Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Precious Gems Co purchased a diamond-cutting machine at a cost of $58 000. They bought it at a discount from the recommended price of

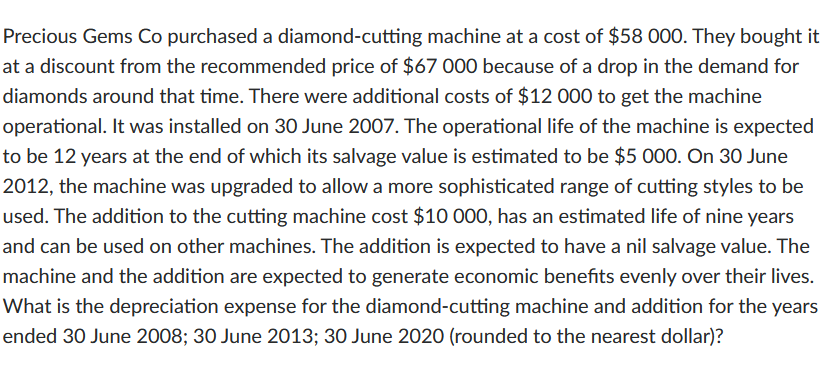

Precious Gems Co purchased a diamond-cutting machine at a cost of $58 000. They bought it at a discount from the recommended price of $67 000 because of a drop in the demand for diamonds around that time. There were additional costs of $12 000 to get the machine operational. It was installed on 30 June 2007. The operational life of the machine is expected to be 12 years at the end of which its salvage value is estimated to be $5 000. On 30 June 2012, the machine was upgraded to allow a more sophisticated range of cutting styles to be used. The addition to the cutting machine cost $10 000, has an estimated life of nine years and can be used on other machines. The addition is expected to have a nil salvage value. The machine and the addition are expected to generate economic benefits evenly over their lives. What is the depreciation expense for the diamond-cutting machine and addition for the years ended 30 June 2008; 30 June 2013; 30 June 2020 (rounded to the nearest dollar)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the depreciation expense for the diamondcutting machine and its addition for the specified years well follow these steps 1 Determine the initial cost of the diamondcutting machine 2 Calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started