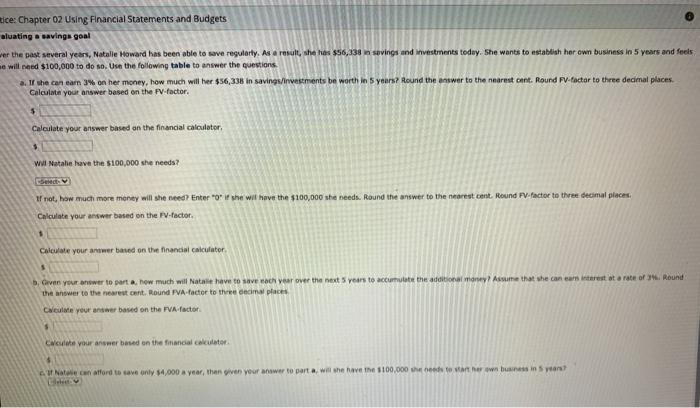

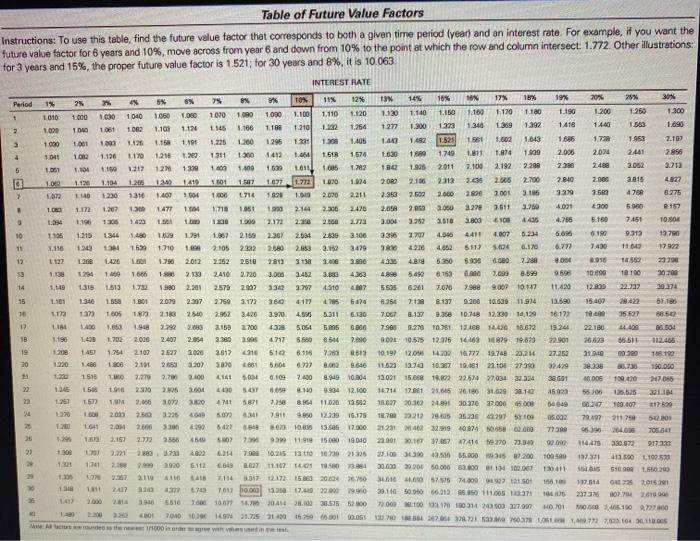

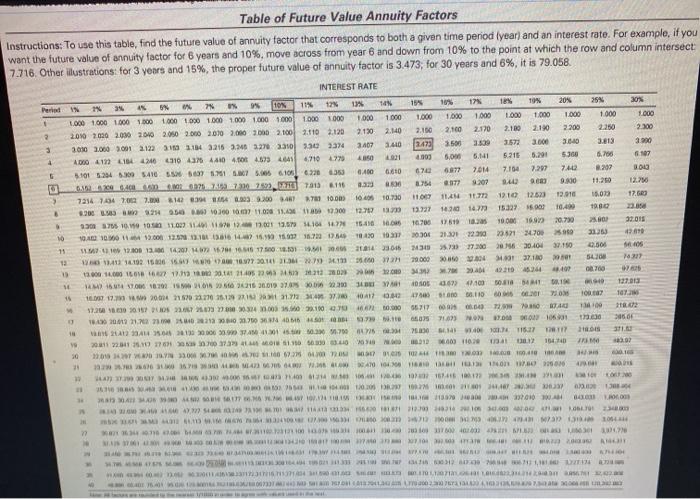

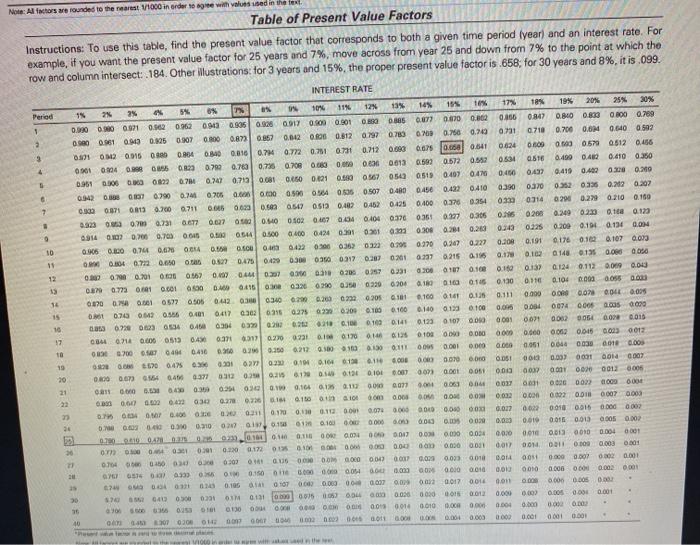

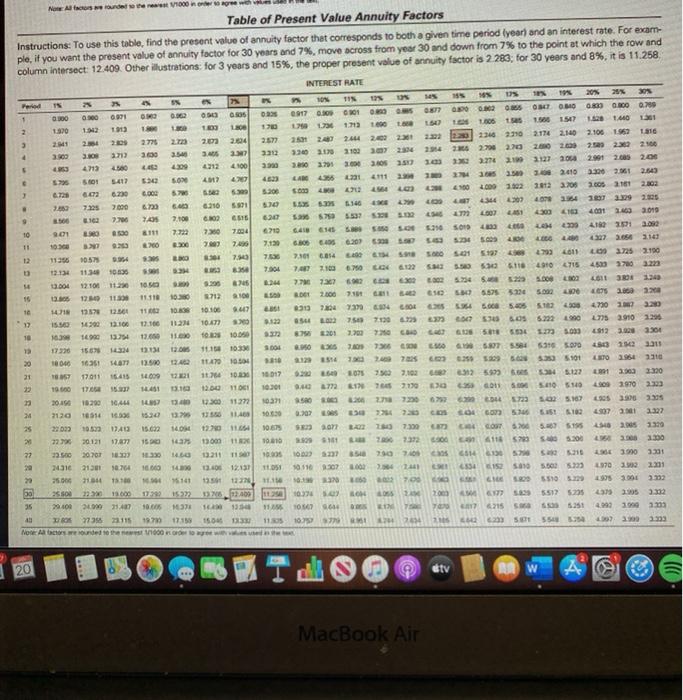

Pracuce: Chapter Evaluating a savings goal Over the past several years, Natalie Howard has been shie to save regularly. As a result, she has 556,338 in savings and investments today. She wants to establisher own business in 5 years and feels she will need $100,000 to do so. Use the folowing table to answer the questions 2. If she can earn bet money, how much will her $56,378 in saving/investments be worth in Syair Round the answer to the nearest cent Round FV-factor to three decimal places Calculate your awer based on the factor $ Chit you ower based on the financial sito we have the $100.000 needs w much money with inter if she will have the $100,000 wheed one that the cent Hound Factor to the decimal place Can IV.actor Co the cor 1. Wir wat har ett stone me she can art www.sar, way to the tice: Chapter 02 Using Financial Statements and Budgets aluating savings goal wer the past several years, Natalie Howard has been able to save regularly. As a result, she $56,138 savings and investments today. She wants to establish her own business in 5 years and feels we will need $100,000 to do so. Use the following table to answer the questions a. If he can earn 3% on her money, how much will her $56,338 in savings/investments be worth in 5 years? Round the answer to the nearest cont. Round FV-factor to three decimal places. Calculate your answer based on the FV.factor $ Calculate your answer based on the financial calculator $ wil Natale have the $100,000 she needs? If not, how much more money will she need? EnterTo" if she will have the $100,000 she needs. Round the answer to the nearest cent. Round PV.factor to three decimal places Calculate your answer based on the FV-Factor. Calculate your answer based on the financial Calculator b. Give your answer to part ahow much will Natale have to save wach year over the next years to accumulate the additional money Assume that she can earn interest rate of Round the answer to the nearestent Round FVA-factor to the decimal places Calcule your answer based on the FVA-factor $ Create your answer based on the financial calculator 5 Nate con afford to save only $4,000 a year, then given your answer to part with have the $100.000 bother business in 5 years Table of Future Value Factors Instructions: To use this table, find the future