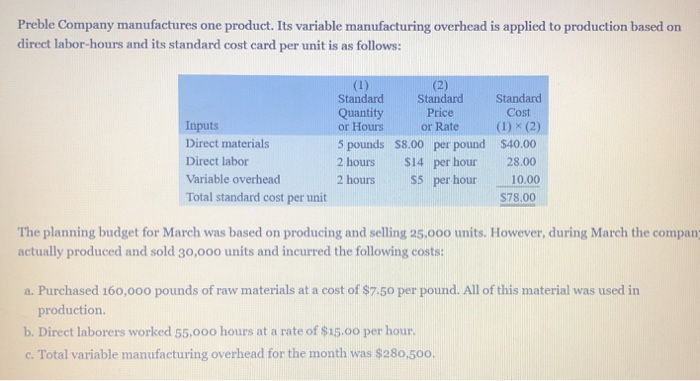

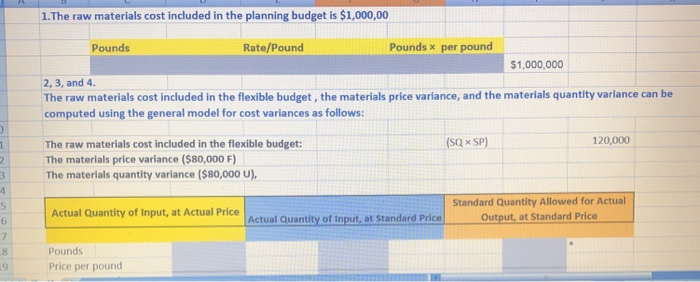

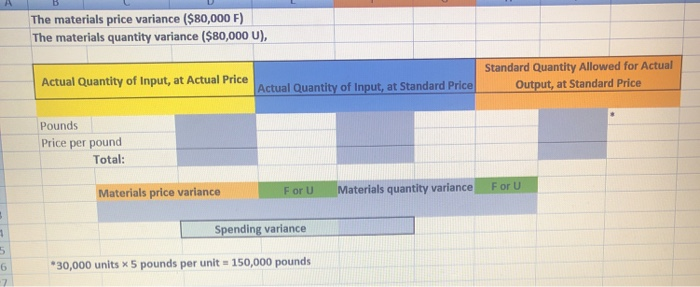

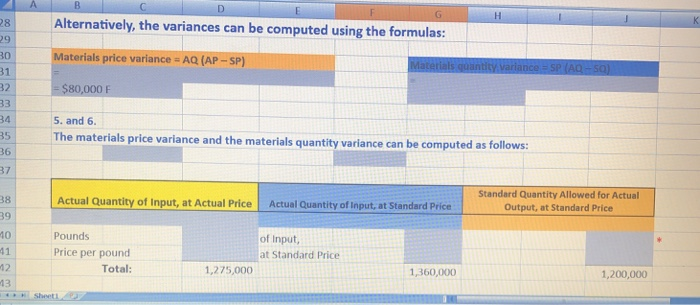

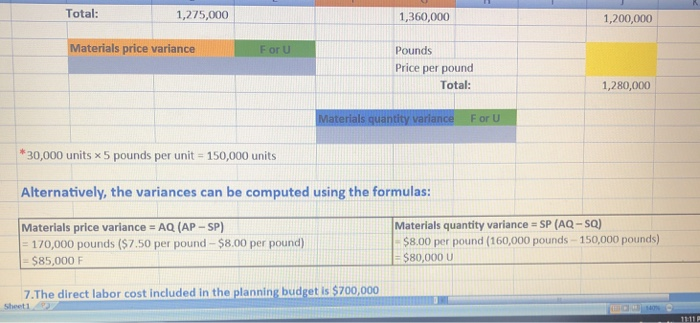

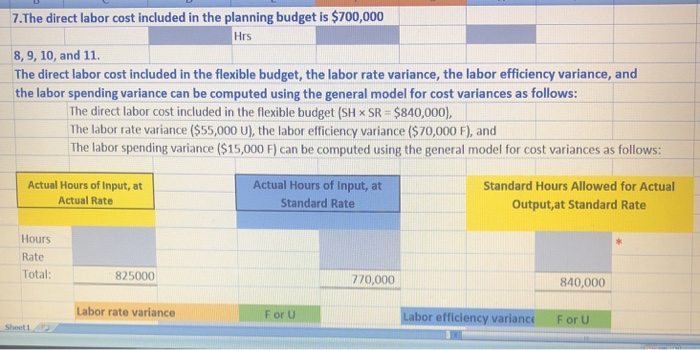

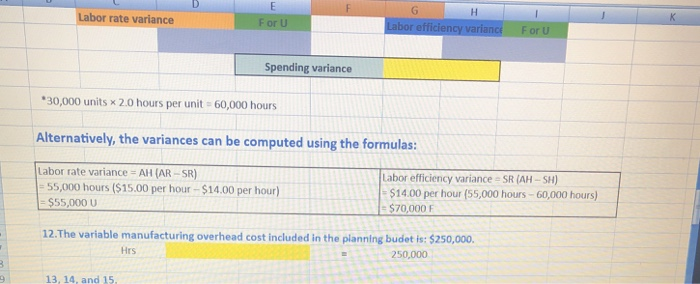

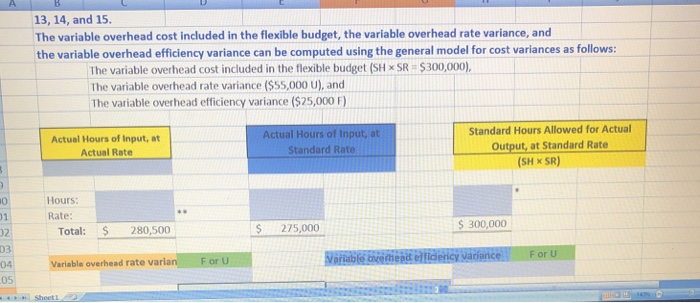

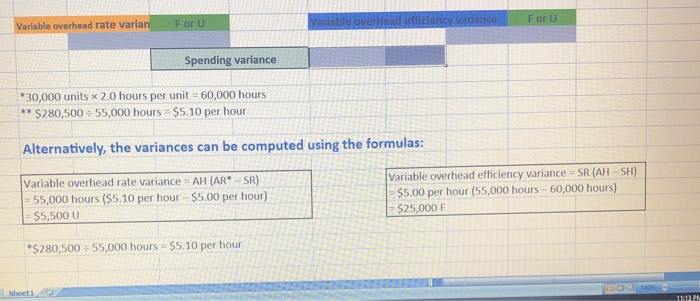

Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Standard Cost Standard Quantity or Hours or Rate (1)-( 5 pounds $8.00 per pound $40.00 2 hours $14 per hour 28.00 2 hours S5 per hour 10.00 Standard Price Inputs Direct materials Direct labor Variable overhead Total standard cost per unit S78.00 The planning budget for March was based on producing and selling a5,ooo units. However, during March the compan actually produced and sold 30,00o units and incurred the following costs: a. Purchased 160,000 pounds of raw materials at a cost of $7.50 per pound. All of this material was used in production. b. Direct laborers worked 55,000 hours at a rate of $15.oo per hour. c. Total va riable manufacturing overhead for the month was $280.500 . 1.The raw materials cost included in the planning budget is $1,000,00 Pounds Rate/Pound Pounds x per pound $1,000,000 2, 3, and 4. The raw materials cost included in the flexible budget, the materials price variance, and the materials quantity varlance can be computed using the general model for cost variances as follows: (sQ x SP) 120,000 The raw materials cost included in the flexible budget: The materials price variance ($80,000 F) The materials quantity variance($80,000 U) Standard Quantity Allowed for Actual Output, at Standard Price Actual Quantity of Input, at Actual Price 6 Actual Quantity of Input, at Standard Price Pounds Price per pound The materials price variance ($80,000 F) The materials