Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Precision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $40.3 million cash on October 1, 2024, to provide working

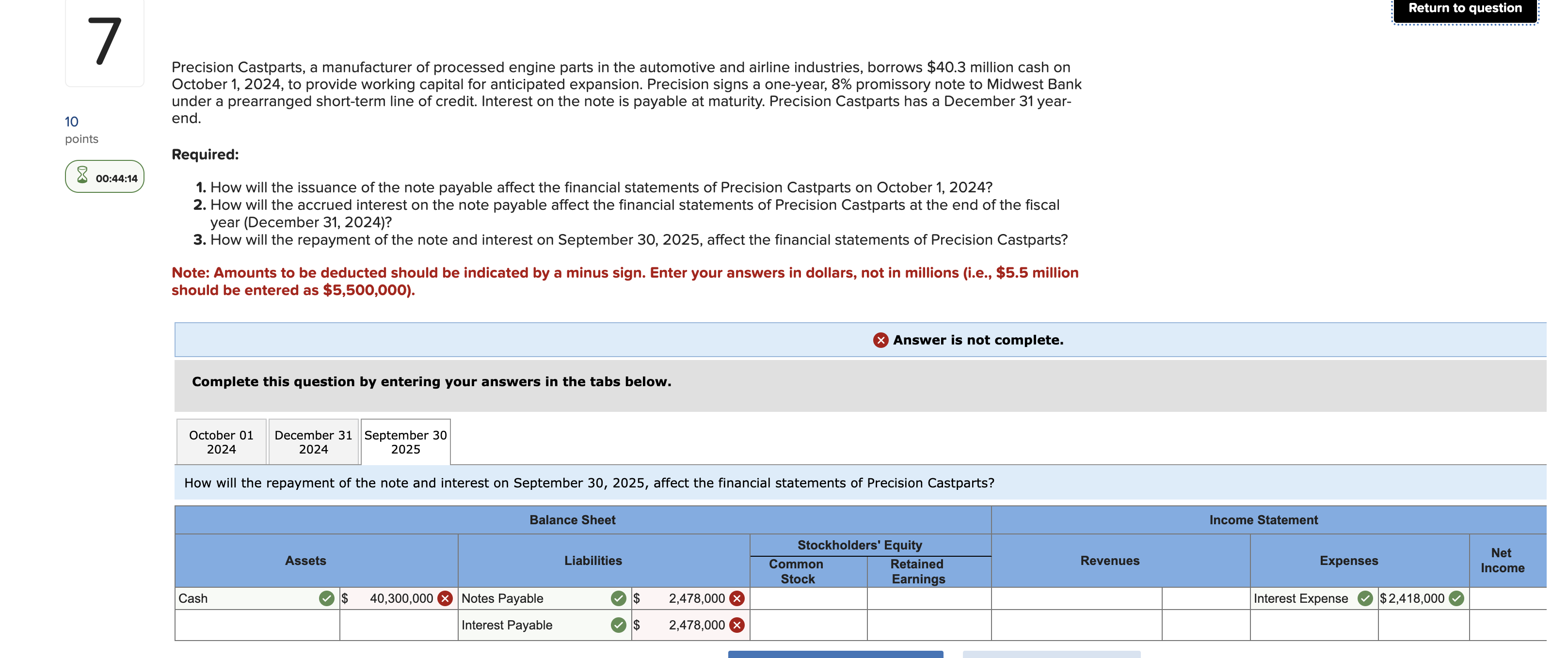

Precision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $40.3 million cash on October 1, 2024, to provide working capital for anticipated expansion. Precision signs a one-year, 8% promissory note to Midwest Bank under a prearranged short-term line of credit. Interest on the note is payable at maturity. Precision Castparts has a December 31 yearend. Required: 1. How will the issuance of the note payable affect the financial statements of Precision Castparts on October 1, 2024? 2. How will the accrued interest on the note payable affect the financial statements of Precision Castparts at the end of the fiscal year (December 31, 2024)? 3. How will the repayment of the note and interest on September 30, 2025, affect the financial statements of Precision Castparts? Note: Amounts to be deducted should be indicated by a minus sign. Enter your answers in dollars, not in millions (i.e., $5.5 million should be entered as $5,500,000 ). Complete this question by entering your answers in the tabs below

Precision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $40.3 million cash on October 1, 2024, to provide working capital for anticipated expansion. Precision signs a one-year, 8% promissory note to Midwest Bank under a prearranged short-term line of credit. Interest on the note is payable at maturity. Precision Castparts has a December 31 yearend. Required: 1. How will the issuance of the note payable affect the financial statements of Precision Castparts on October 1, 2024? 2. How will the accrued interest on the note payable affect the financial statements of Precision Castparts at the end of the fiscal year (December 31, 2024)? 3. How will the repayment of the note and interest on September 30, 2025, affect the financial statements of Precision Castparts? Note: Amounts to be deducted should be indicated by a minus sign. Enter your answers in dollars, not in millions (i.e., $5.5 million should be entered as $5,500,000 ). Complete this question by entering your answers in the tabs below Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started