value factor that corresponds to both a given time period year and an interest rate. For example, if you want the future value factor for 6 years and 10%, move across from year 6 and down from 10% to the point at which the row and column intersect 1.772. Other illustrations: for 3 years and 15%, the proper future value factor is 1.521, for 30 years and 8%, it is 10.063 N 9 NEI C C . 1.13 433 INTEREST RATE 14 Period EN 5% 75 24 TOS 115 12% 14% 16% 10% 17% 16% 20% 19% 25% 30% 1 1 010 1000 1040 1.050 1.000 1090 1080 1.030 1.100 1.110 1.120 1.130 1.140 1.150 1.160 1.170 1.180 1.190 1.200 1.250 1.300 1620 100 1681 102 1.100 1.124 1.145 1.166 1180 1.210 1.232 1254 1 272 1.300 1.323 1.340 1.359 1.392 1416 1440 1563 1.690 1030 TOBI 1.800 1126 16 1.100 1.225 1.300 1.295 1.21 1.30 1.405 140 1.47 1.525 151 1.002 1.643 1.686 1.720 1.963 2.103 104 1.02 1.120 1170 1.210 100 1311 1300 1.00 1.618 1574 1630 1.680 1.740 1811 1.8% 1.500 2.006 2014 2441 2856 5 1.104 1 1.317 1309 1.400 1400 1600 1.610 1.282 The 1996 2011 2.100 2.192 2.280 2390 2488 3.002 1.00 1.129 1.134 120 1342 1410 1101 1987 1677 1.772 1.030 2.0R2 2106 2.312 2005 2.700 2.840 2.00 2015 4827 2 12 1.140 1230 1316 1.402 1604 1.000 1714 18:20 1018 2.000 2211 2.353 2.502 3.600 2.00 2001 3.106 3379 25 768 5275 1.12 1.202 1300 1477 1.064 1.718 1.051 1900 2.144 2.300 2420 2,658 3.03 2060 2220 3.611 3.250 4.021 2900 5000 1. 1.196 1300 1. 1.500 2.173 2.00 2.000 2.11a 3.000 3.252 2010 3.800 4100 1436 4.766 5.160 7451 TO 801 10 1.105 1.215 1346 1.480 1619 1.791 1.862 2.159 2367 2.594 2.835 3.100 3.395 3.707 4.06 4411 1007 8.234 6.036 6.190 9.312 13.70 2.318 1248 13 16.30 1.710 1. 2.105 2332 2.580 2.53 3.159 3479 320 4.652 6112 5.4.20 0.370 6.773 7430 1.122 1.61 1790 2012 2.510 2013 3.000 300 5.350 6.96 1680 7.280 2.000 0911 1562 23.00 1605 1 2.139 2410 2.720 3.000 3.452 3.860 5.492 8.163 . 7.090 8.599 9.98 10.000 TTOO 2000 14 1,149 1313 1.72 1.580 2.2011 2.575 2007 230 2.792 4.510 107 5635 6241 7.626 7988 2.00210.17 11.420 12800 30.374 15 1161 1340 1.550 1.B01 2.070 2307 2.750 3.172 360 4172 6170 8.95 7.13 8137 9.200 10:30 11.94 13590 15.402 51.186 10 1373 1605 1.870 2.150 25.00 3.426 3.970 4.595 8.130 7.06 3.137 3.358 10.748 12.330 14,129 16177 Te 3597 $8.50 17 19 1.00 1.948 222 2083 2.159 2.700 43 5.054 5905 8800 7965 275 10.751 12.1812.420 18.672 19.24 22.180 44400 0504 1.4 1.702 2.000 2.407 3.380 1995 4.717 5500 8544 7.490 2024 10.575 12.5 14.03 16829. 