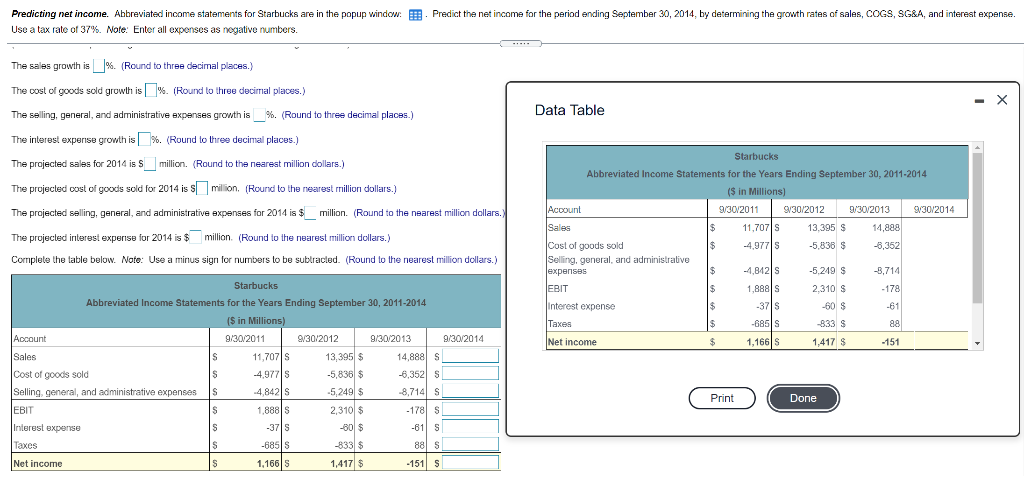

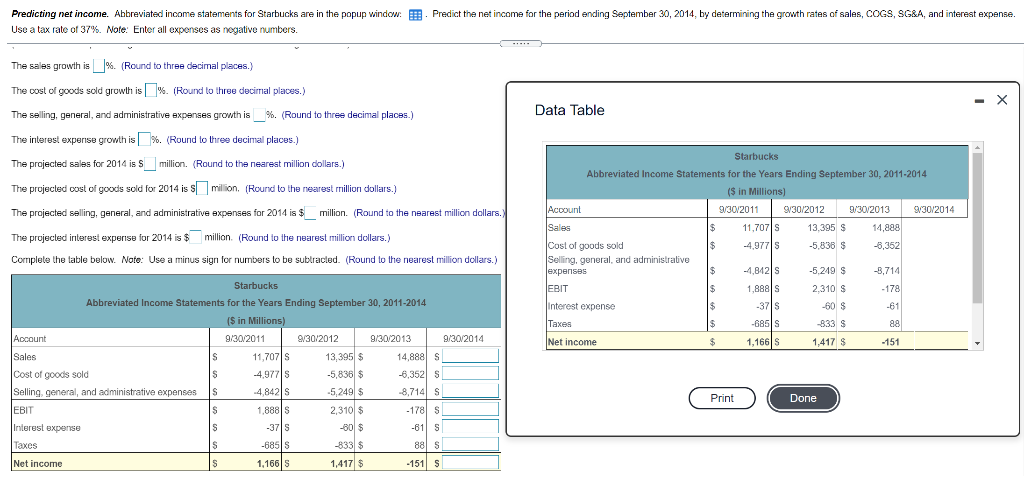

Predicting net income. Abbreviated income statements for Starbucks are in the popup window. E. Predict the net income for the period ending September 30, 2014, by determining the growth rates of sales, COGS, SG&A, and interest expense. Use a tax rate of 37%. Note: Enter all expenses as negative numbers. The sales growth is_%. (Round to three decimal places.) The cost of goods sold growth is%. (Round to three decirial places.) The selling, general, and administrative expenses growth is_%. (Round to three decimal places.) Data Table The interest experise growth is %. (Round to three decimal places.) The projected sales for 2014 is $_million. (Round to the nearest million dollars.) The projected cost of goods sold for 2014 is million (Round to the nearest million dollars.) The projected selling, general, and administrative expenses for 2014 is $ million (Round to the nearest million dollars. The projected interest experise for 2014 is $ million (Round to the nearest million dollars.) ( Complete the table below. Note: Use a minus sign for numbers to be subtracted. (Round to the nearest million dollars.) Starbucks Abbreviated Income Statements for the Years Ending September 30, 2011-2014 ($ in Millions) Account 9/30/2011 9/30/2012 9/30/2013 9/30/2014 Isales $ 11,707 S 13,395 S 14.888 Cost of goods sold $ -4,97718 -5,838 $ -6,352 Selling, general, and administrative expenses $ -4,84218 -5.249 $ -3,714 EBIT $ 1,888 2.310 S - 178 interest expense $ $ -3715 -60 $ -61 Taxes $ -685 S 833 S 88 Net income $ 1,166 1,417 S -151 9/30/2014 Starbucks Abbreviated Income Statements for the Years Ending September 30, 2011-2014 ($ in Millions) Account 9/30/2011 9/30/2012 9/30/2013 Sales S 11,707 S 13,395 $ 14,888 S Cost of goods sold S -4,9771 -5,836 $ -6,3521 s Selling general, and administrative expenses S 4,842 S -5,249 $ -8,714 S |EBIT S 1,888 2,310 $ -1781 S Interest expense S -37 S -30$ -611 S Taxes S -685 S -833 $ 88 s Net income S 1,166 S 1,417 $ -151 S Print Done Predicting net income. Abbreviated income statements for Starbucks are in the popup window. E. Predict the net income for the period ending September 30, 2014, by determining the growth rates of sales, COGS, SG&A, and interest expense. Use a tax rate of 37%. Note: Enter all expenses as negative numbers. The sales growth is_%. (Round to three decimal places.) The cost of goods sold growth is%. (Round to three decirial places.) The selling, general, and administrative expenses growth is_%. (Round to three decimal places.) Data Table The interest experise growth is %. (Round to three decimal places.) The projected sales for 2014 is $_million. (Round to the nearest million dollars.) The projected cost of goods sold for 2014 is million (Round to the nearest million dollars.) The projected selling, general, and administrative expenses for 2014 is $ million (Round to the nearest million dollars. The projected interest experise for 2014 is $ million (Round to the nearest million dollars.) ( Complete the table below. Note: Use a minus sign for numbers to be subtracted. (Round to the nearest million dollars.) Starbucks Abbreviated Income Statements for the Years Ending September 30, 2011-2014 ($ in Millions) Account 9/30/2011 9/30/2012 9/30/2013 9/30/2014 Isales $ 11,707 S 13,395 S 14.888 Cost of goods sold $ -4,97718 -5,838 $ -6,352 Selling, general, and administrative expenses $ -4,84218 -5.249 $ -3,714 EBIT $ 1,888 2.310 S - 178 interest expense $ $ -3715 -60 $ -61 Taxes $ -685 S 833 S 88 Net income $ 1,166 1,417 S -151 9/30/2014 Starbucks Abbreviated Income Statements for the Years Ending September 30, 2011-2014 ($ in Millions) Account 9/30/2011 9/30/2012 9/30/2013 Sales S 11,707 S 13,395 $ 14,888 S Cost of goods sold S -4,9771 -5,836 $ -6,3521 s Selling general, and administrative expenses S 4,842 S -5,249 $ -8,714 S |EBIT S 1,888 2,310 $ -1781 S Interest expense S -37 S -30$ -611 S Taxes S -685 S -833 $ 88 s Net income S 1,166 S 1,417 $ -151 S Print Done