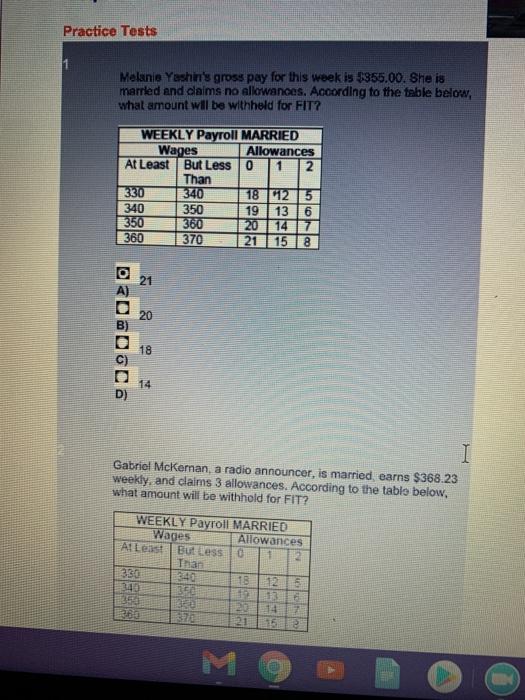

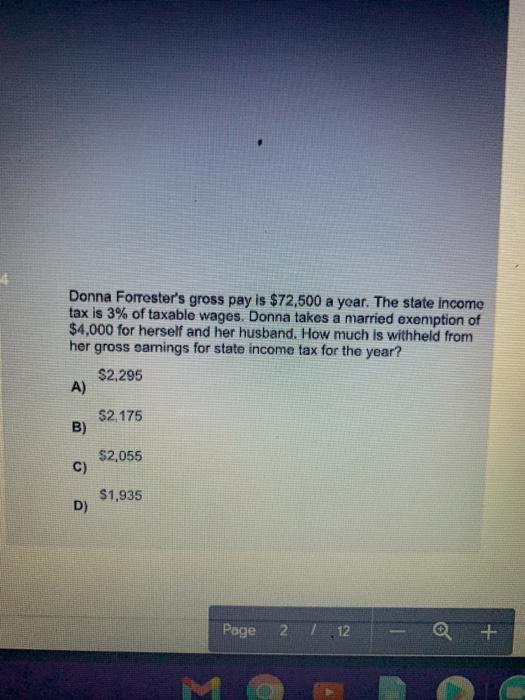

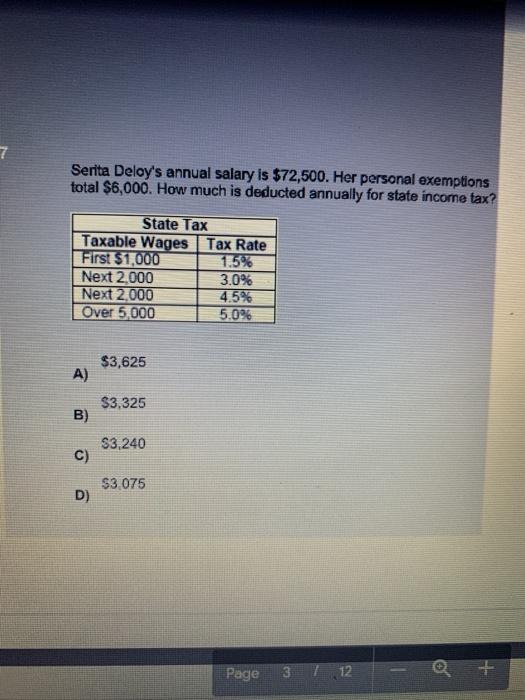

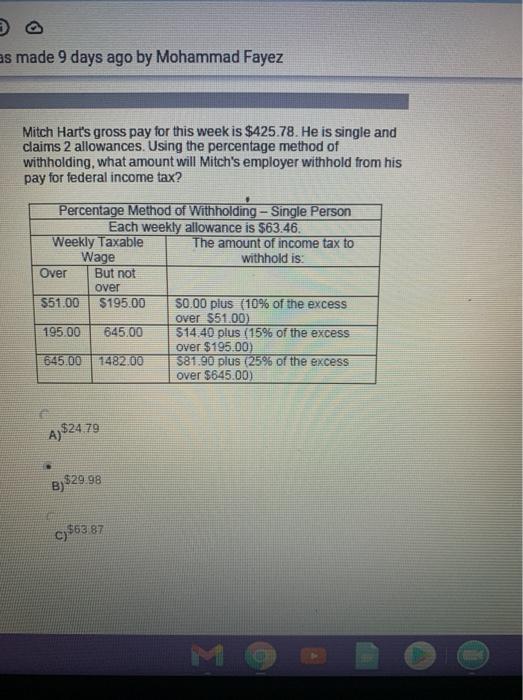

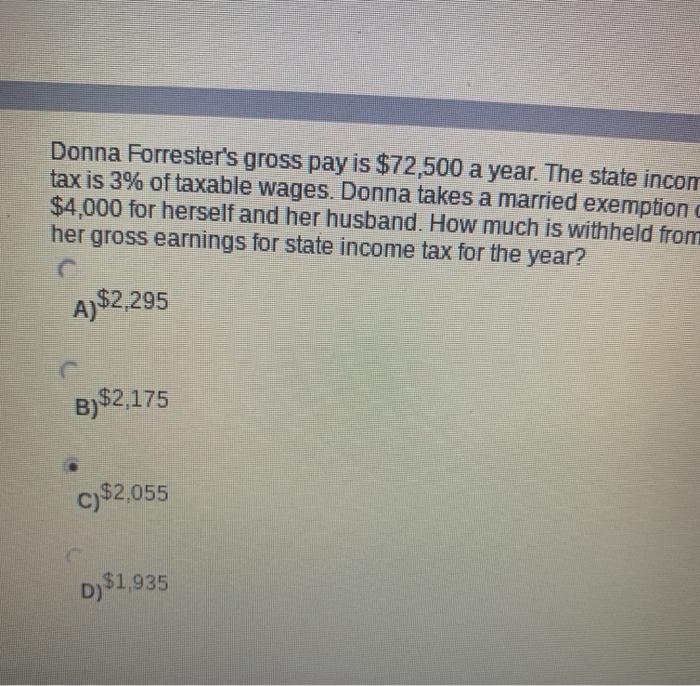

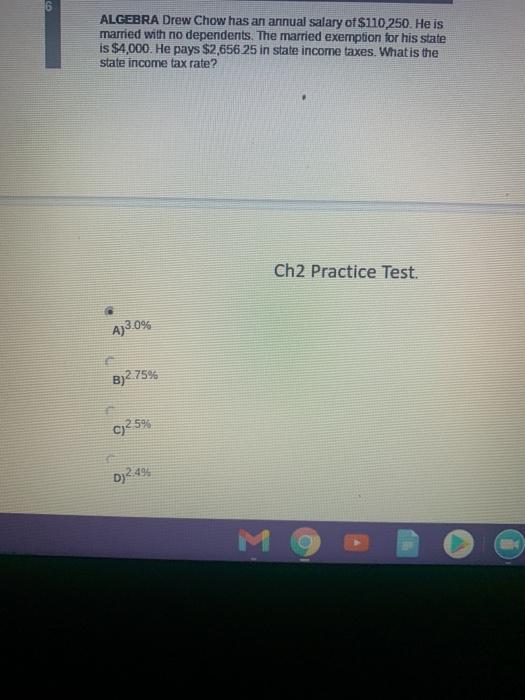

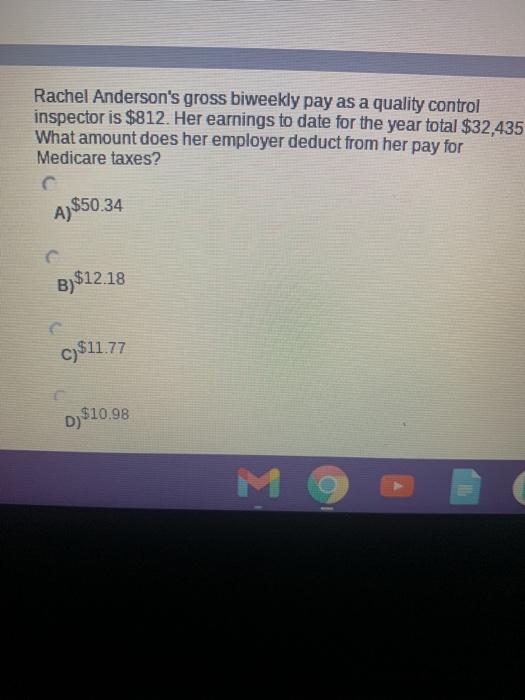

Practice Tests 1 Melanie Yeshin's gross pay for this week is 1955.00. She is married and claims no allowances. According to the table below, what amount will be withheld for FIT? WEEKLY Payroll MARRIED Wages Allowances At Least But Less 0 2 Than 330 340 18 1125 340 350 19 13 6 350 360 20 14 360 370 21 15 8 21 20 18 14 I Gabriel Mckeman, a radio announcer, is married, earns $368.23 weekly, and claims 3 allowances. According to the table below, what amount will be withhold for FIT? WEEKLY Payroll MARRIED Wages Allowances Alleas But Less 1 Taas 330 340 B 12 340 350 13 30 14 7 21 15 Donna Forrester's gross pay is $72,500 a year. The state income tax is 3% of taxable wages. Donna takes a married exemption of $4,000 for herself and her husband. How much is withheld from her gross earnings for state income tax for the year? $2,295 A) $2 175 B) $2,055 C) $1,935 D) Page 2 / 12 + 7 Serita Deloy's annual salary is $72,500. Her personal exemptions total $6,000. How much is deducted annually for state income tax? State Tax Taxable Wages Tax Rate First $1,000 1.5% Next 2.000 3.0% Next 2.000 4.5% Over 5,000 5.0% $3,625 A) $3,325 B) $3,240 C) $3.075 D) Page 3 / 12 as made 9 days ago by Mohammad Fayez Mitch Hart's gross pay for this week is $425.78. He is single and claims 2 allowances. Using the percentage method of withholding, what amount will Mitch's employer withhold from his pay for federal income tax? Percentage Method of Withholding - Single Person Each weekly allowance is $63.46. Weekly