Answered step by step

Verified Expert Solution

Question

1 Approved Answer

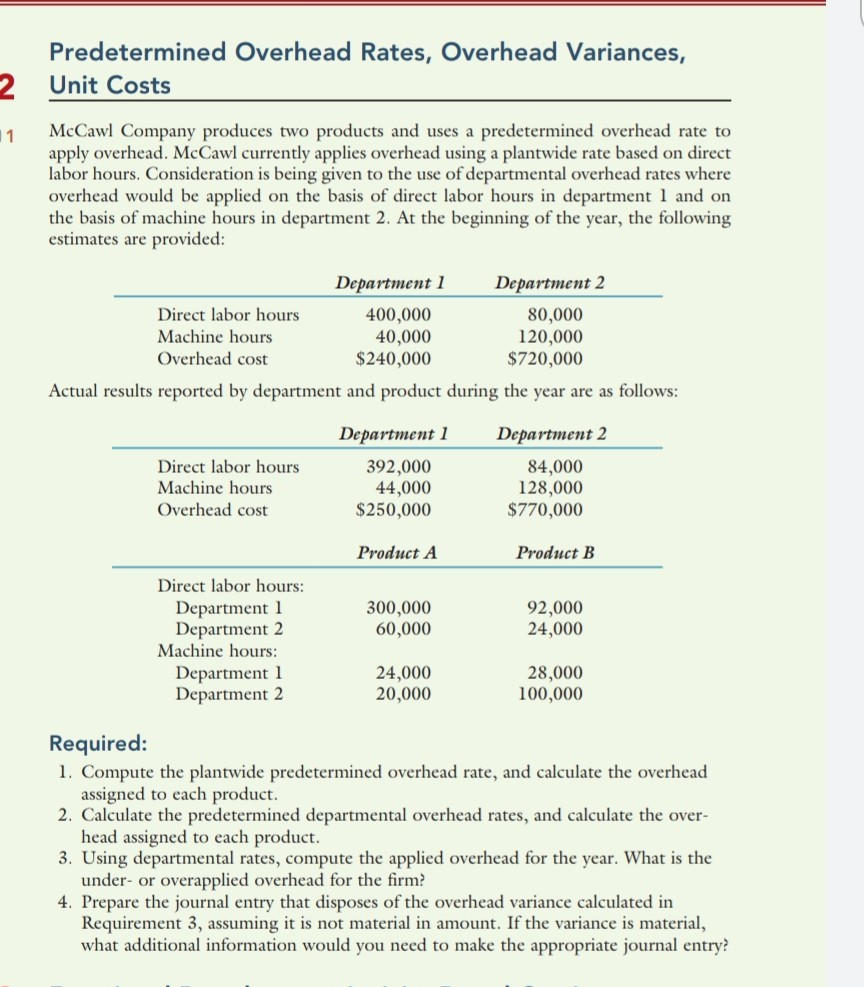

Predetermined Overhead Rates, Overhead Variances, Unit Costs McCawl Company produces two products and uses a predetermined overhead rate to apply overhead. McCawl currently applies overhead

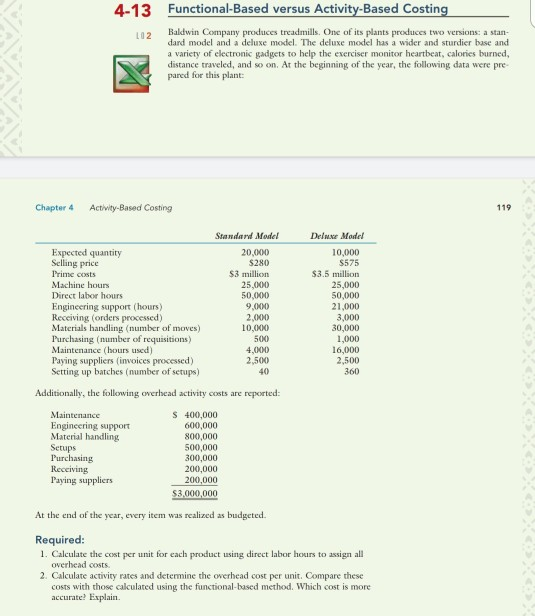

Predetermined Overhead Rates, Overhead Variances, Unit Costs McCawl Company produces two products and uses a predetermined overhead rate to apply overhead. McCawl currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates where overhead would be applied on the basis of direct labor hours in department 1 and on the basis of machine hours in department 2. At the beginning of the year, the following estimates are provided: Hours Department 1 Department 2 Direct labor hours 400,000 80,000 Machine hours 40,000 120,000 Overhead cost $240,000 $720,000 Actual results reported by department and product during the year are as follows: Direct labor hours Machine hours Overhead cost Department 1 392,000 44,000 $250,000 Department 2 84,000 128,000 $770,000 Product A Product B 300,000 60,000 92,000 24,000 Direct labor hours: Department 1 Department 2 Machine hours: Department 1 Department 2 24,000 20,000 28,000 100,000 Required: 1. Compute the plantwide predetermined overhead rate, and calculate the overhead assigned to each product. 2. Calculate the predetermined departmental overhead rates, and calculate the over- head assigned to each product, 3. Using departmental rates, compute the applied overhead for the year. What is the under- or overapplied overhead for the firm? 4. Prepare the journal entry that disposes of the overhead variance calculated in Requirement 3, assuming it is not material in amount. If the variance is material, what additional information would you need to make the appropriate journal entry? 4.13 Functional-Based versus Activity-Based Costing Baldwin Company produces treadmills. One of its plants produces two versions a stan- dard model and a deluxe model. The deluxe model has a wider and sturdier base and a variety of clectronic gadgets to help the exerciser monitor heartbeat, calories burned, distance traveled, and so on. At the beginning of the year, the following data were pre pared for this plant Chapter 4 Activity-Based Costing Expected quantity Selling price Prime costs Machine hours Direct labor hours Engineering support (hours) Receiving (orders processed) Materials handling (number of moves) Purchasing (number of requisitions) Maintenance (hours used) Paying suppliers (invoices processed) Setting up batches (number of setups) Standard Model 20.000 $280 $3 million 25.000 50.000 9.000 2.000 10,000 Deluxe Model 10.000 $575 $3,5 million 25.000 50.000 21,000 3,000 30.000 1.000 16.000 2,500 360 50 4.000 2,500 Additionally, the following overhead activity costs are reported: Maintenance Engineering support Material handling Setups Purchasing Receiving Paying suppliers $ 400,000 600,000 800,000 500,000 300,000 200,000 200.000 $3,000,000 At the end of the year, every item was realized as budgeted. Required: 1. Calculate the cost per unit for cach product using direct labor hours to assign all overhead costs 2. Calculate activity rates and determine the overhead cost per unit. Compare these costs with those calculated using the functional-based method. Which cost is more accurate! Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started