Answered step by step

Verified Expert Solution

Question

1 Approved Answer

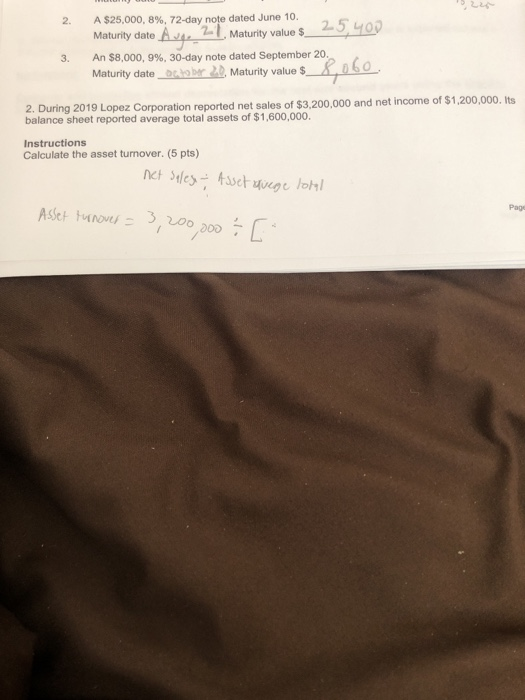

practice problems need help please 2. A $25,000,8%, 72-day note dated June 10. Maturity date Auge 21. Maturity value $_25,400 3. An $8,000, 9%, 30-day

practice problems need help please

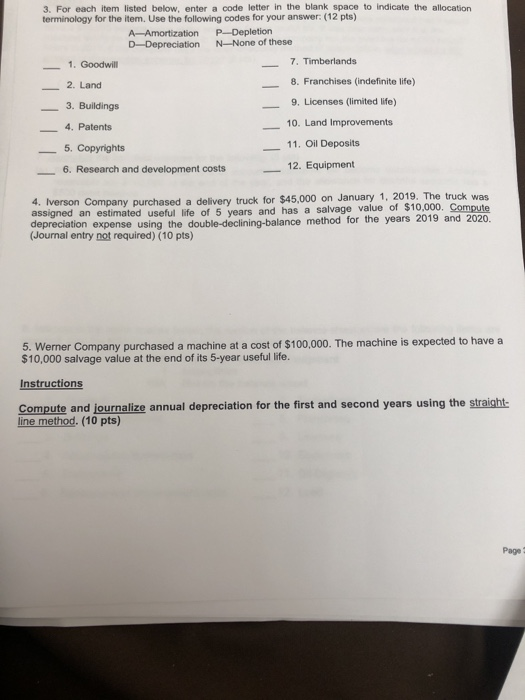

2. A $25,000,8%, 72-day note dated June 10. Maturity date Auge 21. Maturity value $_25,400 3. An $8,000, 9%, 30-day note dated September 20. Maturity date_october 20, Maturity value $ 8,060. 2. During 2019 Lopez Corporation reported net sales of $3,200,000 and net income of $1,200,000. Its balance sheet reported average total assets of $1,600,000. Instructions Calculate the asset turnover. (5 pts) net salese - Asset avage loll Page AsSet turnover 3,200,000 & [ 3. For each item listed below, enter a code letter in the blank space to indicate the allocation terminology for the item. Use the following codes for your answer: (12 pts) A-Amortization p-Depletion DDepreciation N-None of these 7. Timberlands 1. Goodwill 2. Land 3. Buildings 8. Franchises (indefinite life) 9. Licenses (limited life) 10. Land Improvements 4. Patents 11. Oil Deposits 5. Copyrights 6. Research and development costs 12. Equipment 4. Iverson Company purchased a delivery truck for $45,000 on January 1, 2019. The truck was assigned an estimated useful life of 5 years and has a salvage value of $10,000. Compute depreciation expense using the double-declining-balance method for the years 2019 and 2020. (Journal entry not required) (10 pts) 5. Werner Company purchased a machine at a cost of $100,000. The machine is expected to have a $10,000 salvage value at the end of its 5-year useful life. Instructions Compute and journalize annual depreciation for the first and second years using the straight- line method. (10 pts) Page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started