19:07 22.01 26.623 66511 112.456 19 1457 1.754 2.107 2527 2.000 3.817 16 510 6.116 8613 10.197 12.056 14.222 16.777 19.748 2.214 27.252 21.90 00.00 788790 20 1.220 1.486 1.800 2.100 2.655 3307 3090 4.66 8.00 9.646 11523 13.70 10.17 19.163 22101 27990 32429 38.338 21 30 150.00 1518 1. 7.270 2.700 3.100 1141 5.034 0.109 2.400 8.949 10.804 1302115.68 18.02 9284 27034 34 38.691 OS 139.00 07.066 158 1. 2320 2025 2001 LA30 3.69 10 1934 12.100 14716 17 11 2016 2018 31.629 10 215023 56.300 135.525 za 157 2.66 307 4741 7.48 8.554 11.020 13.12 1827 20:36 24.891 30.370 37000 5.000 54649 06.347 19:407 24 2003 3.236 5073 7.911 2012 203 16.179 1.7232125 26.731297 3100 05.092 79.497 12 2.04 1641 2.600 211750 2300 500 290 547 107 10 33.56 17.000 21231490 10.074 5065 2003 1.29 264.00 12 95.190 2152 705.5LT 2566 450 SMO 2 939 1910 16.00 19.040 22.01.18 17.057 474162102334 92.00 20 114.475 330.00 917 32 2.221 2.880 370 6.147.900 10.25 12.101673021325 23.1000 3.00 35.000 35 82.200 13 105 1701 21 2.99 13500 1995 1920 13731 6.649 027 11.167.1 18.03 30.03.20150.006 83.000 14 102.00 . 120011 2119 5100901.512) 16 172172 153 2004 260 13 57574.00 350 11 1714 15 2016 201 62 701 10.03.2017.40 22.000 1960 30.1165000 66.12.150 111.005 1037 2331 310510 BOX 36180 307 SW 0414.038.575 52100 7200 100 100 103142503 277.987 1 0701 40 7040 01 N31.725 30 306759 60 MOB 41507270 0.03 270 271 2016 Marded the 311 2 310 WEBS IEL LIVE CHE . Table of Future Value Annuity Factors Instructions: To use this table, find the future value of annuity factor that corresponds to both a given time period year) and an interest rate. For example, if you want the future value of annuity factor for 6 years and 10%, move across from year 6 and down from 10% to the point at which the row and column intersect 7.716. Other illustrations for 3 years and 15%, the proper future value of annuity factor is 3.473, for 30 years and 6%, it is 79.058 INTEREST RATE MI Ne 30% Period WWE 0001 1.000 OGIE 2.100 OLE OC & DIE LOVE OVE DE Ora 01 00 00 00 00 00 000 000 NOT OICE TE CITE TEE 16 DE DOC 107 CORY TO OY WEY OLOT TOY TOY MEE ICE 3.900 6107 SCTE IT'S VITE LOCE 3.000 1 CH SCH D 1 5% 7 94 10% 11% 12% ta 154 10% 17 1 20% 25% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1000 1.000 1000 1.000 1.000 1.000 1.000 1.000 1000 2.110 2.120 2.140 2.100 2.70 2200 2.250 2.473 3.500 3.573 6.710 79 6.000 5215 5.291 5300 6.700 5.101 5.204 6.09 5410 507 517 3.0 6.105 00353 400 6.610 67 6.972 7.164 7.297 7.442 2207 0.0005730 731 731 8116 233 54 24 9.00 B 10.00 10.406 10730 110 114 11.12 12.10 12.523 12.010 16.03 6.2003 214954000 1000 11000 11.4919300 12.7730 13:27 1230 12.79 15.327 6.900 10400 1980 30370610.719 10 11.027 114 113.00 13.67 1.101 1672 154100 16700 17619 10. 