Answered step by step

Verified Expert Solution

Question

1 Approved Answer

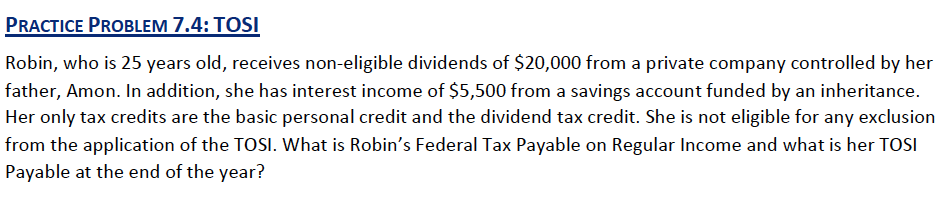

PRACTICE PROBLEM 7.4: TOSI Robin, who is 25 years old, receives non-eligible dividends of $20,000 from a private company controlled by her father, Amon. In

PRACTICE PROBLEM 7.4: TOSI Robin, who is 25 years old, receives non-eligible dividends of $20,000 from a private company controlled by her father, Amon. In addition, she has interest income of $5,500 from a savings account funded by an inheritance. Her only tax credits are the basic personal credit and the dividend tax credit. She is not eligible for any exclusion from the application of the TOSI. What is Robin's Federal Tax Payable on Regular Income and what is her TOSI Payable at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started