Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pratt Company purchased 40,000 shares of Silas Company's common stock for $860,000 on January 1, 2016. At that time Silas Company had $500,000 of

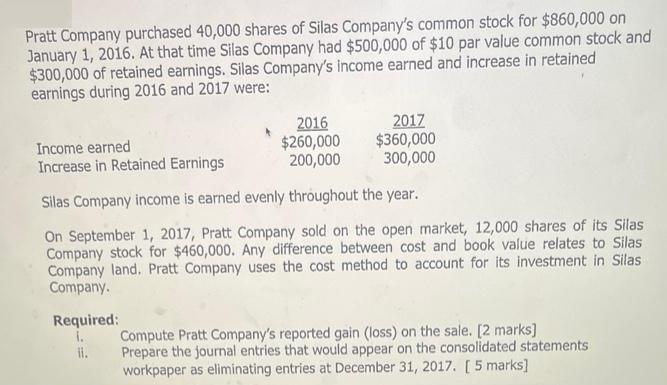

Pratt Company purchased 40,000 shares of Silas Company's common stock for $860,000 on January 1, 2016. At that time Silas Company had $500,000 of $10 par value common stock and $300,000 of retained earnings. Silas Company's income earned and increase in retained earnings during 2016 and 2017 were: Required: 1. 2016 $260,000 200,000 Income earned Increase in Retained Earnings Silas Company income is earned evenly throughout the year. On September 1, 2017, Pratt Company sold on the open market, 12,000 shares of its Silas Company stock for $460,000. Any difference between cost and book value relates to Silas Company land. Pratt Company uses the cost method to account for its investment in Silas Company. ii. 2017 $360,000 300,000 Compute Pratt Company's reported gain (loss) on the sale. [2 marks] Prepare the journal entries that would appear on the consolidated statements workpaper as eliminating entries at December 31, 2017. [ 5 marks]

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer I Gains Loss on Sale Gains Loss on Sale 460000 40000 x 860000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started