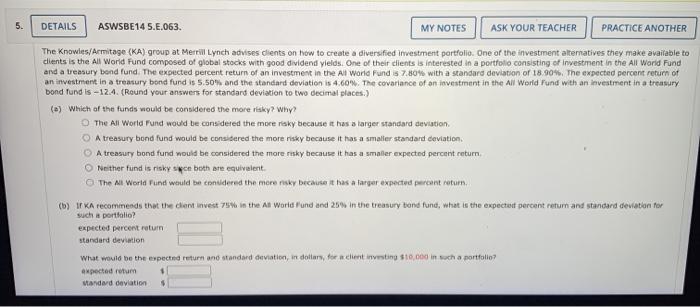

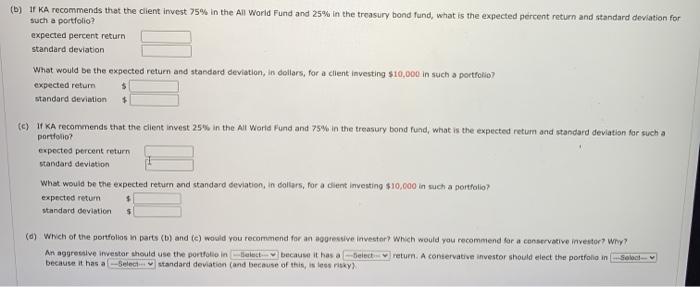

PRACTICEANOTH MY NOTES ASK YOUR TEACHER The Kwa Kwet wtory and dients in parte contingent in the Army Bondhu The contente www dhe wyddion and The lates-124 warded a) who underw the wound wollte de merchant Arred and they want to Abondanced the many chalec Matter tandlere Acadetut the destined the world and send it on to what we woman dorth speed Venturen, stor for en code Are the devil Warto trybendfun wurden aus der ar tea docent wand perte wanan which der AM 5. DETAILS ASWSBE14 5.1.063. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER The Knowles/Armitage (KA) group at Merrill Lynch advises clients on how to create a diversified investment portfolio. One of the investment alternatives they make available to clients is the All World Fund composed of global stocks with good dividend yields. One of their clients is interested in a portfolio consisting of investment in the All World Fund and a treasury bond fund. The expected percent return of an investment in the All World Funds 7.804 with a standard deviation of 18 90%. The expected percent return of an investment in a treasury bond fund is 5.50% and the standard deviation is 4.60%. The covariance of an investment in the All World Fund with an investment in a treasury bond fund is -12.4. (Round your answers for standard deviation to two decimal places.) () Which of the funds would be considered the more risky? Why? The All World Fund would be considered the more risky because it has a larger standard deviation A treasury bond fund would be considered the more risky because it has a smalier standard deviation. A treasury bond fund would be considered the more risky because it It has a smaller expected percent return Neither fund is risky s both are equivalent The Al World Fund would be considered the more risky because it has a larger expected percent return () A recommends that the dent invest 79% in the An World land and 25% in the treasury and fund, what is the expectat percent return and standard deviation for such portfolio? expected percent return standard deviation What would be the expected return and standard deviation in dollars for client investing $10,000 inwoch a portfolio expected retum Mandard deviation () 1 KA recommends that the client invest 75% in the All World Fund and 25% in the treasury bond fund, what is the expected percent return and standard deviation for such a portfolio? expected percent return standard deviation What would be the expected return and standard deviation, in dollars, for a client investing $10,000 in such a portfolio expected return standard deviation c) * KA recommends that the client invest 25% in the All World Fund and 75% in the treasury bond fund, what is the expected retum and standard deviation for such a portfolio? expected percent return standard deviation What would be the expected return and standard deviation, in dollars, for a client investing $10,000 in such a portfolio expected retum standard deviation (d) Wich of the portfolios in parts (b) and (c) would you recommend for an aggressive investor? Which would you recommend for a conservative investor? Why? An aggressive investor should use the portfolio in Belt because it has a Delect return. A contervative investor should elect the portfolio in Select because it has a select standard deviation (and because of this is less sky)