Answered step by step

Verified Expert Solution

Question

1 Approved Answer

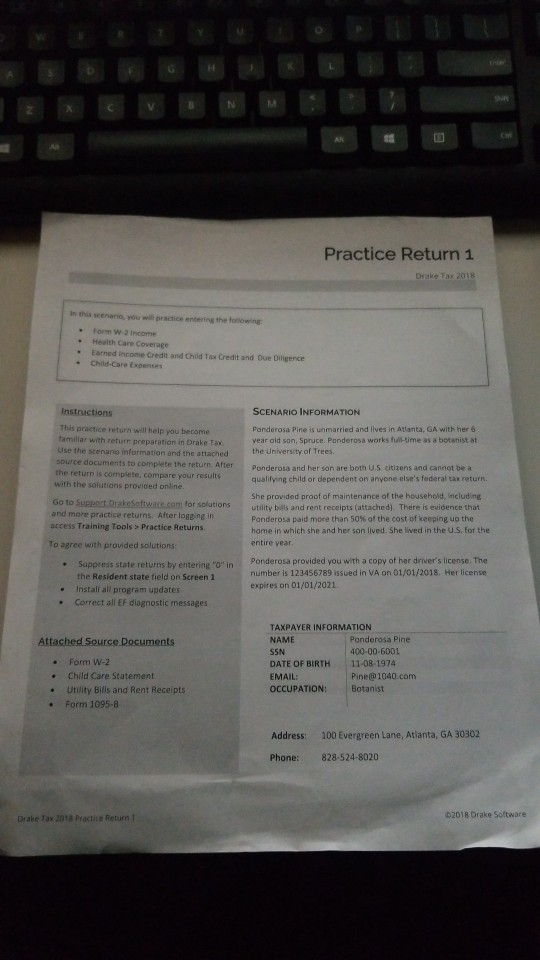

Practice Return 1 Drake Tax 2018 In this scenario, you will practice entering the towing Form w 2 income Health Care Coverage Earned Income Credit

