PSAB, or (b) limited in applicability as outlined in the individual Sections When applying the CPA Canada Public Sector Accounting (PSA) Handbook where the standards are silent on an issue, public sector entities should apply GENERALLY ACCEPTED ACCOUNTING PRINCIPLES, Section PS 1150 all of General purpose financial statements are financial statements prepared in accor- dance with a financial reporting framework designed to meet the common finan- cial information needs of a wide range of users. Not all public sector entities issas general purpose financial statements. Public sector entities that issue general pur pose financial statements should comply with the applicable accounting standards in accordance with this Introduction. For purposes of the PSA Handbook, the use of the tennfinancial statements" means general purpose financial statements. 12 t can rofit tual y or ics: In contrast, special purpose financial statements are financial statements prepared in accordance with a financial reporting framework that is designed to meet the financial information needs of specifie users. The broad distribution of special purpose financial statements does not make these financial statements general purpose. The PSA Handbook is not required for the preparation of special pur- pose financial statements. 13 14 For purposes of preparing general purpose financial statements, govemments 15 For purposes of preparing general purpose financial statements, government 16 For purposes of determining the appropriate standards, a govemment organiza- ng apply the standards for govemments in the PSA Handbook. ts components' apply the standards for govenments in the PSA Handbook. tion may be classified as: (a) a govemment business enterprise: (b) a govemment not-for-profit organization; or (c) an other government organization. Government components that adopt the standards issued by the Public Sector Accounting Board should do so for fiscal periods beginning on or after January 1, 2017. Earlier adoption is permited. Govem- ment components that expect to change their basis of accounting should disclose this fact in the periods preceding the period the change becomes effective. The adoption of the standards should be accounted for by retroactive application with restatement of prior periods in accordance with FIRST-TIME ADCRTION Section PS 2125. INTRODUCTION introduction to public sector accounting standa For purposes of preparing general purpose financial ness enterprises apply the standards for publicly of the CPA Canada Handbook- Accounting 17 cly accountabilc enterprises in For purposes of preparing general purpose financial for-profit organizations apply the standards otments, for-profit organizations in t purodorot-t withou Sections Ps 4 factors would indicat Part I of the CPA C 1S PSA Handbook or the standards in the PSA Handbook w For purposes of pa partnerships betwe .21 to PS 4270 (the PS 4200 series).2 For purposes of preparing general purpose financial s ment statements, other gven the PSA Handboo users' needs, the st of the CPA Cans consider in asses determined to be 19 ions would normally apply the standards for ernments in the PSA Handbook. When these standards do not meet th determined to be most appropriate should be disclosed anda users' needs, in addition to those outlined in FINANCIAL STATEMENTCNSg users' needs, the standards applicable to pub of the CPA Canada Handbook-Accounting should besi licly accountable considered. The standands 22 For purposes of business partner dards for public ty Determining the most appropriate standards for other requires the application of professional judgment. Factors to 20 The standards nerships with Handbook bu 23 Section PS 1000, include, but are not limited to, whether an organization (a) has issued, or is in the process of issuing, debt or equity instruments the or will be, outstanding and traded in a public market (for example, a domesti or foreign stock exchange or an over-the-counter market, including local and 24 The chart ins applying the regional markets); 25 GUNERALLY describes th use of the non-italici assets in a fiduciary capacity for a broad group of outsiders as one of ts pimary (c) has commercial-type operations and substantially derives its revenue from these activities; and SIGNIFI d) receives limited government assistance on an ongoing basis The degree of importance of these factors further depends on the particular cir- cumstances in cach case, including the nature of an organization's mandate and considering its purpose, objectives and limitations. In some situations, a particular factor may provide a high degree of evidence of the appropriateness of a particu- lar set of standards whereas, in other situations, the importance of the same factor may not be as significant. Positive responses to one or a combination of these 26 These sta matters. 27 In devel can be may ar 3 Governmer Sandards for not-for-profis ceganizations in the PSA Handbook include Sections PS 4200 to PS 4270 pyemment noe-for profit organizations are permitted to follow these Sections, Govemmet nd foe-profit organizations should adogs the standards for not-for-profit organizations or the sandards in the PSA Handbock without Sections PS 4200 to PS 4270 for fiscal periods beginning on ot after January 2012. Government for-profit organizations dat change their basis of i a also do so ment part in the PSA Handbook Sector A periods i ing should disclose this fact is the periods proceding the period the change becomes effective Ihe tion of the standards for nct-foe-profit organizations in the PSA Handhook or the standards in the Handbook without Sections PS 420 to PS 4270 should be accounted for by retrcactive application restacmet of prior periads in accordance with FIRST -TIME ADOPTION, Section PS 2125. 