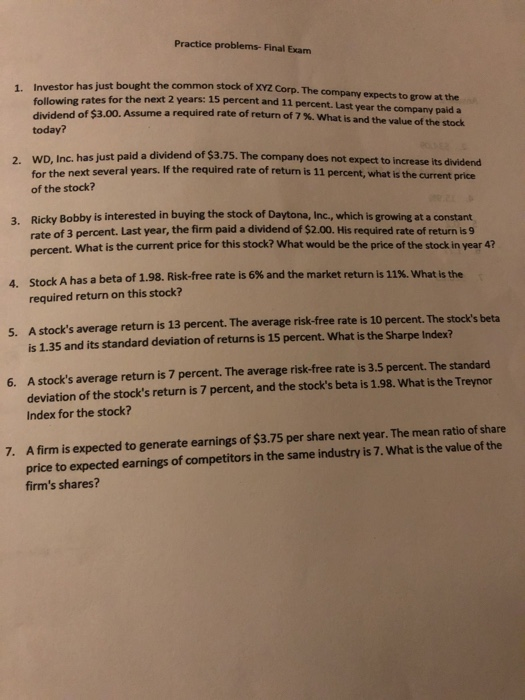

Practice problems- Final Exam has just bought the common stock of XYZ Corp. The company expects to grow at the rates for the next 2 years: 15 percent and 11 percent. Last year the company paid a Assume a required rate of return of 7 %. What is and the value of the stock 1. Investor dividend of $3.00. today? 2 WD. Inc. has just paid a dividend of $3.75. The company does not expect to increase its dividend for the next several years. If the required rate of return is 11 percent, what is the current price of the stock? Ricky Bobby is interested in buying the stock of Daytona, Inc., which is growing at a constant rate of 3 percent. Last year, the firm paid a dividend of $2.00. His required rate of return is 9 percent. What is the current price for this stock? What would be the price of the stock in year 4? 3. Stock A has a beta of 1.98. Risk-free rate is 6% and the market return is 11%. What is the required return on this stock? 4. 5. A stock's average return is 13 percent. The average risk-free rate is 10 percent. The stock's beta is 1.35 and its standard deviation of returns is 15 percent. What is the Sharpe Index? deviation of the stock's return is 7 percent, and the stock's beta is 1.98. What is the Treynor Index for the stock? A stock's average return is 7 percent. The average risk-free rate is 3.5 percent. The standard 6. A firm is expected to generate earnings of $3.75 per share next year. The mean ratio of share price to expected earnings of competitors in the same industry is 7. What is the value of the firm's shares? 7. Practice problems- Final Exam has just bought the common stock of XYZ Corp. The company expects to grow at the rates for the next 2 years: 15 percent and 11 percent. Last year the company paid a Assume a required rate of return of 7 %. What is and the value of the stock 1. Investor dividend of $3.00. today? 2 WD. Inc. has just paid a dividend of $3.75. The company does not expect to increase its dividend for the next several years. If the required rate of return is 11 percent, what is the current price of the stock? Ricky Bobby is interested in buying the stock of Daytona, Inc., which is growing at a constant rate of 3 percent. Last year, the firm paid a dividend of $2.00. His required rate of return is 9 percent. What is the current price for this stock? What would be the price of the stock in year 4? 3. Stock A has a beta of 1.98. Risk-free rate is 6% and the market return is 11%. What is the required return on this stock? 4. 5. A stock's average return is 13 percent. The average risk-free rate is 10 percent. The stock's beta is 1.35 and its standard deviation of returns is 15 percent. What is the Sharpe Index? deviation of the stock's return is 7 percent, and the stock's beta is 1.98. What is the Treynor Index for the stock? A stock's average return is 7 percent. The average risk-free rate is 3.5 percent. The standard 6. A firm is expected to generate earnings of $3.75 per share next year. The mean ratio of share price to expected earnings of competitors in the same industry is 7. What is the value of the firm's shares? 7