quantity variance ($80,000 U) Standard Quantity Allowed for Actual Output, at Standard Price Actual Quantity of Input, at Actual Price Actual Quantity of Input, at Standard Price Pounds Price per pound Total: aterials price variance Materials quantity variance Spending variance 30,000 units x 5 pounds per unit 150,000 pounds 6 Alternatively, the variances can be computed using the formulas: 28 29 30 31 32 Materials price variance AQ (AP-SP) ,000 F 5. and 6 The m 34 35 36 37 aterials price variance and the materials quantity variance can be computed as follows: Standard Quantity Allowed for Actual Output, at Standard Price Actual Quantity of Input, at Actual Price Actual Quantity of Input, at Standard Price 38 39 10 of Input at Standard Price Pounds Price per pound 1,360,000 1,200,000 Total: 1,275,000 12 13 Total: 1,275,000 1,360,000 1,200,000 aterials price variance F or U Pounds Price per pound Total: 1,280,000 30,000 units x 5 pounds per unit- 150,000 units Alternatively, the variances can be computed using the formulas: Materials price variance AQ (AP-SP) 170,000 pounds ($7.50 per pound - $8.00 per pound $85,000 F Materials quantity variance SP (AQ-SQ) $8.00 per pound (160,000 pounds - 150,000 pounds) $80,000 U 7.The direct labor cost included in the planning budget is $700,000 Sheet1 7.The direct labor cost included in the planning budget is $700,000 Hrs 8, 9, 10, and 11. The direct labor cost included in the flexible budget, the labor rate variance, the labor efficiency variance, and the labor spending variance can be computed using the general model for cost variances as follows: The direct labor cost included in the flexible budget (SH x SR $840,000), The labor rate variance($55,000 U), the labor efficiency variance ($70,000 F), and The labor spending variance ($15,000 F) can be computed