Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Oman Mills Company is a producer of flour products and uses standard costing. Manufacturing overhead for its variable and fixed is allocated to

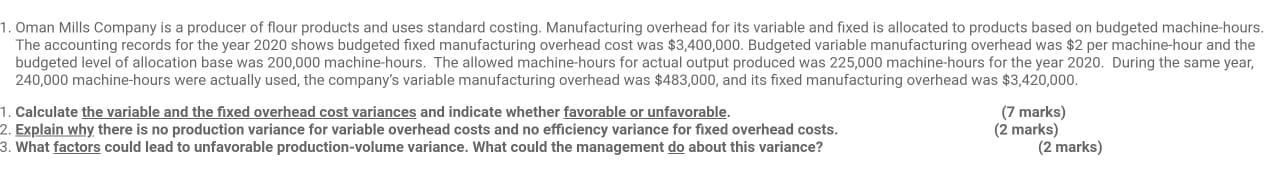

1. Oman Mills Company is a producer of flour products and uses standard costing. Manufacturing overhead for its variable and fixed is allocated to products based on budgeted machine-hours. The accounting records for the year 2020 shows budgeted fixed manufacturing overhead cost was $3,400,000. Budgeted variable manufacturing overhead was $2 per machine-hour and the budgeted level of allocation base was 200,000 machine-hours. The allowed machine-hours for actual output produced was 225,000 machine-hours for the year 2020. During the same year, 240,000 machine-hours were actually used, the company's variable manufacturing overhead was $483,000, and its fixed manufacturing overhead was $3,420,000. 1. Calculate the variable and the fixed overhead cost variances and indicate whether favorable or unfavorable. 2. Explain why there is no production variance for variable overhead costs and no efficiency variance for fixed overhead costs. 3. What factors could lead to unfavorable production-volume variance. What could the management do about this variance? (7 marks) (2 marks) (2 marks)

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Variable overhead cost variance Standard cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started