4 Govenv should emme the per INTRODUCTION t bust introduction to public sector accounting standards Part factors would indicate standards applicable to publicly accountable enterprises in Part I of the CPA Canada Handbook- Accounting may be more appropriate. t not in the 4200 For purposes of preparing general purpose financial statements, governmem erships between two or more public sector entities) except for govemment business partnerships, would normally apply the standards for govemments in the PSA Handbook. When these standards do not meet their financial statemen users' needs, the standards applicable to publicly accountable enterprises in Part of the CPA Canada Handbook Accounting should be considered. Factors to consider in assessing users' needs are included in paragraph .20. The standards determined to be most appropriate should be disclosed and consistently applied. n the art I ied. ons 22 For purposes of preparing gemeral purpose financial statements, government business partnerships between two or more public sector entities apply the stan- dards for publicly accountable enterprises in Part I of the CPA Canada Handbook Accounting The standards used by govenment partnerships and government business part- nerships with Handbook but, instead, determined by the partners. 23 one or more private sector partners is not specified by the PSA The chart inc applying the appropriate standards to various types of public sector entities. luded as Appendix A to this Introduction is intended to assist in stic and 24 describes the relationship between italicized and non-italicized paragraphs. The use of the term "standards" in the PSA Handbook refers to both italicized and non-italicized paragraphs. 25 GENERALLY ACCEPTED ACCOUNTING PRINCIPLES, paragraph PS 1150.14, its SIGNIFICANCE AND JUDGMENT 26 These standards are not intended to apply to immaterial or insignificant items or In developing its standards, PSAB recognizes that no rule of general application can be phrased to suit all circumstances or combinations of circumstances that may arise, nor is there any substitute for the exercise of professional judgment matters 27 ar Govemment partnerships that detcrmine standards applicable to publicly accountable enterprises are most appropriate for their partnership should do so for fiscal periods beginning on or after Janury 1, 3017, Govemment partnerships that adopt the standards issued by the Public Sector Accounting Board should also do so for fiscal periods beginning on or after January 1, 2017. Earlier adoption is perimined. Goven ment partnerships that expect to change their basis of accounting should disclose this fact in the periods preceding the period the change becomes effective. The adoption of the standards issued by the Public Sector Accounting Board should be accounted for by retroactive application with restatement of prie periods in accordance with FIRST-TIME ADOPTION, Section PS 2125. should do so for fiscal periods beginning on or after January 1,2017. Earlicr adoption is permitied. Gov emment business partnerships that expect to change their basis of accounting should disclose this fact in the periods preceding the period the change becomes effective. Govenment business partnerships that adopt the standands applicable to publicdy accountable enterprises INTRODUCTION introduction to public sector accounting standarde presentation or good in the determination of what constitutes fair particular case. EFFECTIVE DATE dated to s Italicized paragraphs issued before February 2002 PSAB PSABencournges the dotion of its standardions 28 were approved by PSAB. PSAB encourages t as practicable Italicized paragraphs issued after February 2002 have e compliance with the principles expressed therein is required. indicated, standards are effective with respect to financial issued after February 2002 have effective dates ao 29 Unless otherwise cial reports relating to years commecing on or after the first of the as nd beside the italicized paragraph. Standards being amended the effective date of the amendments. In many cases, however remain in force a adopt new or amended standards before the effective date.Pepaer NEUTRALITY IN STANDARD SETTING Neutrality in accounting has a greater significance for those who set standards than for those who have to apply those standards in reports, but the concept has substantially the same meaning for the two accounting .30 and both will maintain neutrality in the same way. Neutrality means that eithe in formulating or implementing standards, the primary concern should be the te evance and reliability of the information that results, not the effect that the e ule may have on a particular interest. As a matter of policy, PSAB assesses the merits of proposed standards from a position of neutrality. That is, the sound- ness of standards is not evaluated on the grounds of their possible impact on behaviour. PSAB does not choose standards according to the kinds of behaviour it wishes to promote and the kinds it wishes to discourage. At the same time, it is admitted that some standards will often have the effect of influencing behaviour and PSAB is alert to the economic impact of the standards that it promulgates. However, the justification for standards is conceptual and not in terms of their impact ADDITIONS AND REVISIONS Establishing standards for the public sector is an evolutionary process bui this process evolves, standards will be developed to respond to changing informa 31 on research, widespread experimentation, practical experience and consensus. As tion needs. There will also be periodic review and amendment of material prevh ously issued. The approval of at least two-thirds of the members of PSAB is required for new standards and for changes in existing standards. PSAB issues public exposure 32 drafts to ensure that those affected have t standards before they are approved by PSAB the opportunity to comment on proposed 0 INTRODUCTION 10 introduction to public sector accounting standards 2. 0 INTRODUCTION