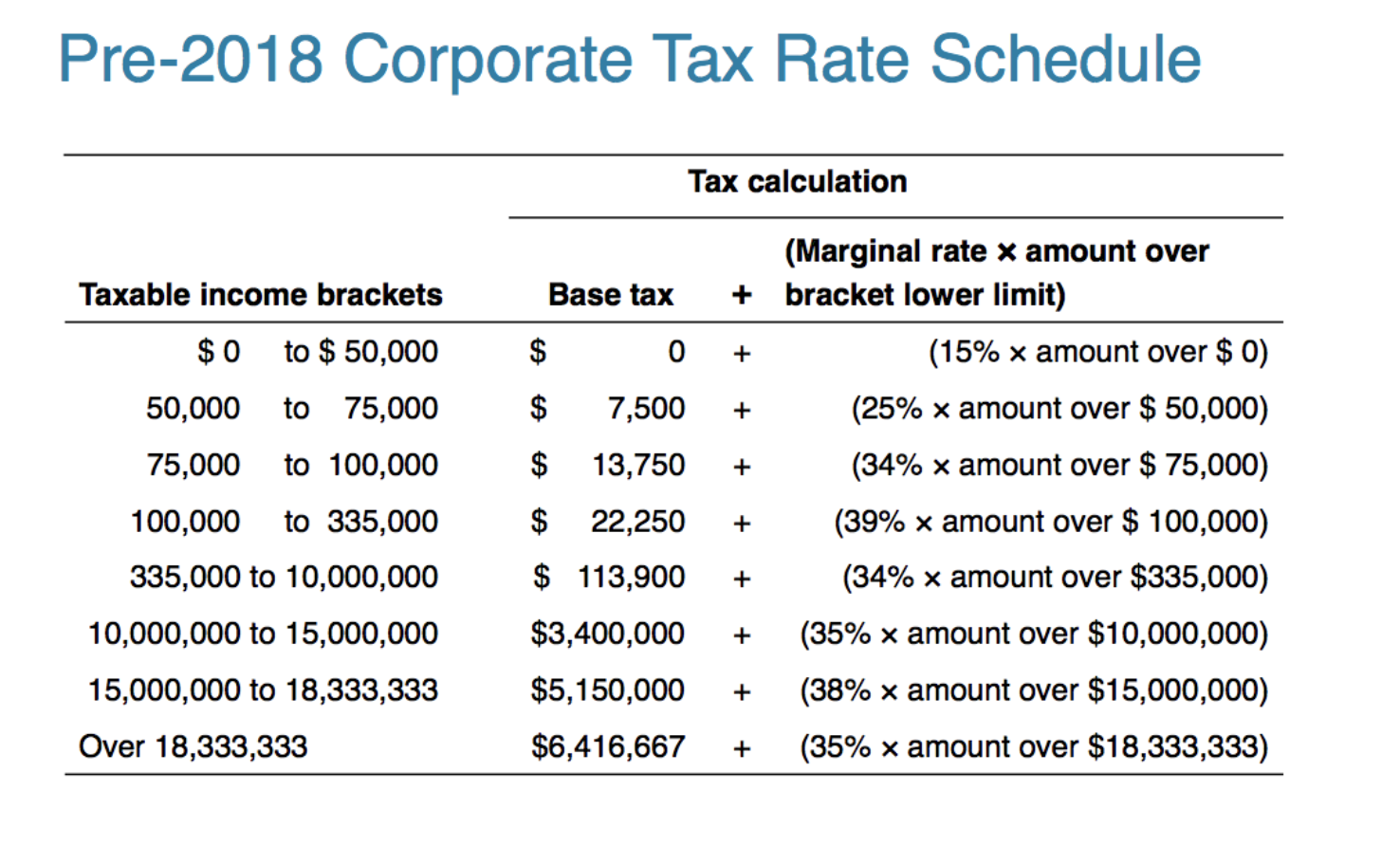

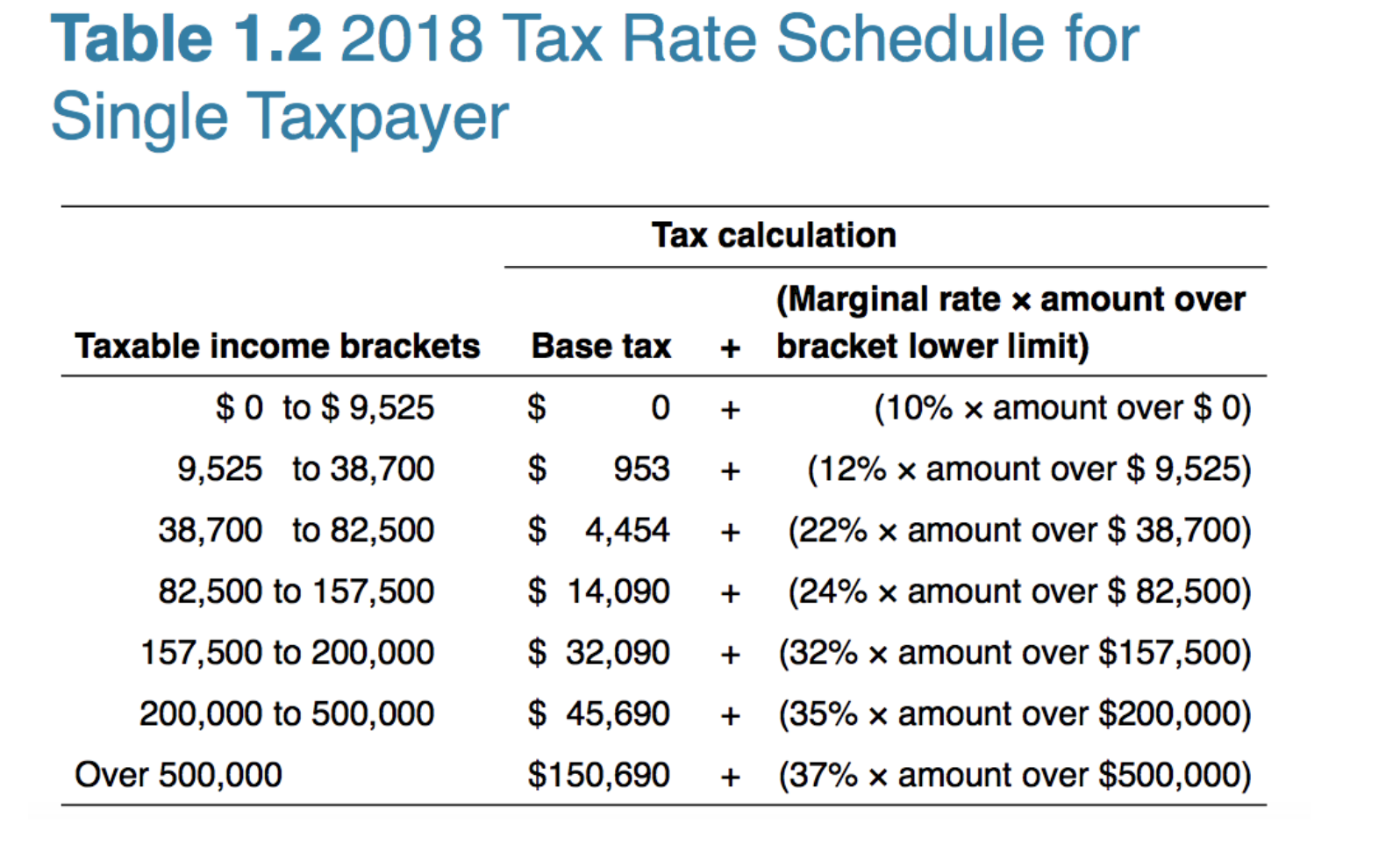

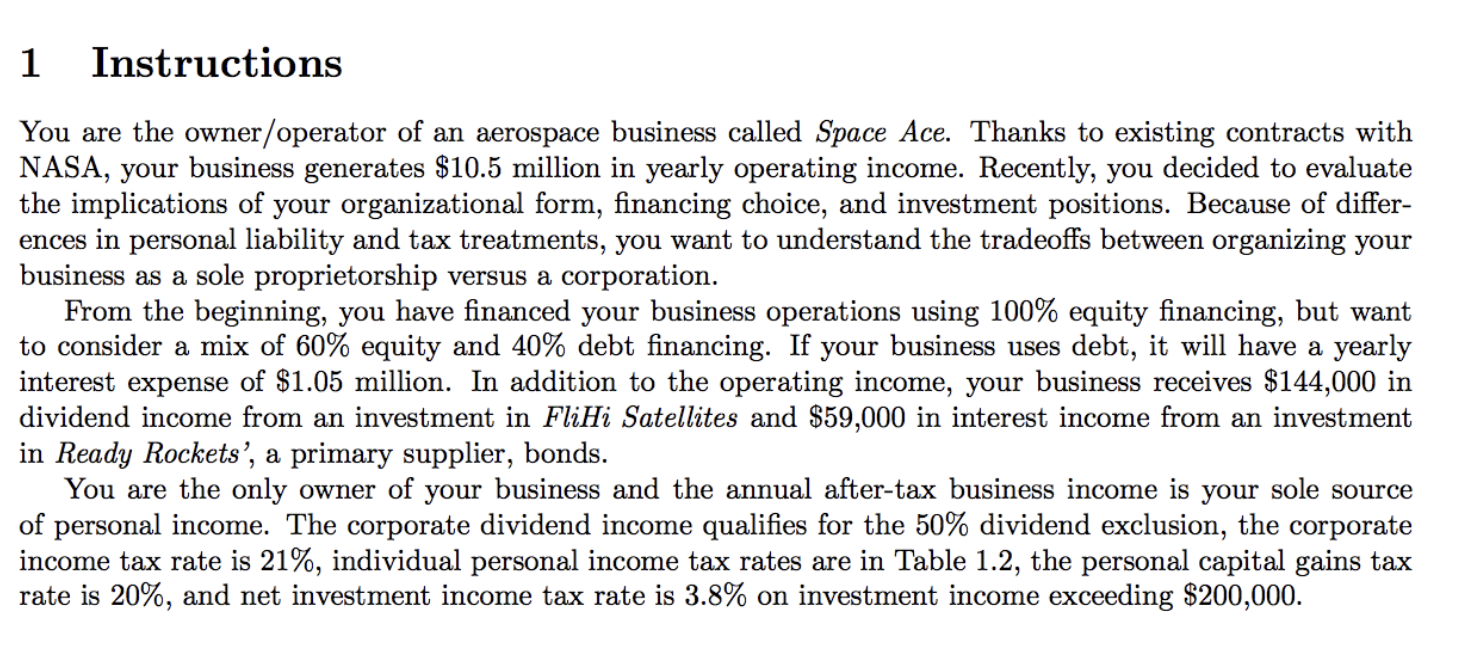

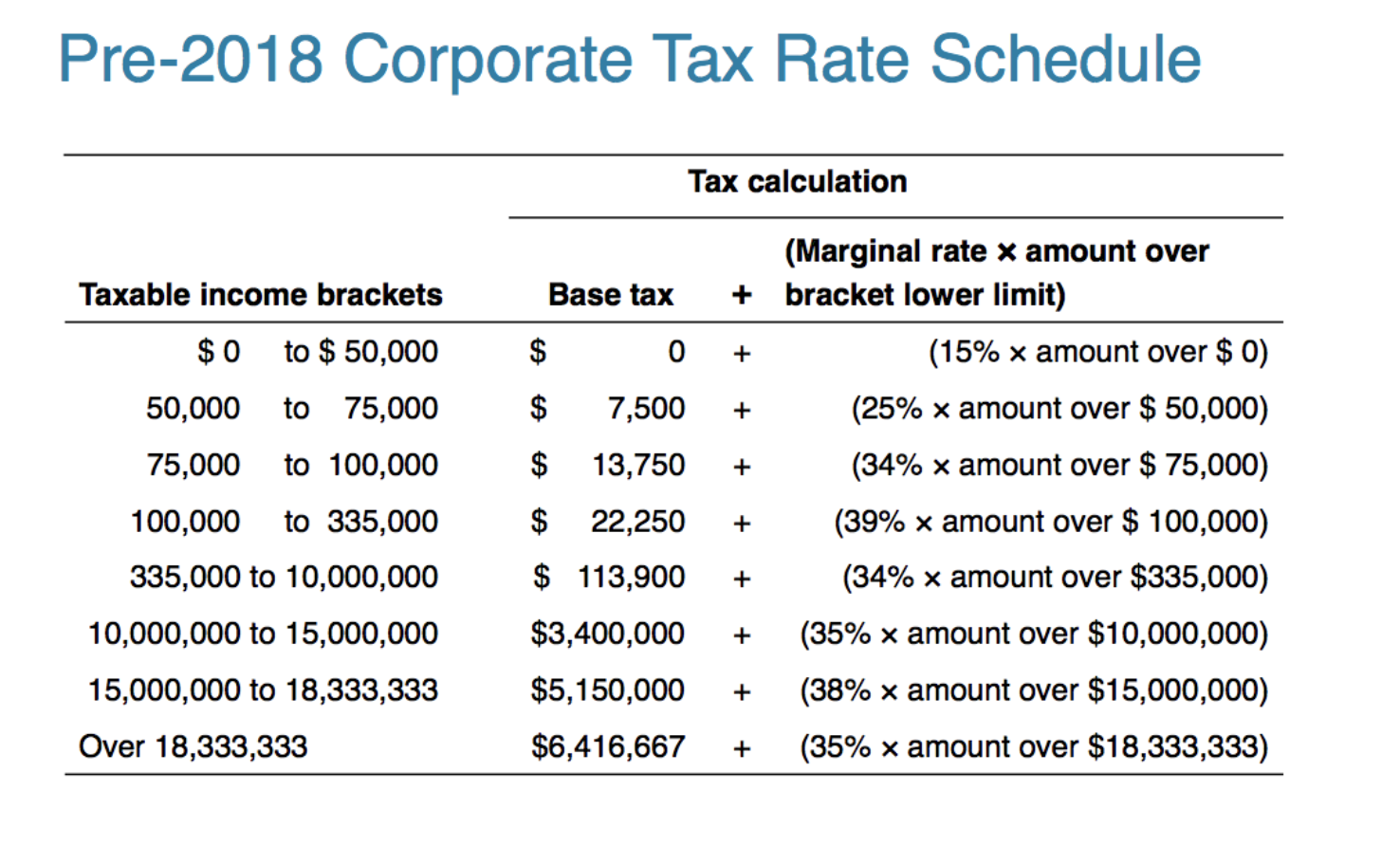

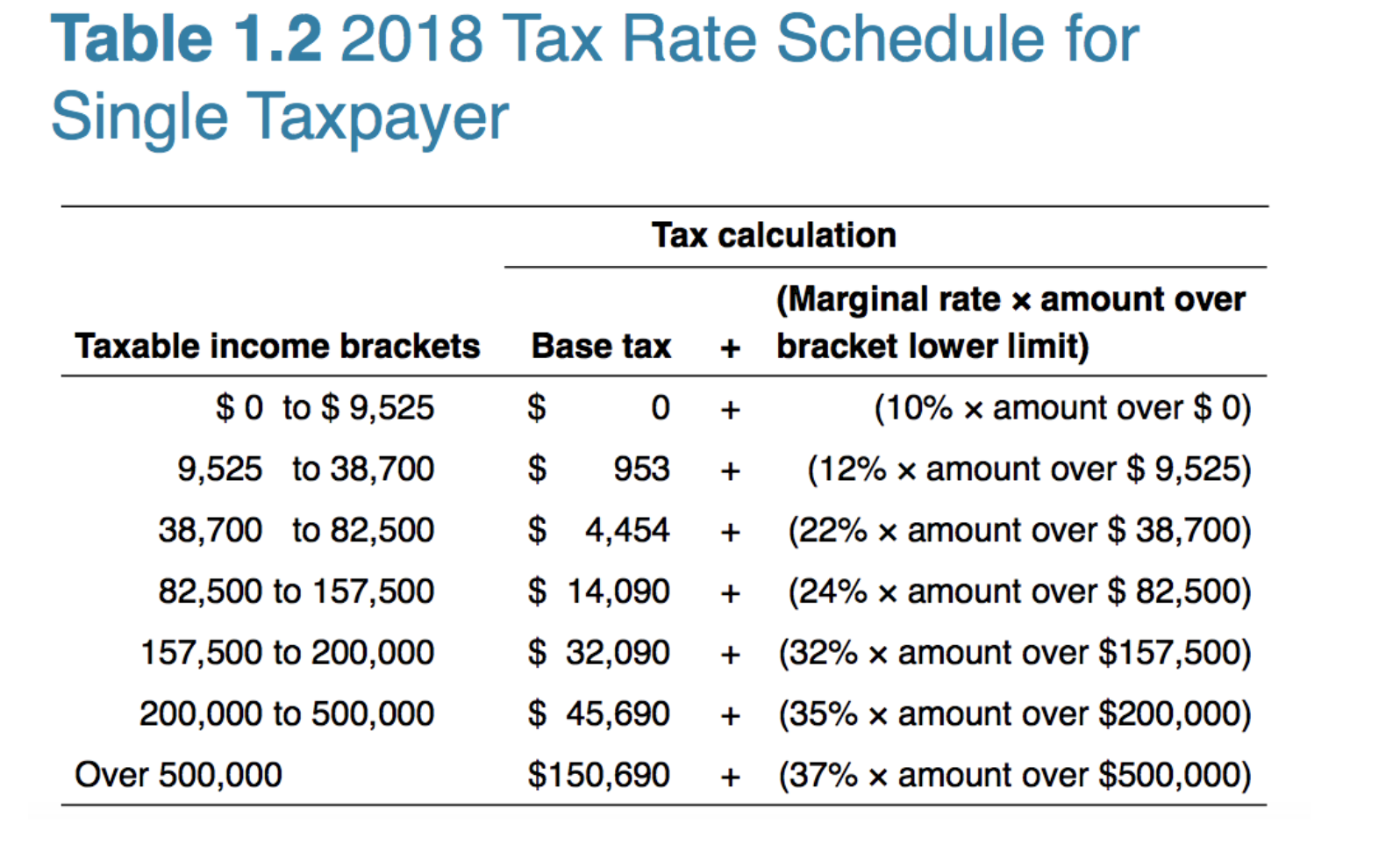

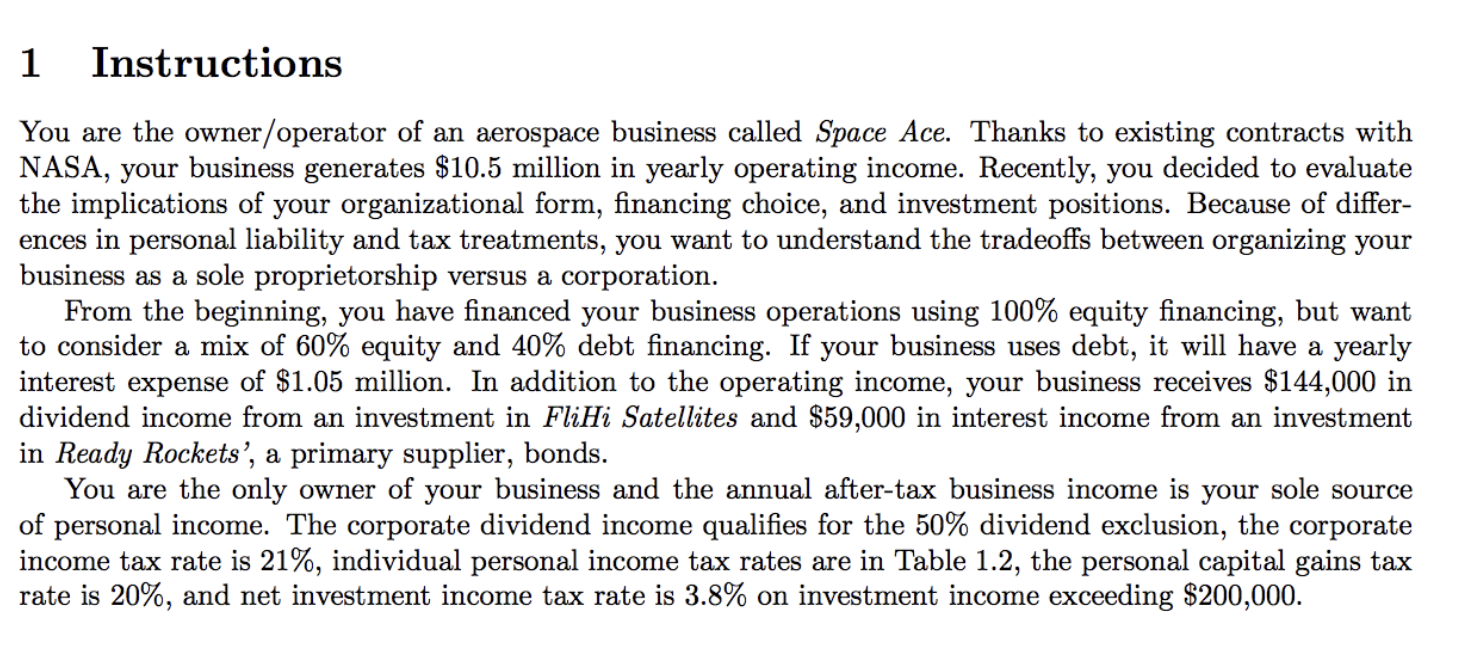

Pre-2018 Corporate Tax Rate Schedule Tax calculation Taxable income brackets Base tax $ 0 to $ 50,000 $ 0 + $ 7,500 + 50,000 75,000 to 75,000 to 100,000 $ 13,750 + (Marginal rate x amount over + bracket lower limit) (15% x amount over $0) (25% x amount over $ 50,000) (34% x amount over $ 75,000) (39% x amount over $ 100,000) (34% x amount over $335,000) (35% x amount over $10,000,000) (38% x amount over $15,000,000) (35% x amount over $18,333,333) 100,000 to 335,000 $ 22,250 + $ 113,900 + 335,000 to 10,000,000 10,000,000 to 15,000,000 15,000,000 to 18,333,333 + $3,400,000 $5,150,000 + Over 18,333,333 $6,416,667 + Table 1.2 2018 Tax Rate Schedule for Single Taxpayer Tax calculation Taxable income brackets + $0 to $ 9,525 9,525 to 38,700 + 38,700 to 82,500 (Marginal rate x amount over Base tax bracket lower limit) $ O + (10% x amount over $0) $ 953 (12% x amount over $ 9,525) $ 4.454 (22% x amount over $ 38,700) $ 14,090 + (24% x amount over $ 82,500) $ 32,090 (32% x amount over $157,500) $ 45,690 + (35% x amount over $200,000) $150,690 + (37% x amount over $500,000) + 82,500 to 157,500 + 157,500 to 200,000 200,000 to 500,000 Over 500,000 1 Instructions You are the owner/operator of an aerospace business called Space Ace. Thanks to existing contracts with NASA, your business generates $10.5 million in yearly operating income. Recently, you decided to evaluate the implications of your organizational form, financing choice, and investment positions. Because of differ- ences in personal liability and tax treatments, you want to understand the tradeoffs between organizing your business as a sole proprietorship versus a corporation. From the beginning, you have financed your business operations using 100% equity financing, but want to consider a mix of 60% equity and 40% debt financing. If your business uses debt, it will have a yearly interest expense of $1.05 million. In addition to the operating income, your business receives $144,000 in dividend income from an investment in FliHi Satellites and $59,000 in interest income from an investment in Ready Rockets', a primary supplier, bonds. You are the only owner of your business and the annual after-tax business income is your