1000 16.97 20.730 25.80 10.10.2011 19.00 12.5 13:10 131 1415.9.18.632 167225 31353 12.00 13.04.2017 16 15 17 500.01 0.00233661305 77.300 5000 12.750 17.60 e CB CB LL YOYE TEL 22.018 12.6 01 11 12 132.13 107. 02 15 ADOS 47100 5084 1017 A 00000000 10.000 56717 PORTA 660574073.00 104 73.30 3.40 1937 TRTI 0312 010 132 104 10 102.10.10 SA ROBE DICIOCO OLENCE FOTO OSTE OP HELE TIDE LUNE SI VETIVE T 050 000 E CHE CHER 0 itu USO NEL 11 500 CK EN PEGGIO SOLO DE LE GIOCSLEVESEBBNEW VEC cro LEH NIE USE OLETE SE VOEL RE CO DE CE CODE COW SOME 00 1109190 COD TO BE WE DO ort 1090 DOW OP DE WEBCODE IS VEHIVE IN HU SOBIT OTTOBRE O CHE CV COCHE O MEU PORTE DE LA SE WE ON THE FOLLOWERS ET LINE WESORIOS DE CE OF SOWIE CHE HODE WWW EINEN bercer corte WWW.THE HTC ONE KOHE WWW NANCY TO FOOL WITHIN HVER HELE FOR TETE FORME Terri CH 2016 DE 13 15 TOLLA 2.0 DHAN 154ME 204 15% NG w . 2 0.003 5 1000 1 e 7 06 10 18 Note: All factors are founded to the nearest 11000 in order to agree with values used in the text Table of Present Value Factors Instructions: To use this table, find the present value factor that corresponds to both a given time period fyear) and an interest rate. For example, if you want the present value factor for 25 years and 7%, move across from year 25 and down from 7% to the point at which the row and column intersect: .184. Other illustrations for 3 years and 15%, the proper present value factor is 658, for 30 years and 8%, it is.099. INTEREST RATE Period 9 2 54 ON 10 111 12 13% 145 tos 17% 18 19% 25 30% 0.00 0.00 0.21 0.2 0.963 0913 0.035 0.06 0.17 0.00 0.001 0.300.385 0.07 0.00 0.002 0.866 0.947 0.840 0.839 0.000 0.789 0.000 0.961 0.90 0.125 0.907 0.800 0.8.730.867 0.002 0.06 0.812 0797 0.70 0 0 0.750 0.749 0731 0.710 0.700 0.6 0.640 6.592 21 02 0915 000 0.804 0.840 0.816 0.74 0.72 0.751 0.71 0.12 0.69 0.06 0.65 0.641 0.624 0.575 0.512 0.456 0004 0.906855 0.023 0.799 0.760 0.735 0.708 OG 0.00 0.00 2013 0692 0.672 0.552 0.54 0616 0.400 0.42 0.400.350 0.961030600600892 6.74 0.240 0.71 0.081 0.250 0.21 0.60 0567 0542 05190407 0.40 0.497 0.419 0.402 0.300 0.20 010790 0.705 0.00 0.00 0.596 055 0.507 0.40 0.450 0.432 0.410 0.30 0.370 0352 0.33 0.22 0.202 C. 00710813 6.700 0711 0006 0.023 0.3 0.547 0.512 0.402 0:42 0425 0.400 0.3700354 0.330 0314 0.29 0.299 0.210 0.180 2.323 0 0.70 0.731 0.67 0.027 0.00 0.0 0.02 0467 0494 0404 0.370 0360 0.327 0.306 ON 0.200 0.249 0.220 otta 0.123 0.002 0.700.705 0015 . 