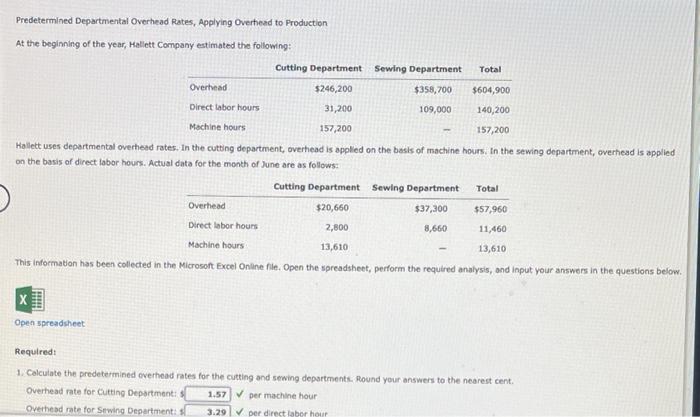

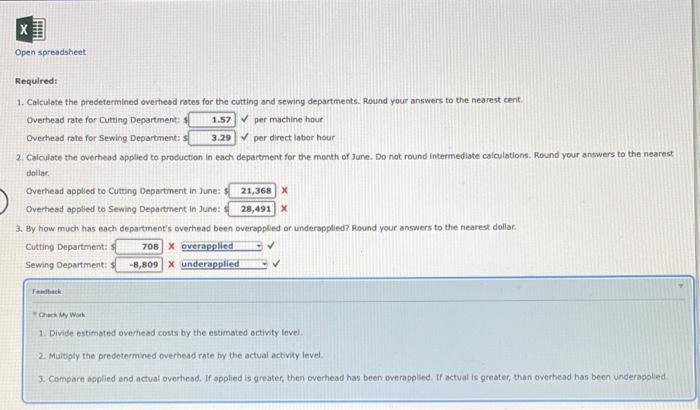

Predetermined Departmental Overhead Rates, Applying Overhead to Production At the beginning of the year, Hallett Company estimated the following: Cutting Department Sewing Department Total Overhead $246,200 $358,700 $604,900 Direct labor hours 31,200 109,000 140,200 Machine hours 157,200 157,200 Hallett uses departmental overhead rates. In the cutting department, overhead is applied on the basis of machine hours. In the sewing department, overhead is applied on the basis of direct labor hours. Actual data for the month of June are as follows: Cutting Department Sewing Department Total Overhead $20,660 $37,300 $57,960 Direct labor hours 2,800 11,460 Machine hours 13,610 13,610 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. 8,660 TH Open spreadsheet Required: 1. Calculate the predetermined overhead rates for the cutting and sewing departments. Round your answers to the nearest cent. Overhead rate for Cutting Department: 1.57 per machine hour Overhead rate for Sewing Departments 3.291 per direct labor hour THAT Open spreadsheet Required: 1. Calculate the predetermined overhead rates for the cutting and sewing departments. Round your answers to the nearest cent Overhead rate for Cutting Department: 1.57 per machine hour Overhead rate for Sewing Department: 3.29 per direct labor hour 2. Calculate the overhead applied to production in each department for the month of June. Do not round intermediate calculations. Round your answers to the nearest dollar Overhead appled to Cutting Department in June: 21,368 X Overhead applied to Sewing Department in June 28,491 X 3. By how much has each department's overhead been overapplied or underapplled? Round your answers to the nearest dollar Cutting Department: 708 X overapplied Sewing Department: -8,809 X underapplied Fad Check My Work 1. Divide estimated overhead costs by the estimated activity levels 2. Multiply the predetermined overhead rate by the actual activity level 3. Compare applied and actual overhead. If applied is greater, then overhead has been overappled. If actual is geeater than overhead has been underappled