practice test help

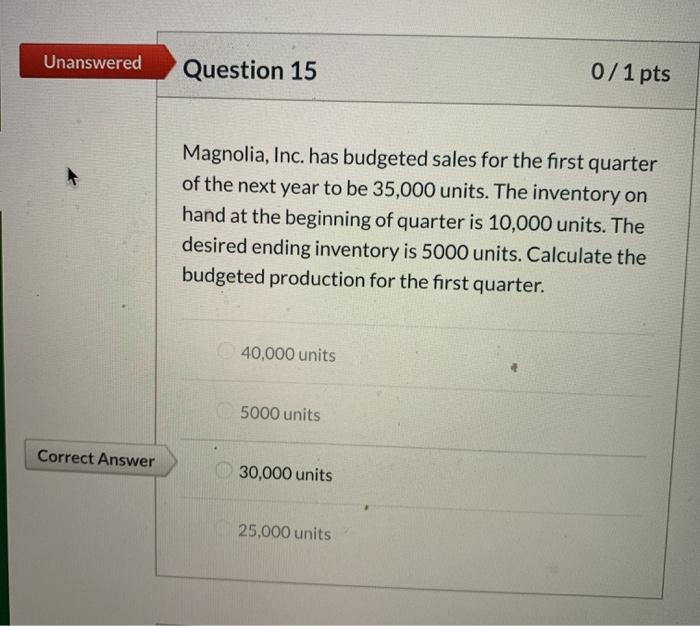

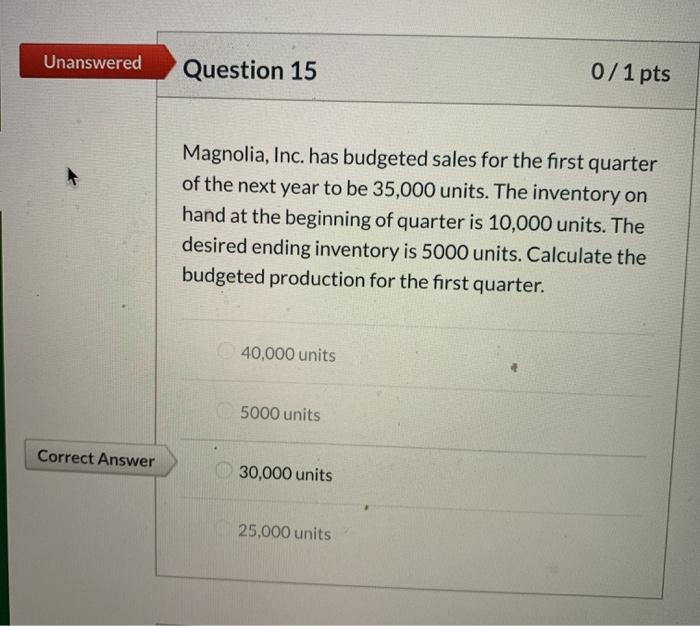

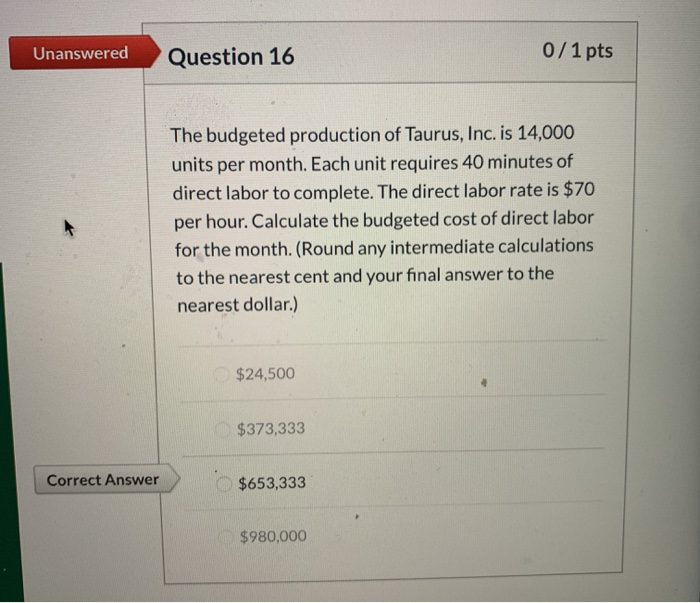

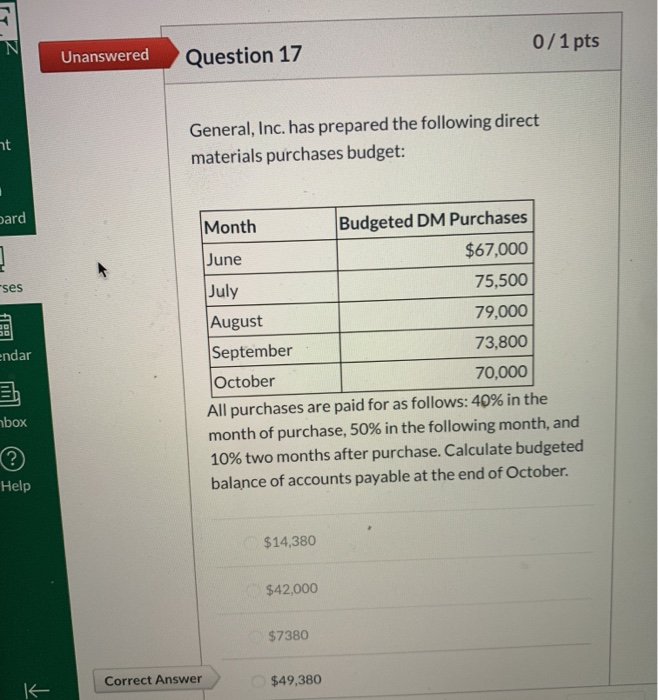

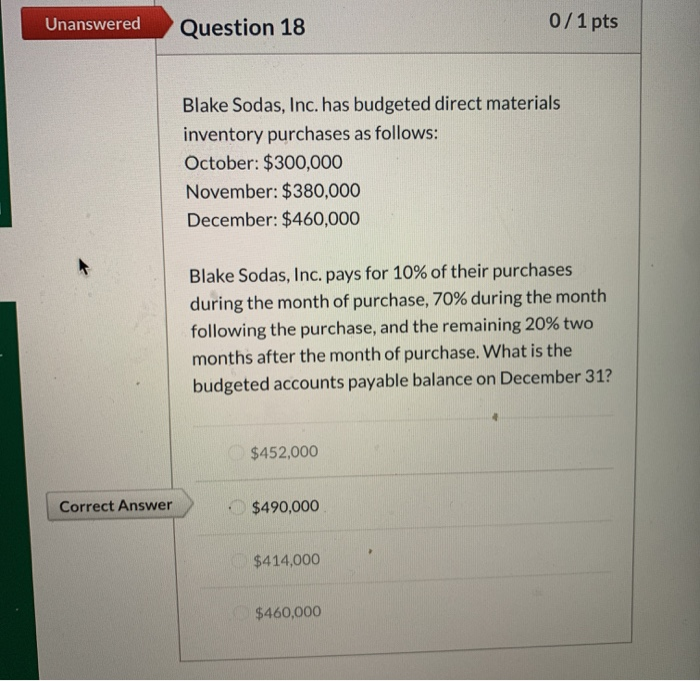

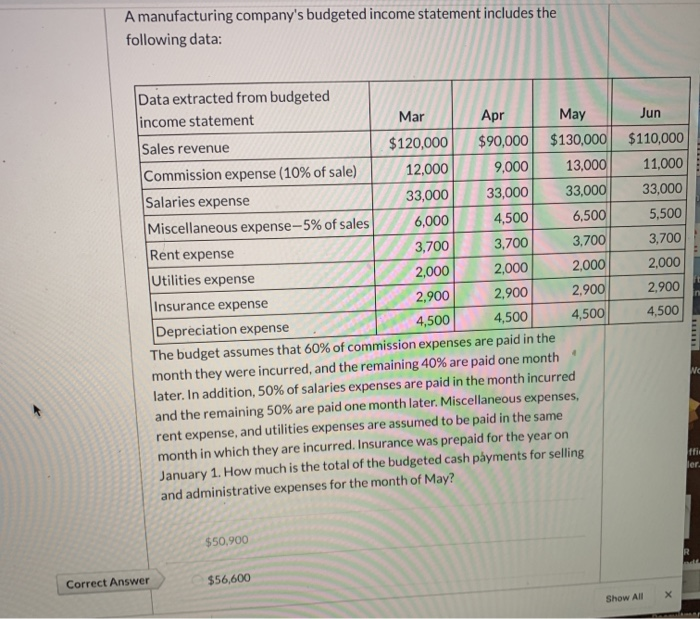

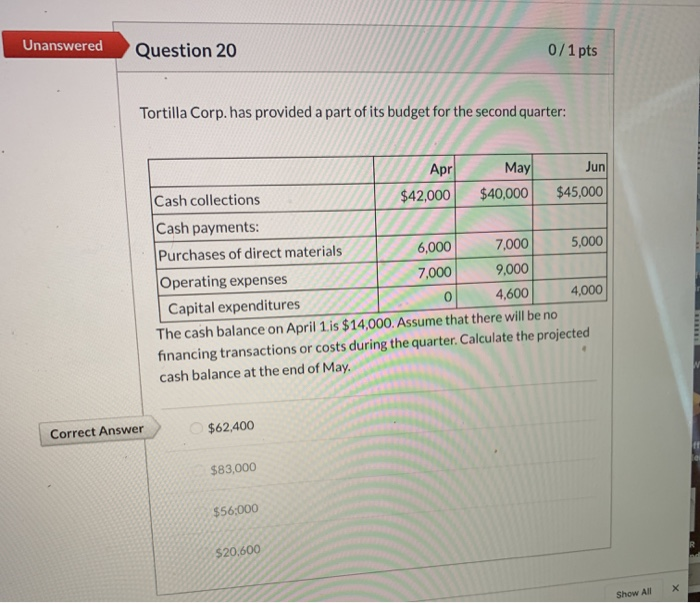

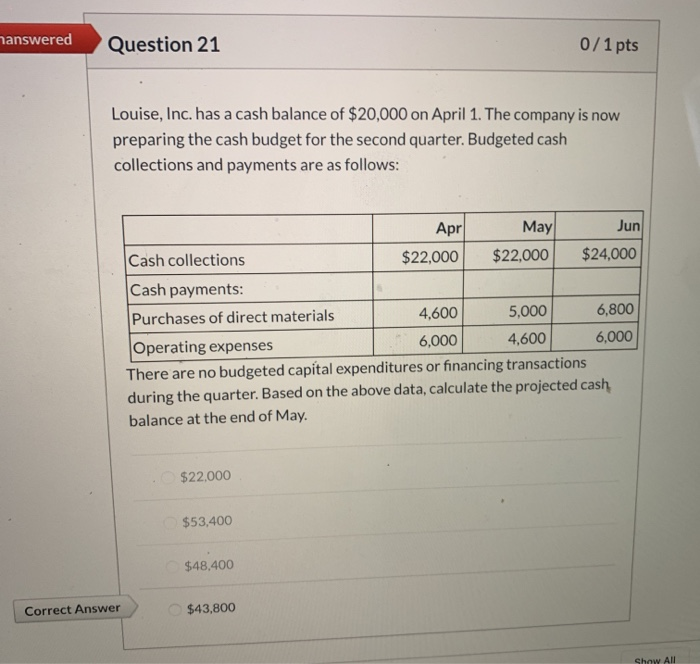

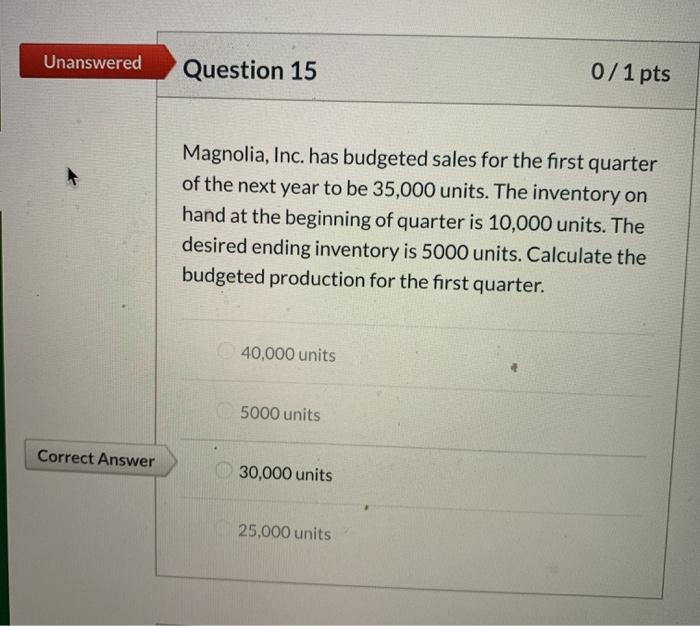

0/1 pts Unanswered Question 15 Magnolia, Inc. has budgeted sales for the first quarter of the next year to be 35,000 units. The inventory on hand at the beginning of quarter is 10,000 units. The desired ending inventory is 5000 units. Calculate the budgeted production for the first quarter. 40,000 units 5000 units Correct Answer 30,000 units 25,000 units 0/1 pts Unanswered Question 16 The budgeted production of Taurus, Inc. is 14,000 units per month. Each unit requires 40 minutes of direct labor to complete. The direct labor rate is $70 per hour. Calculate the budgeted cost of direct labor for the month. (Round any intermediate calculations