0.500 0.400 0.4240391 0.01 0.03 0.300 0.280 0.26 0.243 0.225 0.200 0.194 0.134 0.01 0.005 0.00 0.74 0.00 ORA . cu 3 0422 0.00 0.36 033 0.00 0.920 0.307 0.227 0.100 0.191 0176 0.1 0.107 0073 Q 0.040.000 0.522 0.475 0429 3 000 0917 020 020 0337 0.215 0.155 0.10 140 0.13 0.000000 0.00022 0.01 0.00 0.567 0.07 OM 0.3 300 000 0.231 0300 1070.100 0.140 0.137 0.124 0.11 0.009 0.000 0.87 0.723 0.01 0.6010 DADO 0416 one 03260290 0.50 0290 6.200 0.18001000105 0.130 0.110 0.101 0.0000055 000000010527 05050442 Q3 6340 6.200 0.26062320205101 0.1000 1010.15 0.000 0.00020 0:04 0035 0.743 062 OS 0401 0417 032 031 0.275 020 6900 0.00 0.100 0.14001 0.100 0.00 00740.000 0.005 0.000 0.03 0.720623 66 0.400 0354 03 028 0.28 0.1000 100 0.141 01230107 000 0.001 007 0.002 0056 0.02 0.015 17 084 0.21 0.000 0513 0:40 03 0.200.231 0.100.150014126 0100000000 000 0.000 0.002 0.015 0.003 0012 00700 7 046 0416 30.00 0.350 0212 0.100.100.150 0111 000 0.001 0.000 0.000 0.051 004400300018 0.00 10 08.60 0.475 20 0277 033 0.101640194 0.116 000 0.00 0.00 0.00 O.SI 0.001 001 OR 000 070 0.673015404637 0020 0.15 0.100.100.1010007 0.00 0.001 051 0.00 003 000 00000126005 21 11 000 0.8514 0.360 021010 0.100.164 0.1 01100007 0.00 0.003 004 0.017 0.001 0.00022 0001 . 0.00 0.002 0.42 0.270.220.16 0.1100 101 om 0000 0.0000 00 0.032 0.000 0.002 0.01 0.007 0.003 05 06 0 0.000 0.311 0.100.10 0.11 0.00 0.00 0.000000 0.000000 0.017 0.022 0.0100011 00002 24 0.003 0.40 03 2010.15 10.10000 0.000000 0000 0020 0.000 0.01 0.0160.013 0.00 0.00 2014.10 011000004 003 0.00 0.00 0.034 0.0.0 0.00013010 0.00400 30 0 0000 001 020 0.172 0175 0.0000 0.00 0.000 0.000 0.00! 0.017 0.014 0011 0:00 0.003 0.001 0164 0600 16 0.00 0.00 0.00 0.00 0.025 0.025 000 DOM 9.05 0.000 0.007 0.002 0.001 0.010333 0:10 3.000 0.00051 000 0.00 0.00 0.00 0010 00 010 0.00 ON 0.002 000 67 0.100 0167 0.00 0.00 0.00 0.007 0.0002 0.0170014 0.011 0.000 0.005 0.000 20 SM 040 023 OM 013 10000 0035 000 000 000 000 0015 002 0.00 0.00 0.00 0.001 30 0 0 1 0130 000 0.00 0.00 0.00014 0010 0.00 0.00 . 40 070305 OH om 3002000010011 000 000 0.000 0.00 D CT 0.111 16 15 DO LCD 030 31 BO WHO 076 10 noco WO 1000 en 2000 VW NA delete 1000 Table of Present Value Annuity Factors Instructions: To use this table, find the present value of annuity factor that corresponds to both a given time period year and an interest rate. For exam- ple, if you want the present value of annuity factor for 30 years and 7%, move across from year 