Question

Practice Question On 1 July 2020, Jane Ltd, an Australian company, acquired all of the issued shares of Doe Ltd, a company incorporated in the

Practice Question

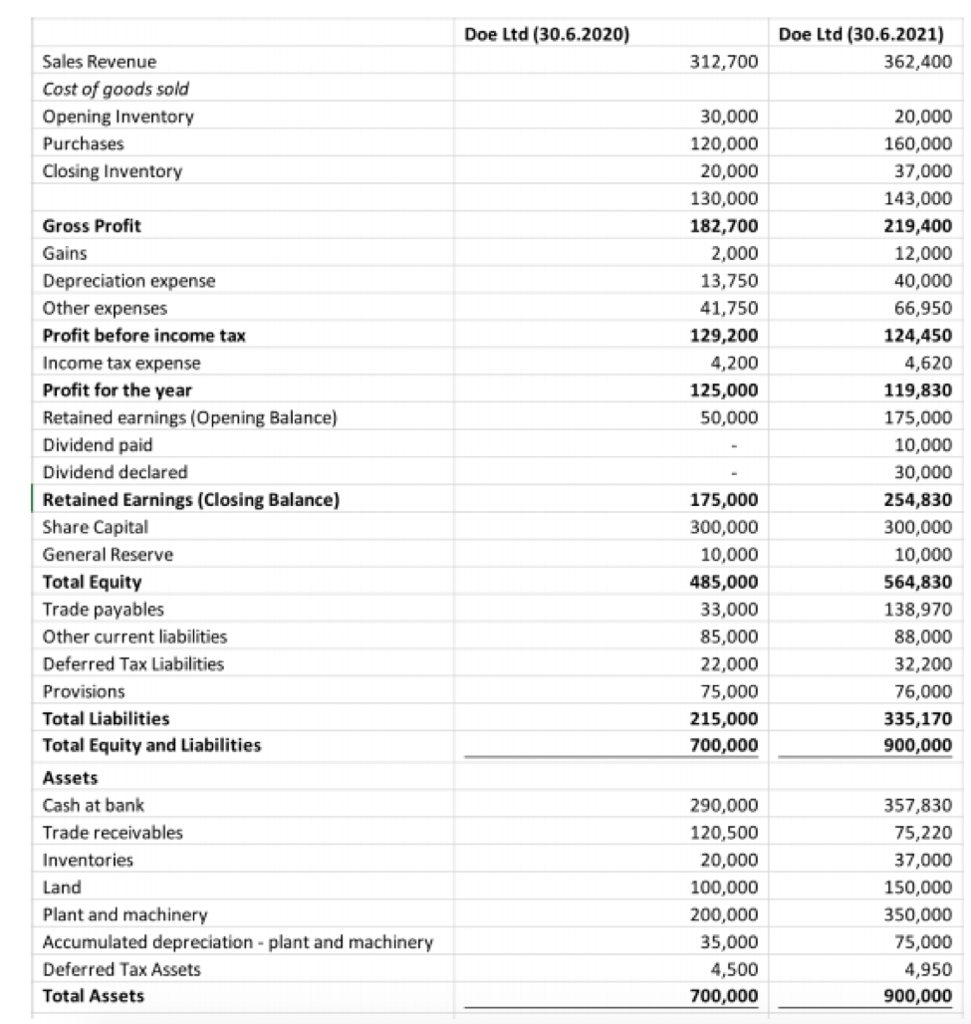

On 1 July 2020, Jane Ltd, an Australian company, acquired all of the issued shares of Doe Ltd, a company incorporated in the US. The financial statements of profit or loss and other comprehensive income and statement of financial position of Doe Ltd at 30 June 2020 and 30 June 2021 were as follows:

Additional information:

