Answered step by step

Verified Expert Solution

Question

1 Approved Answer

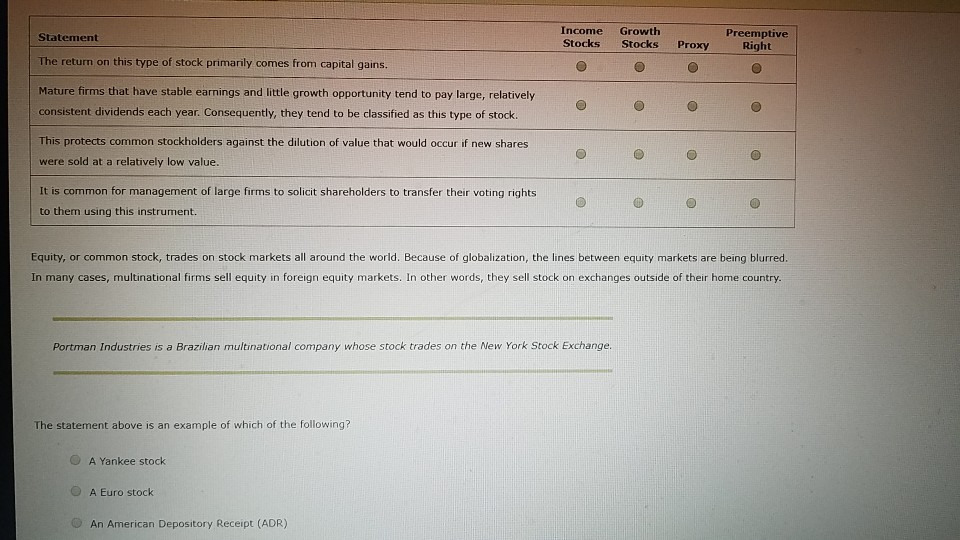

Preemptive Statement Income Growth Stocks Stocks Proxy The return on this type of stock primarily comes from capital gains. Mature firms that have stable earnings

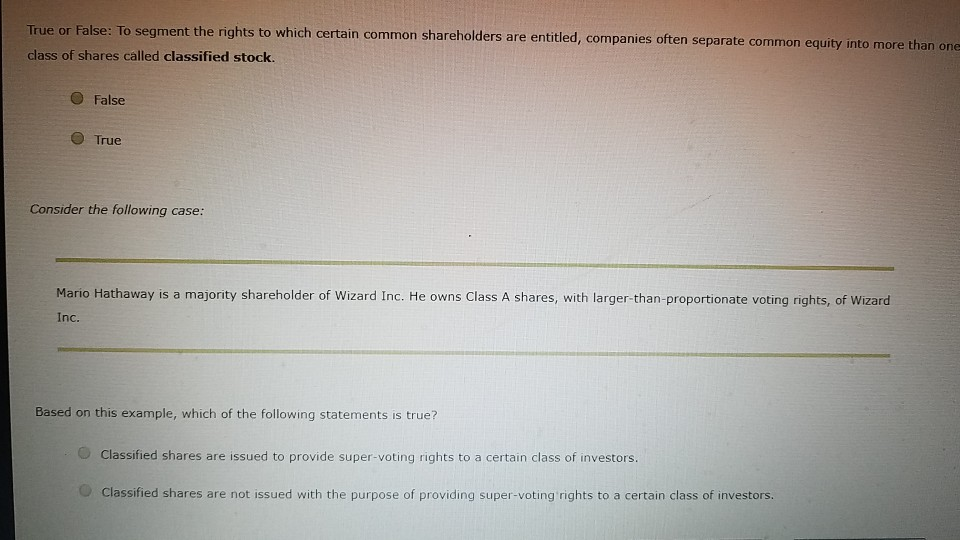

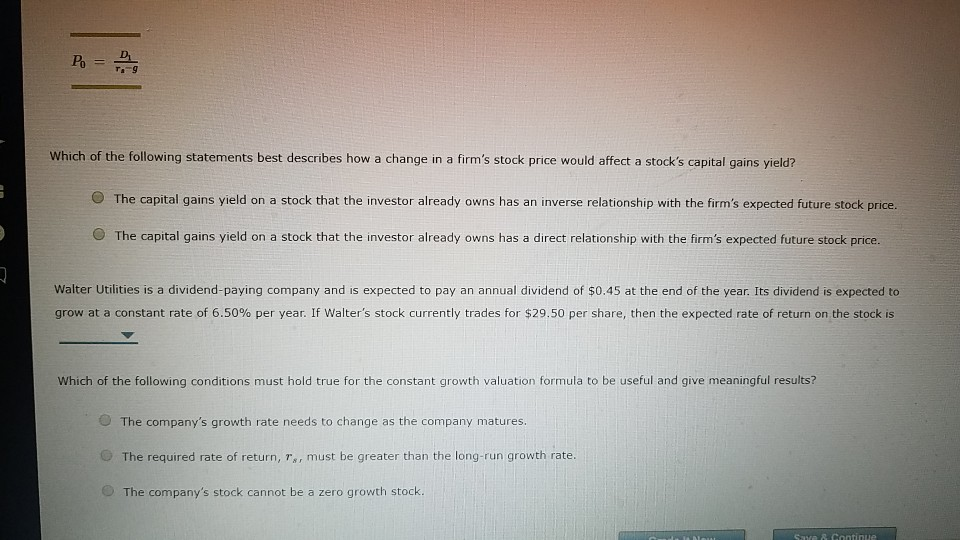

Preemptive Statement Income Growth Stocks Stocks Proxy The return on this type of stock primarily comes from capital gains. Mature firms that have stable earnings and little growth opportunity tend to pay large, relatively consistent dividends each year. Consequently, they tend to be classified as this type of stock. O This protects common stockholders against the dilution of value that would occur if new shares were sold at a relatively low value. It is common for management of large firms to solicit shareholders to transfer their voting rights to them using this instrument. Equity, or common stock, trades on stock markets all around the world. Because of globalization, the lines between equity markets are being blurred. In many cases, multinational firms sell equity in foreign equity markets. In other words, they sell stock on exchanges outside of their home country. Portman Industries is a Brazilian multinational company whose stock trades on the New York Stock Exchange. The statement above is an example of which of the following? A Yankee stock O A Euro stock An American Depository Receipt (ADR) True or False: To segment the rights to which certain common shareholders are entitled, companies often separate common equity into more than one class of shares called classified stock. False True Consider the following case: Mario Hathaway is a majority shareholder of Wizard Inc. He owns Class A shares, with larger-than-proportionate voting rights, of Wizard Inc. Based on this example, which of the following statements is true? Classified shares are issued to provide super-voting rights to a certain class of investors. Classified shares are not issued with the purpose of providing super-voting rights to a certain class of investors. Po = Which of the following statements best describes how a change in a firm's stock price would affect a stock's capital gains yield? The capital gains yield on a stock that the investor already owns has an inverse relationship with the firm's expected future stock price. The capital gains yield on a stock that the investor already owns has a direct relationship with the firm's expected future stock price. Walter Utilities is a dividend paying company and is expected to pay an annual dividend of $0.45 at the end of the year. Its dividend is expected to grow at a constant rate of 6.50% per year. If Walter's stock currently trades for $29.50 per share, then the expected rate of return on the stock is Which of the following conditions must hold true for the constant growth valuation formula to be useful and give meaningful results? The company's growth rate needs to change as the company matures. The required rate of return, Tx, must be greater than the long-run growth rate. The company's stock cannot be a zero growth stock. SB Continue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started