using the general model for cost variances as follows: Actual Hours of Input, at Actual Rate Actual Hours of Input, at Standard Rate Standard Hours Allowed for Actual Output,at Standard Rate Hours Rate Total: 825000 770,000 840,000 Labor effi abor rate variance ciency variance F or Labor rate variance Spending variance 30,000 units x 2.0 hours per unit 60,000 hours Alternatively, the variances can be computed using the formulas: Labor rate variance AH (AR-SR) Labor efficiency variance SR(AH-SH) 55,000 hours ($15.00 per hour-$14.00 per hour) $55,000 U 14.00 per hour (55,000 hours 60,000 hours) e $70,000 F 12. The variable manufacturing overhead cost included in the planning budet is: $250,000 Hrs 250,000 13, 14, and 15 13, 14, and 15. The variable overhead cost included in the flexible budget, the variable overhead rate variance, and the variable overhead efficiency variance can be computed using the general model for cost variances as follows: The variable overhead cost included in the flexible budget (SHSR The variable overhead rate variance ($55,000 U), and The variable overhead efficiency variance ($25,000 F) $300,000), Standard Hours Allowed for Actual Actual Hours of input, at Actual Rate Actual Hours of Input, at Standard Rate Output, at Standard Rate (SH x SR) Hours Rate: S 275,000 300,000 Total: 280,500 2 03 04 05 F or U iable overhead rate varia or F or U Variable overhead rate varian For U Spending variance 30,000 units x 2.0 hours per unit 60,000 hours $280,500 55,000 hours $5.10 per hour Alternatively, the variances can be computed using the formulas Variable overhead efficiency variance SR (AH-SH) Variable overhead rate variance AH (AR SR) 55,000 hours (S5.10 per hour $5.00 per hour) $5,500 U $5.00 per hour (55,000 hours-60,000 hours) $25,000F $280,500 55,000 hours $5.10 per hour Sheeti.tz