sole source of personal income. The corporate dividend income qualifies for the 50% dividend exclusion, the corporate income tax rate is 21%, individual personal income tax rates are in Table 1.2, the personal capital gains tax rate is 20%, and net investment income tax rate is 3.8% on investment income exceeding $200,000. 3. Calculate the total tax liability on all of Space Ace's income, both as a sole proprietorship and a corpo- ration,if it's financed using 100% equity versus 60% equity and 40% debt. What are your observations? Pre-2018 Corporate Tax Rate Schedule Tax calculation Taxable income brackets Base tax $ 0 to $ 50,000 $ 0 + $ 7,500 + 50,000 75,000 to 75,000 to 100,000 $ 13,750 + (Marginal rate x amount over + bracket lower limit) (15% x amount over $0) (25% x amount over $ 50,000) (34% x amount over $ 75,000) (39% x amount over $ 100,000) (34% x amount over $335,000) (35% x amount over $10,000,000) (38% x amount over $15,000,000) (35% x amount over $18,333,333) 100,000 to 335,000 $ 22,250 + $ 113,900 + 335,000 to 10,000,000 10,000,000 to 15,000,000 15,000,000 to 18,333,333 + $3,400,000 $5,150,000 + Over 18,333,333 $6,416,667 + Table 1.2 2018 Tax Rate Schedule for Single Taxpayer Tax calculation Taxable income brackets + $0 to $ 9,525 9,525 to 38,700 + 38,700 to 82,500 (Marginal rate x amount over Base tax bracket lower limit) $ O + (10% x amount over $0) $ 953 (12% x amount over $ 9,525) $ 4.454 (22% x amount over $ 38,700) $ 14,090 + (24% x amount over $ 82,500) $ 32,090 (32% x amount over $157,500) $ 45,690 + (35% x amount over $200,000) $150,690 + (37% x amount over $500,000) + 82,500 to 157,500 + 157,500 to 200,000 200,000 to 500,000 Over 500,000 1 Instructions You are the owner/operator of an aerospace business called Space Ace. Thanks to existing contracts with NASA, your business generates $10.5 million in yearly operating income. Recently, you decided to evaluate the implications of your organizational form, financing choice, and investment positions. Because of differ- ences in personal liability and tax treatments, you want to understand the tradeoffs between organizing your business as a sole proprietorship versus a corporation. From the beginning, you have financed your business operations using 100% equity financing, but want to consider a mix of 60% equity and 40% debt financing. If your business uses debt, it will have a yearly interest expense of $1.05 million. In addition to the operating income, your business receives $144,000 in dividend income from an investment in FliHi Satellites and $59,000 in interest income from an investment in Ready Rockets', a primary supplier, bonds. You are the only owner of your business and the annual after-tax business income is your sole source of personal income. The corporate dividend income qualifies for the 50% dividend exclusion, the corporate income tax rate is 21%, individual personal income tax rates are in Table 1.2, the personal capital gains tax rate is 20%, and net investment income tax rate is 3.8% on investment income exceeding $200,000. 3. Calculate the total tax liability on all of Space Ace's income, both as a sole proprietorship and a corpo- ration,if it's financed using 100% equity versus 60% equity and 40% debt. What are your observations