Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Practice Problems # 1 ( 1 ) The Anderson Company is planning to finance a new project by selling bonds. The face value of each

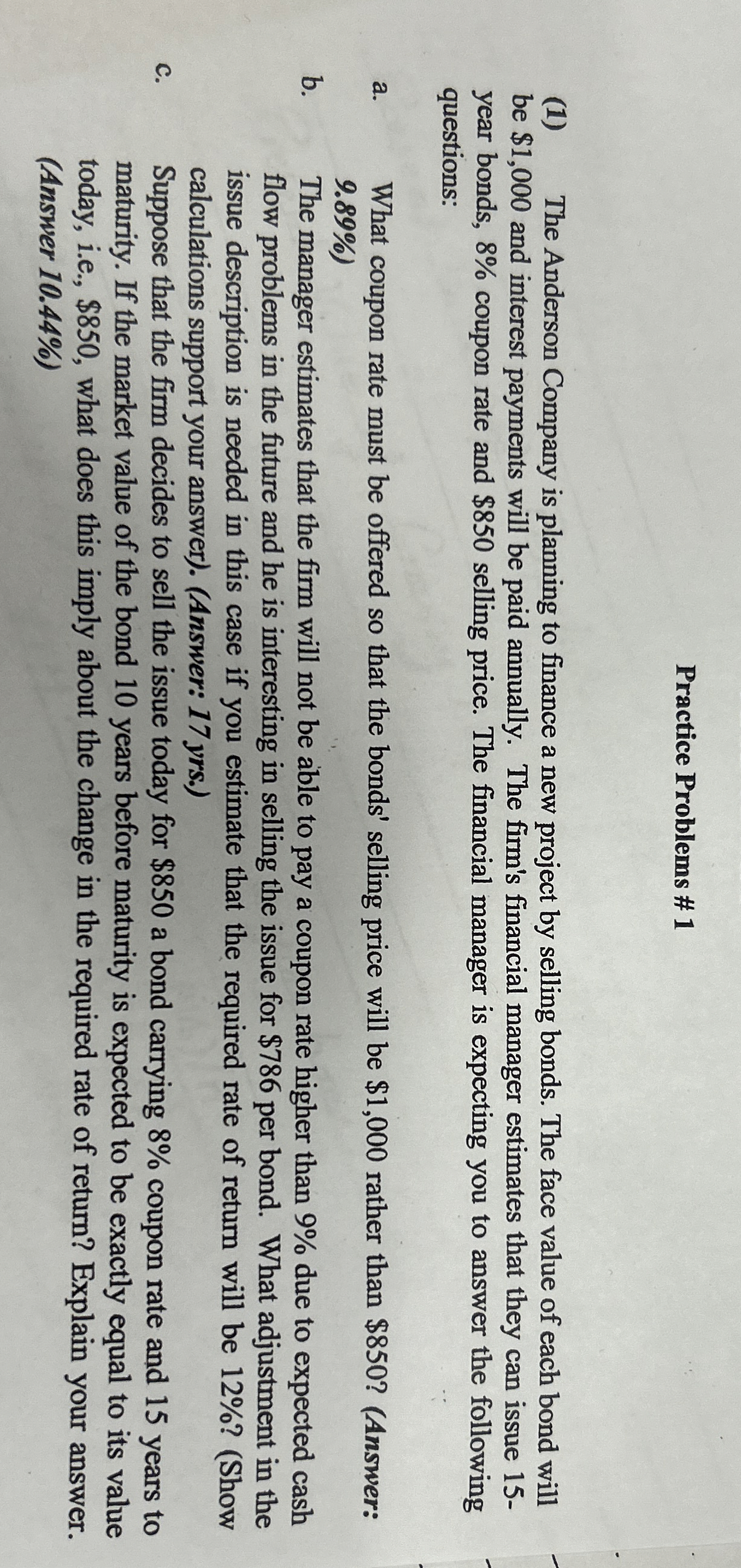

Practice Problems #

The Anderson Company is planning to finance a new project by selling bonds. The face value of each bond will

be $ and interest payments will be paid annually. The firm's financial manager estimates that they can issue

year bonds, coupon rate and $ selling price. The financial manager is expecting you to answer the following

questions:

a What coupon rate must be offered so that the bonds' selling price will be $ rather than $Answer:

b The manager estimates that the firm will not be able to pay a coupon rate higher than due to expected cash

flow problems in the future and he is interesting in selling the issue for $ per bond. What adjustment in the

issue description is needed in this case if you estimate that the required rate of return will be Show

calculations support your answerAnswer: yrs

c Suppose that the firm decides to sell the issue today for $ a bond carrying coupon rate and years to

maturity. If the market value of the bond years before maturity is expected to be exactly equal to its value

today, ie $ what does this imply about the change in the required rate of return? Explain your answer.

Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started