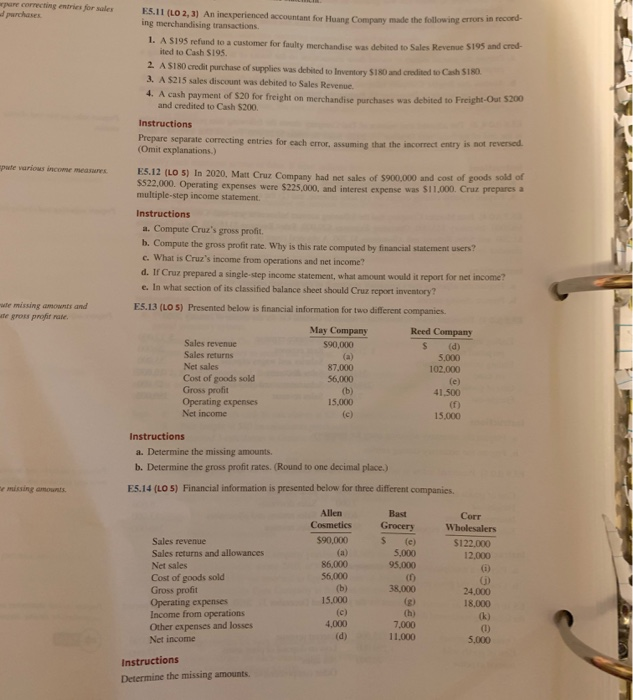

pre correcting entries for sale ESIT (LO 2, 3) An inexperienced accountant for Hua Com made the following errors in rece ing merchandising transactions 1. A $195 refund to a customer for faulty merchandi s dehised to Sales Revenue $195 and cred- ited to Cash S195. 2. ASI credit purchase of supplies was debited to Inventory SIRO and credited to Cash 180 3. A S215 sales discount was debited to Sales Revenue 4. A cash payment of $20 for freight on merchandise nurchases was debited to Freight Out 200 and credited to Cash $200 Instructions Prepare separate correcting entries for each crror assuming that the incorrect entry is not revered (Omit explanations.) pole various comm unes E5.12 (LO 5) In 2020, Matt Cruz Company had net sales of $900.000 and cost of goods som $522.000. Operating expenses were $225.000, and interest expense was $11,000. Cruz prepares a multiple-step income statement Instructions a. Compute Cruz's gross profit. b. Compute the gross profit rate. Why is this rate computed by financial statement users c. What is Cruz's income from operations and net income? d. If Cruz prepared a single-step income statement, what amount would it report for net income e. In what section of its classified balance sheet should Cruz report inventory? E5.13 (LOS) Presented below is financial information for two different companies. May Company Reed Company Sales revenue 590000 $ (d) Sales returns 5.000 Net sales 87.000 102.000 Cost of goods sold 56,000 Gross profit 41,500 Operating expenses 15.000 (f) Net income 15.000 we missing amous and we gross profit rate (b) Instructions a. Determine the missing amounts. b. Determine the gross profit rates. (Round to one decimal place.) mising mo E5.14 (LOS) Financial information is presented below for three different companies Allen Cosmetics $90,000 Bast Grocery S (e) 5.000 95.000 Corr Wholesalers $122.000 12.000 86,000 56,000 Sales revenue Sales returns and allowances Net sales Cost of goods sold Gross profit Operating expenses Income from operations Other expenses and losses Net income 38,000 15.000 24.000 18.000 k) (1) 5.000 4,000 (d) 7.000 11.000 Instructions Determine the missing amounts