to the nearest cent and your final answer to the nearest dollar.) $24,500 $373,333 Correct Answer $653,333 $980,000 0/1 pts Unanswered Question 17 General, Inc. has prepared the following direct materials purchases budget: nt oard Month Budgeted DM Purchases $67,000 June ses July 75,500 79,000 August September endar 73,800 70,000 October All purchases are paid for as follows: 40% in the month of purchase, 50% in the following month, and 10% two months after purchase. Calculate budgeted box (? Help balance of accounts payable at the end of October. $14,380 $42,000 $7380 Correct Answer $49,380 J 0/1pts Unanswered Question 18 Blake Sodas, Inc. has budgeted direct materials inventory purchases as follows: October: $300,000 November: $380,000 December: $460,000 Blake Sodas, Inc. pays for 10% of their purchases during the month of purchase, 70% during the month following the purchase, and the remaining 20% two months after the month of purchase. What is the budgeted accounts payable balance on December 31? $452,000 Correct Answer $490,000 $414,000 $460,000 A manufacturing company's budgeted income statement includes the following data: Data extracted from budgeted income statement Sales revenue Mar Apr May Jun $90,000 $120,000 $130,000 $110,000 Commission expense (10% of sale) Salaries expense 13,000 9,000 11,000 12,000 33,000 33,000 33,000 33,000 6,500 5,500 6,000 4,500 Miscellaneous expense-5% of sales 3,700 3,700 3,700 3,700 Rent expense 2,000 2,000 Utilities expense 2,000 2,000 2,900 2,900 2,900 2,900 Insurance expense 4,500 4,500 4,500 4,500 Depreciation expense The budget assumes that 60% of commission expenses are paid in the month they were incurred, and the remaining 40% are paid one month later. In addition, 50% of salaries expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses rent expense, and utilities expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1. How much is the total of the budgeted cash payments for selling and administrative expenses for the month of May? ffis ler. $50,900 $56,600 Correct Answer x Show All Unanswered Question 20 0/1pts Tortilla Corp. has provided a part of its budget for the second quarter: May Apr Jun Cash collections $42,000 $40,000 $45,000 Cash payments: Purchases of direct materials 7,000 5,000 6,000 Operating expenses 7,000 9,000 4,600 4,000 Capital expenditures The cash balance on April 1.is $14,000. Assume that there will be no financing transactions or costs during the quarter. Calculate the projected cash balance at the end of May $62,400 Correct Answer $83,000 $56:000 $20,600 X Show All hanswered Question 21 0/1pts Louise,Inc. has a cash balance of $20,000 on April 1. The company is now preparing the cash budget for the second quarter. Budgeted cash collections and payments are as follows: Jun May Apr $24,000 $22,000 Cash collections $22,000 Cash payments: 6,800 5,000 4,600 Purchases of direct materials 6,000 4,600 6,000 Operating expenses There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, calculate the projected cash balance at the end of May. $22,000 $53,400 $48,400 $43,800 Correct Answer Show All