30 and down from 7% to the point at which the row and column intersect 12.409. Other illustrations: for 3 years and 15%, the proper present value of annuity factor is 2 283; for 30 years and 8%, it is 11.258 INTEREST RATE IN 0.789 LORD 0.62 10% OCT 0.610 1 2.174 2.140 000 0.071 1912 1913 0000 OL 1.00 11 3 2775 300 200 20% 20% 0.60 0.300 1.40 2106 1962 229 230 2991 2005 2390 3.561 2006 3161 3. 3712 3.0 4713 I YOTE CRE 0017 CR7 3.50 09 0.00 ta 1306 222 1.346 2110 2.70 2.70 103 3.274 2190 3. 4100 2009 2002 4364 1600 200 2.643 4.500 44 1127 308 2.400 2.610 2012 2.705 ICE IT 2302 501 6.02 6.72 1009 AT 7325 6.230 2000 26 20 63 7.100 1 9 350 SOVE 20 4333 10 5901 9.01 8550 8111 CHE CE LG 11 7.22 2.300 30 ET SO ES CHES 4001 103 3010 3.02 4327 654 2.141 27252190 4620 3700 13:00 05 2.000 470 ONO CE OSCH MC 02 SORT ot 12 100 1955 DO 10.000 10 115 06 23 09170.00 0.005 1603 1.30 1.13 1.000 to 2.02 2.577 26 243 2444 24 3.48 2312 300 300 2100 4312 3.50 3.79 2008 2.50 4017 4033 LAR 4111 . 5320 . LO 6.216 1.340 GO 3516 620 5790 230 7004 6710 G Es 2009 7430 7.130 6.306 6.30 7. 760 7.101 6054 7.00 74 7100 9.296 2737 2712 2100 B. 2.000 902 72 7370 4 LOR 10.477 750 7130 10.00 92 201 2200 1015 10:33 S. 5035 360 TEAM 10. 14 70 11.10.33 16.017 9. 1071 7.102 2011 OCI 10.301 9.00 81717645 7.190 123011272 0371 50 86 11:46 10.630 0.7070 12.10 11.06 10679 077 2.30 om 11 10.216 11 232 10211 11 10:00 OD 237 13.406 12131 105 016307 13 12301111 18.30 332512400 10 10.374 0 . 193 11 SO 6 EIN 15.0123 11 05 10. 24 CICE B CE US 11. 7352910 912 3.920 3304 5312301 TO WICE 03 5.00 BE NE 124 21 11356 005 . ta 12 11:34 10.30 004 12. 10.11.200 10 16 1139 11110 1 1428 12578 12.30 11 17 15.30 12100 171 10 1630 13.54 13.650 13 1730 156 14:34 17:31 20 18040 16351 SON 13.50 21 NOST 17.011 14.000 19 17064 20.10 10290 10:44 2120 16514 1999 1530 10.500 VA 15.02 2 20121 17.872 150 27 3500 20701 22 2431 2131 10764 16.00 25.000 214 15.100 10. 50 350 123 13.000 1792 35 29.400 21407 10.05 OS 77355 19 No wonded to the newest 1000 500 4611 10 6715 52423 Es 55.6753230 5.000 5.00 5.405 2335 SOS 5.222 C. 60 50 5.54 503 5.584 55165.000 03 5.35 $3505101 12 5.933 04.123 011 5. 5010510 518 SO con 5.1 5162 C COUT 5.704 5.07 5195 4116 S70 cs 2514 10 52 CS 153 5.502.223 5.20 5510 520 2000 173 5.85 5525205 TES 6215 5251 23 STE SA DICE OCET CORT CET OUT 057 SOCE 567 DC CE CLES 03 WE 140 CES CHE CO SELE SONE 407 2327 12.05 1310 3000 3900 3701 1970 1902 201 19953001 295 3.312 2993 3.000 14.30 CO DOS INTE 02 ME 17 CECE 17 20 dtv RA A MacBook Air