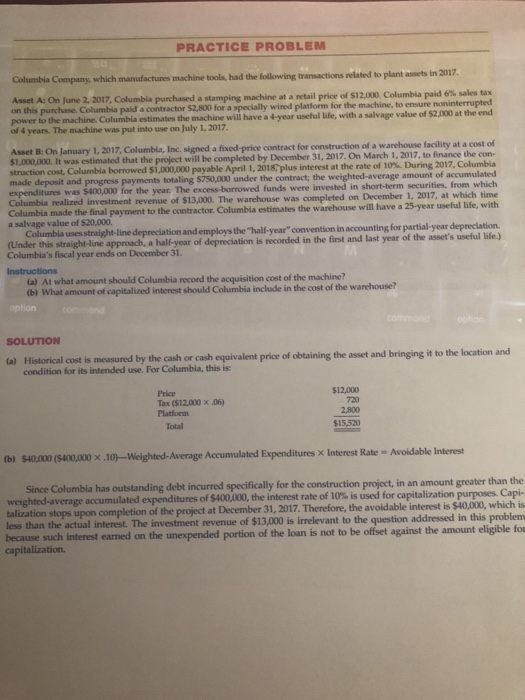

PRACTICE PROBLEM Columbia Company, which manufactures machine tools, had the following transactions related to plant assets in 2017 Asset A: On June 2 2017, Columbia purchased a stamping machine at a retail price of S12 000 Columbia paid 6% sales tax on this purchase. Columbia paid a contractor power to the machine. Columbia estimates the machine will have a 4-year useful life, with a salvage value of $2,000 at of 4 years. The machine was put into use on July 1, 2017 for the machine, to ensure noninterrupted the end Asset B: On January 1, 2017, Columbla, Inc. signed a fixed-price contract for construction of a struction cost, Columbia borrowed $1,000,000 payable April 1, 2018, plus interest at the rate of 10%. During 2017, Columbia warehouse facility at a cost of It was estimated that the project will be completed by December 31, 2017. On March 1, 2017, to finance the con- hted-average amount of accumulated funds were invested in short-term securities, from which have a 25-year useful life, with and progress payments totaling $750,000 under the contract; the weigh expenditures was $400,000 for the year. The excess-borrowed Columbia realized investment revenue of $13,000. The warehouse was completed on December 1, 2017 Columbia made the final payment to the contractor. Columbia estimates the warehouse will a salvage value of $20,000. Columbia uses straight-line depreciation and employs the "half-year" convention in accounting for partial-year depreciation. (Under this straight-ine approach, a half-year of is Columbia's fiscal year ends on December 31. Columbia's fiscal year ends on Decembciation is recorded in the first and last year of the asset's useful life) a) At what amount should Columbia record the acquisition cost of the machine? (b) What amount of capitalized interest should Columbia include in the cost of the warehouse? a) Historical cost is measured by the cash or cash equivalent price of obtaining the asset and bringing it to the location and condition for its intended use. For Columbia, this is $12,000 720 2,800 Price Tax ($12,000 x 06) Platform $15,520 Total b)$40000 400,000 x.10)-Weighted-Average Accumulated Expenditures X Interest Rate - Avoidable Interest Since Columbia has outstanding debt incurred specifically for the construction project, in an amount greater than the ated expenditures of S40000, the interest rate of 10% is used for capitalization purposes. Capi- , 2017. Therefore, the avoidable interest is $40,000, which is less than the actual interest. The investment revenue of $13,000 is irrelevant to the question addressed in this problem because such interest earned on the unexpended portion of the loan is not to be offset against the amount eligible fos talization stops upon completion of the project at December 31 capitalization