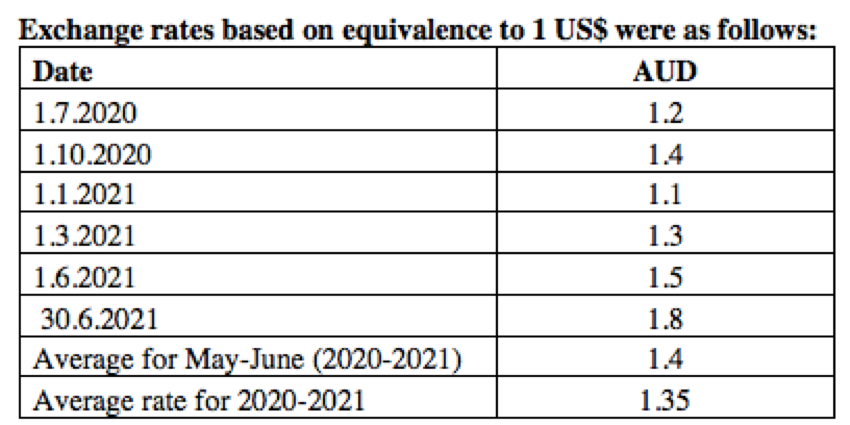

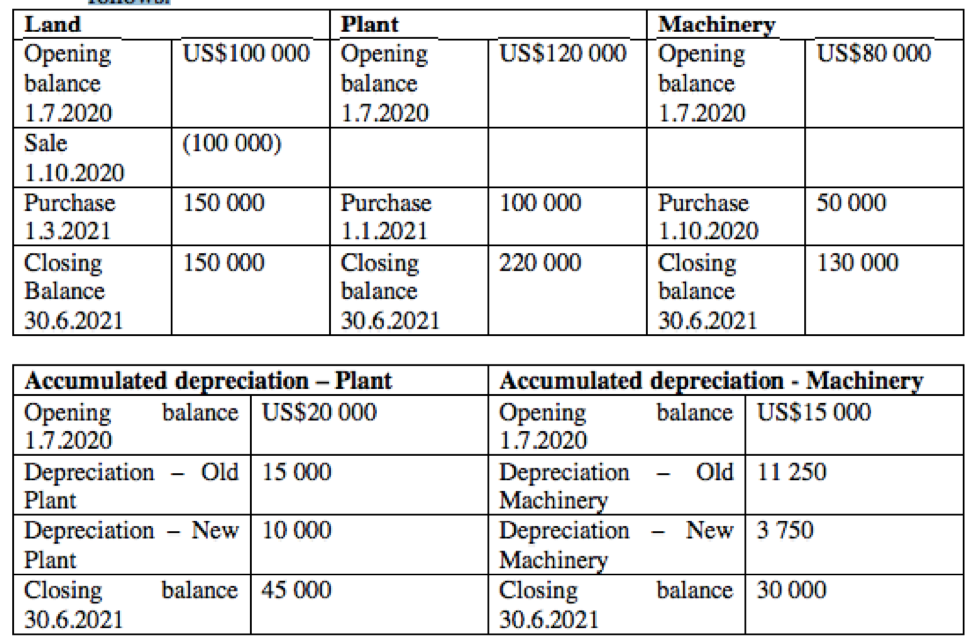

On 1 October 2020, Doe Ltd paid US$50 000 for a sonic scanner which is to be depreciated evenly over a 10-year period. In addition, the land on hand at the beginning of the year was sold for US$112 000 on the same date. The carrying amount of the land at the date of sale was US$100 000.

On 1 January 2021, Doe Ltd acquired a new plant for US$100 000. This plant has a useful life of 5 years. Doe Ltd expects to consume the benefits of this plant evenly over its life. On 1 March 2021, Doe Ltd acquired $US150 000 worth of land.

Movements in Land, Plant and Machinery over the year ended 30 June 2021 were as follows:

Doe Ltd declared dividends of US$40 000 for the year ended 30 June 2021. A quarter of these were the interim dividends declared and paid on 1 January 2021 while the remaining were declared on 1 June 2021.

Sales, purchases, and expenses occurred evenly throughout the period. The closing inventories on 30 June 2021 were acquired during the last 2 months of the financial year ended 30 June 2021.

QUESTION:

1. If the functional currency for Jane Ltd is the Australian Dollar, prepare the financial statements of Jane Ltd at 30 June 2021 in the functional currency.

Doe Ltd (30.6.2020) Doe Ltd (30.6.2021) 362,400 Sales Revenue Cost of goods sold Opening Inventory Purchases Closing Inventory 312,700 30,000 120,000 20,000 130,000 182,700 2,000 13,750 41,750 129,200 4,200 125,000 50,000 Gross Profit Gains Depreciation expense Other expenses Profit before income tax Income tax expense Profit for the year Retained earnings (Opening Balance Dividend paid Dividend declared Retained Earnings (Closing Balance) Share Capital General Reserve Total Equity Trade payables Other current liabilities Deferred Tax Liabilities Provisions Total Liabilities Total Equity and Liabilities Assets Cash at bank Trade receivables Inventories 20,000 160,000 37,000 143,000 219,400 12,000 40,000 66,950 124,450 4,620 119,830 175,000 10,000 30,000 254,830 300,000 10,000 564,830 138,970 88,000 32,200 76,000 335,170 900,000 175,000 300,000 10,000 485,000 33,000 85,000 22,000 75,000 215,000 700,000 290,000 120,500 20,000 100,000 200,000 35,000 4,500 700,000 357,830 75,220 37,000 150,000 350,000 75,000 4,950 900,000 Plant and machinery Accumulated depreciation - plant and machinery Deferred Tax Assets Total AssetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started