Taxable The amount of income tax to Wage withhold is Over But not Over $51.00 $195.00 $0.00 plus (10% of the excess over 551.00) 195.00 645.00 $14.40 plus (15% of the excess over $195.00) 645.00 148200 $81.90 plus (25% of the excess over $645.00) A) $24.79 B)$29.98 c)$6387 Donna Forrester's gross pay is $72,500 a year. The state incom tax is 3% of taxable wages. Donna takes a married exemption $4,000 for herself and her husband. How much is withheld from her gross earnings for state income tax for the year? A)$2,295 B)$2,175 c)$2,055 D) $1,935 ALGEBRA Drew Chow has an annual salary of $110,250. He is married with no dependents. The married exemption for his state is $4,000. He pays $2,65625 in state income taxes. What is the state income tax rate? Ch2 Practice Test. Aj3.0% B)2.7546 0725% Dj2.49 Rachel Anderson's gross biweekly pay as a quality control inspector is $812. Her earnings to date for the year total $32,435 What amount does her employer deduct from her pay for Medicare taxes? A)$50.34 B)$12.18 c)$11.77 D) $10.98 Mg Practice Tests 1 Melanie Yeshin's gross pay for this week is 1955.00. She is married and claims no allowances. According to the table below, what amount will be withheld for FIT? WEEKLY Payroll MARRIED Wages Allowances At Least But Less 0 2 Than 330 340 18 1125 340 350 19 13 6 350 360 20 14 360 370 21 15 8 21 20 18 14 I Gabriel Mckeman, a radio announcer, is married, earns $368.23 weekly, and claims 3 allowances. According to the table below, what amount will be withhold for FIT? WEEKLY Payroll MARRIED Wages Allowances Alleas But Less 1 Taas 330 340 B 12 340 350 13 30 14 7 21 15 Donna Forrester's gross pay is $72,500 a year. The state income tax is 3% of taxable wages. Donna takes a married exemption of $4,000 for herself and her husband. How