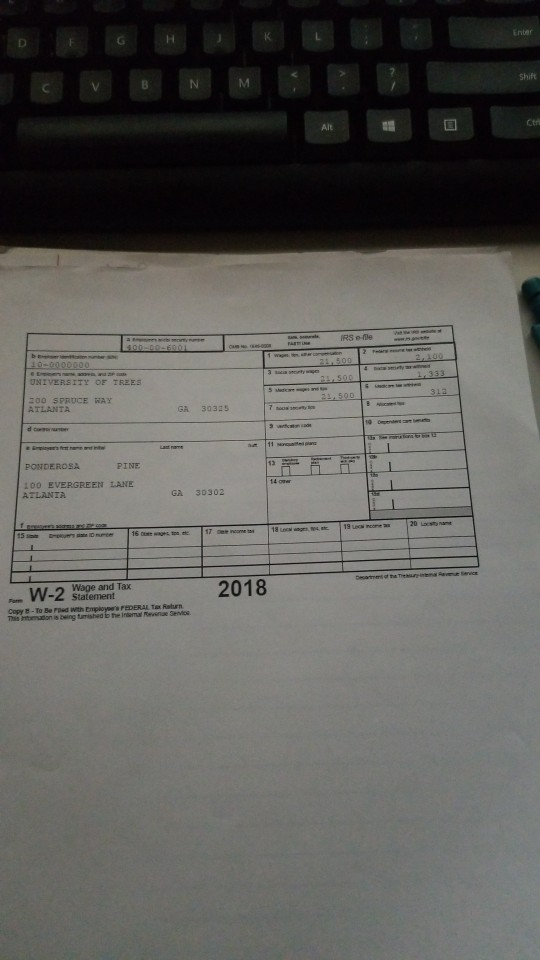

Practice Return 1 Drake Tax 2018 In this scenario, you will practice entering the towing Form w 2 income Health Care Coverage Earned Income Credit and Child Tax Credit and Due Diligence Child Care Expenses SCENARIO INFORMATION Instructions This practice return will help you became familiar with return preparation in Drake Tax Use the scenario information and the attached source documents to complete the return. After the return is complete, compare your results with the solutions provided online Panderosa Pine is unmarried and lives in Atlanta, GA with her 6 vear old son, Spruce. Ponderosa works full-time as a botanist at the University of Trees Ponderosa and her son are both US citizens and cannot be a qualifying child or dependent on anyone else's federal tax return Go to Support Drake Software com for solutions and more practice returns. After losing in access Training Tools > Practice Returns She provided proof of maintenance of the household Including utility balls and rent receipts (attached). There is evidence that Panderosa paid more than 50% of the cost of keeping up the home in which she and her son lived. She lived in the US, for the entire year To agree with provided solutions Suppress state returns by entering "O" in the Resident state field on Screen 1 Install all program updates . Correct all EF diagnostic messages Ponderosa provided you with a copy of her driver's license. The number is 123456789 issued in VA on 01/01/2018. Her license expires on 01/01/2021 Attached Source Documents Form W-2 Child Care Statement Utility Bills and Rent Receipts Form 1095-8 TAXPAYER INFORMATION NAME Ponderosa Pine SSN 400-00-6001 DATE OF BIRTH 11-08-1974 EMAIL: Pine@1040.com OCCUPATION: Botanist Address: 100 Evergreen Lane, Atlanta, GA 30302 828-524-8020 Phone: Drake Tax 2018 Practice Return 2018 Drake Software Shift N M IRS elle UNIVERSITY OF TREES 31.500 200 SPRUCE WAY ATLANTA GA 30335 PONDEROSA PINE 100 EVERGREEN LANE ATLANTA GA 30302 20 17 com 19 18 A Wage and Tax W -2 Statement 2018 Copy - To Bed With Empoy F ERAL Tax Return This manis being tamished the internal Revenue Service Practice Return 1 Drake Tax 2018 In this scenario, you will practice entering the towing Form w 2 income Health Care Coverage Earned Income Credit and Child Tax Credit and Due Diligence Child Care Expenses SCENARIO INFORMATION Instructions This practice return will help you became familiar with return preparation in Drake Tax Use the scenario information and the attached source documents to complete the return. After the return is complete, compare your results with the solutions provided online Panderosa Pine is unmarried and lives in Atlanta, GA with her 6 vear old son, Spruce. Ponderosa works full-time as a botanist at the University of Trees Ponderosa and her son are both US citizens and cannot be a qualifying child or dependent on anyone else's federal tax return Go to Support Drake Software com for solutions and more practice returns. After losing in access Training Tools > Practice Returns She provided proof of maintenance of the household Including utility balls and rent receipts (attached). There is evidence that Panderosa paid more than 50% of the cost of keeping up the home in which she and her son lived. She lived in the US, for the entire year To agree with provided solutions Suppress state returns by entering "O" in the Resident state field on Screen 1 Install all program updates . Correct all EF diagnostic messages Ponderosa provided you with a copy of her driver's license. The number is 123456789 issued in VA on 01/01/2018. Her license expires on 01/01/2021 Attached Source Documents Form W-2 Child Care Statement Utility Bills and Rent Receipts Form 1095-8 TAXPAYER INFORMATION NAME Ponderosa Pine SSN 400-00-6001 DATE OF BIRTH 11-08-1974 EMAIL: Pine@1040.com OCCUPATION: Botanist Address: 100 Evergreen Lane, Atlanta, GA 30302 828-524-8020 Phone: Drake Tax 2018 Practice Return 2018 Drake Software Shift N M IRS elle UNIVERSITY OF TREES 31.500 200 SPRUCE WAY ATLANTA GA 30335 PONDEROSA PINE 100 EVERGREEN LANE ATLANTA GA 30302 20 17 com 19 18 A Wage and Tax W -2 Statement 2018 Copy - To Bed With Empoy F ERAL Tax Return This manis being tamished the internal Revenue Service

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started