Answered step by step

Verified Expert Solution

Question

1 Approved Answer

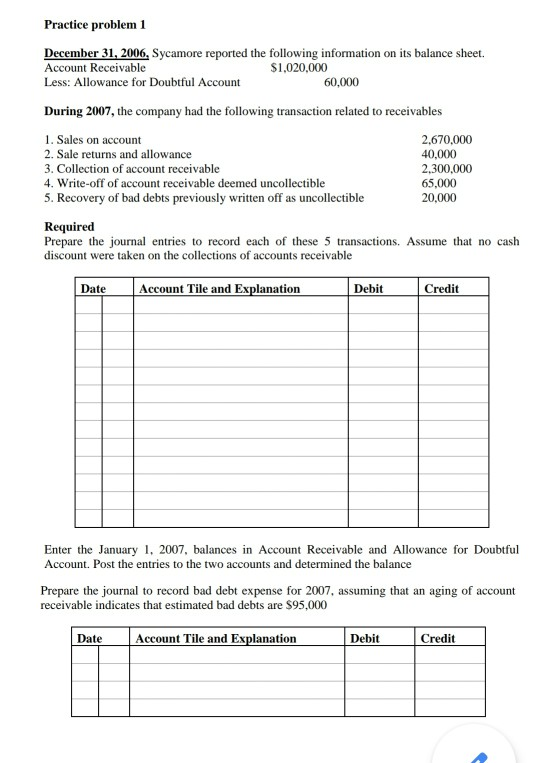

Practice problem 1 December 31, 2006, Sycamore reported the following information on its balance sheet. Account Receivable $1,020,000 Less: Allowance for Doubtful Account 60,000 During

Practice problem 1 December 31, 2006, Sycamore reported the following information on its balance sheet. Account Receivable $1,020,000 Less: Allowance for Doubtful Account 60,000 During 2007, the company had the following transaction related to receivables 1. Sales on account 2,670,000 2. Sale returns and allowance 40,000 3. Collection of account receivable 2,300,000 4. Write-off of account receivable deemed uncollectible 65,000 5. Recovery of bad debts previously written off as uncollectible 20,000 Required Prepare the journal entries to record each of these 5 transactions. Assume that no cash discount were taken on the collections of accounts receivable Date Account Tile and Explanation Debit Credit Enter the January 1, 2007, balances in Account Receivable and Allowance for Doubtful Account. Post the entries to the two accounts and determined the balance Prepare the journal to record bad debt expense for 2007, assuming that an aging of account receivable indicates that estimated bad debts are $95.000 Date Account Tile and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started