much is withheld from her gross earnings for state income tax for the year? $2,295 A) $2 175 B) $2,055 C) $1,935 D) Page 2 / 12 + 7 Serita Deloy's annual salary is $72,500. Her personal exemptions total $6,000. How much is deducted annually for state income tax? State Tax Taxable Wages Tax Rate First $1,000 1.5% Next 2.000 3.0% Next 2.000 4.5% Over 5,000 5.0% $3,625 A) $3,325 B) $3,240 C) $3.075 D) Page 3 / 12 as made 9 days ago by Mohammad Fayez Mitch Hart's gross pay for this week is $425.78. He is single and claims 2 allowances. Using the percentage method of withholding, what amount will Mitch's employer withhold from his pay for federal income tax? Percentage Method of Withholding - Single Person Each weekly allowance is $63.46. Weekly Taxable The amount of income tax to Wage withhold is Over But not Over $51.00 $195.00 $0.00 plus (10% of the excess over 551.00) 195.00 645.00 $14.40 plus (15% of the excess over $195.00) 645.00 148200 $81.90 plus (25% of the excess over $645.00) A) $24.79 B)$29.98 c)$6387 Donna Forrester's gross pay is $72,500 a year. The state incom tax is 3% of taxable wages. Donna takes a married exemption $4,000 for herself and her husband. How much is withheld from her gross earnings for state income tax for the year? A)$2,295 B)$2,175 c)$2,055 D) $1,935 ALGEBRA Drew Chow has an annual salary of $110,250. He is married with no dependents. The married exemption for his state is $4,000. He pays $2,65625 in state income taxes. What is the state income tax rate? Ch2 Practice Test. Aj3.0% B)2.7546 0725% Dj2.49 Rachel Anderson's gross biweekly pay as a quality control inspector is $812. Her earnings to date for the year total $32,435 What amount does her employer deduct from her pay for Medicare taxes? A)$50.34 B)$12.18 c)$11.77 D) $10.98 Mg