Question

Prattle Ltd is an Australian listed firm that operates in the fashion industry. Prattle Ltd has both upstream and downstream operations through its subsidiaries from

Prattle Ltd is an Australian listed firm that operates in the fashion industry. Prattle Ltd has both upstream and downstream operations through its subsidiaries from manufacturing to the final retail of its products to customers. As a part of the firm’s strategy to restructure and improve operational efficiency, the top management of Prattle Ltd has outlined three strategic projects for implementation in the coming year. These include:

➢ Expansion of its product line to include non-luxury clothing line items

➢ 60% expansion of their online sales offerings

➢ An implementation of blockchain accounting ledger

Regarding the product line expansion and the online sales strategies, Prattle Ltd intends to use equity capital to finance these projects. The Chief financial officer (CFO) has proposed the issuance of $6 million in ordinary shares to raise the needed capital. Alternatively, the firm could consider a debt financing option which is deemed to be relatively cheaper. However, the current debt covenant restriction of Prattle Ltd is likely to limit the firm’s ability to fully explore the debt financing option.

In the context of the implementation of the blockchain accounting ledger, the head of the accounting department of Prattle Ltd is very optimistic about its potential benefits for ensuring transparency and accuracy of the firm’s accounting records. For instance, she anticipates that frequent malfunctioning of the accounting information system as a result of the current integration with the online sales platform may be adequately addressed by the implementation of the blockchain accounting ledger. Specifically, the frequent omission and/or duplication of transactions in the recording process could be eliminated. Nonetheless, she remains skeptical of the use of blockchain accounting ledger.

Provide appropriate responses to the following questions based on the scenario presented above:

(1) Assuming Prattle Ltd would like to use debt financing as an option to finance its intended expansion projects. Explain and demonstrate any two window dressing activities that could be utilized by the firm to make the debt financing option possible under its current debt covenant restriction. (Approximate word limit – 300 words)

(2) Discuss any two ethical implications of the window dressing activities highlighted in question 1. (Approximate word limit – 100 words)

(3) Provide an explanation of why and how a blockchain accounting ledger may prevent the omission and/or duplication of transactions in Prattle Ltd.’s accounting records. (Approximate word limit – 300 words)

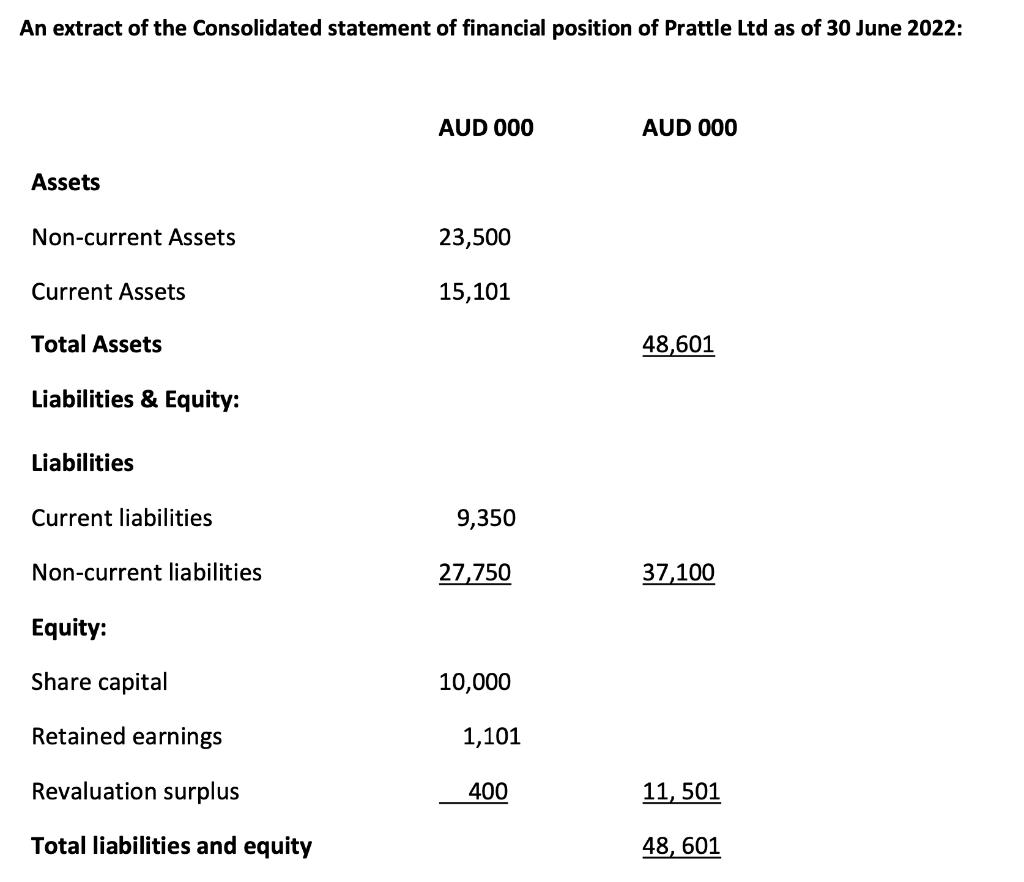

An extract of the Consolidated statement of financial position of Prattle Ltd as of 30 June 2022: Assets Non-current Assets Current Assets Total Assets Liabilities & Equity: Liabilities Current liabilities Non-current liabilities Equity: Share capital Retained earnings Revaluation surplus Total liabilities and equity AUD 000 23,500 15,101 9,350 27,750 10,000 1,101 400 AUD 000 48,601 37,100 11, 501 48, 601

Step by Step Solution

3.55 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 Assuming Pr attle Ltd would like to use debt financing as an option to finance its intended expansion projects Explain and demonstrate any two windo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started