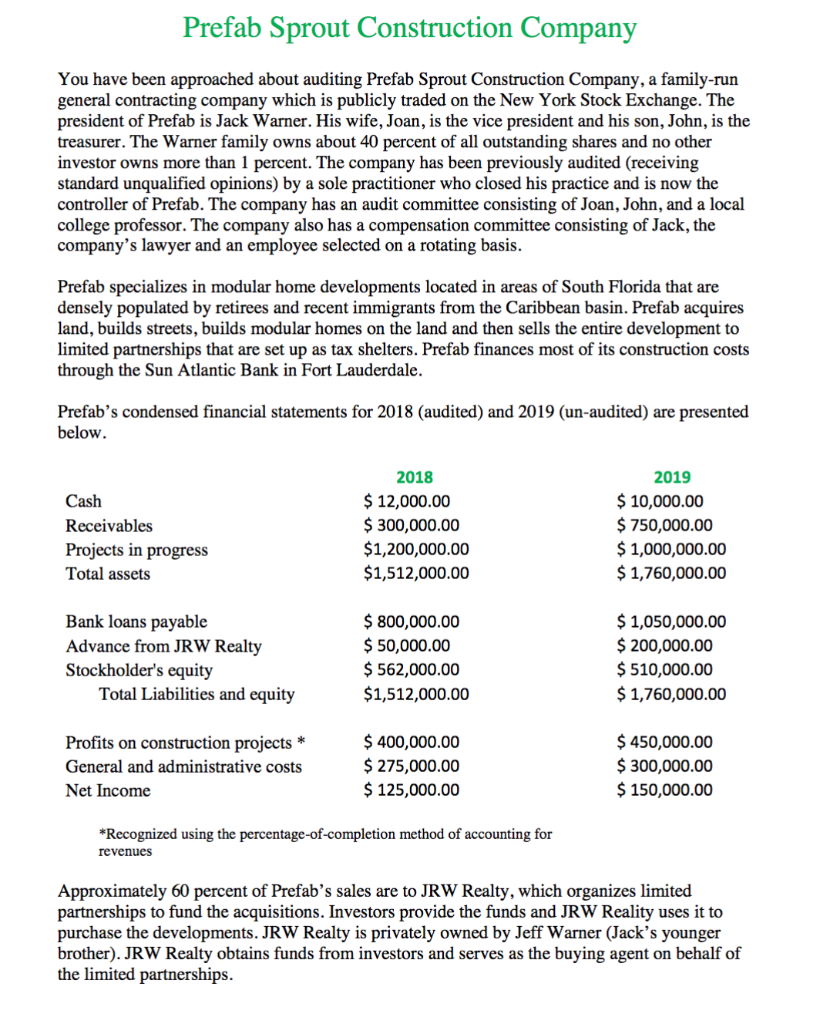

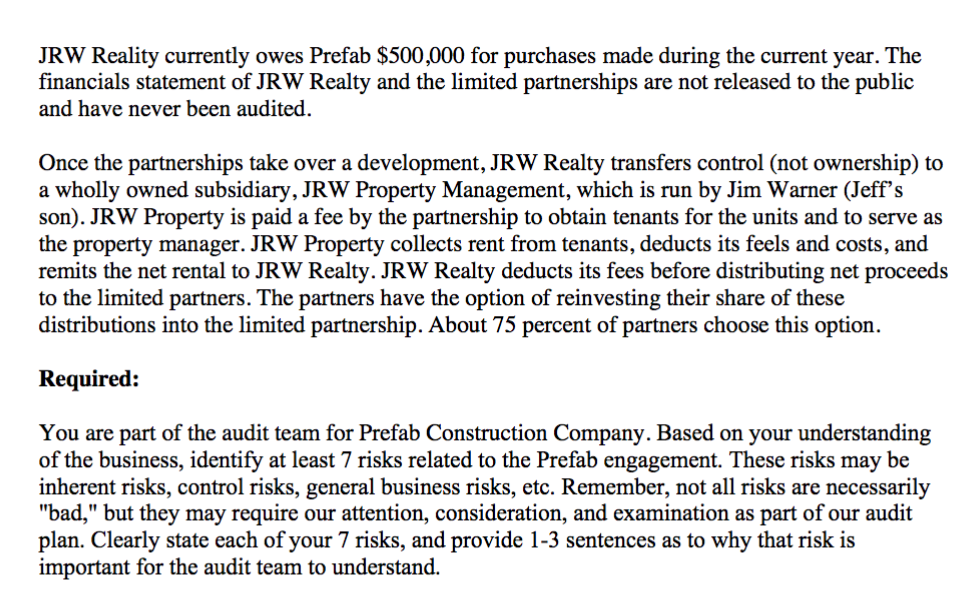

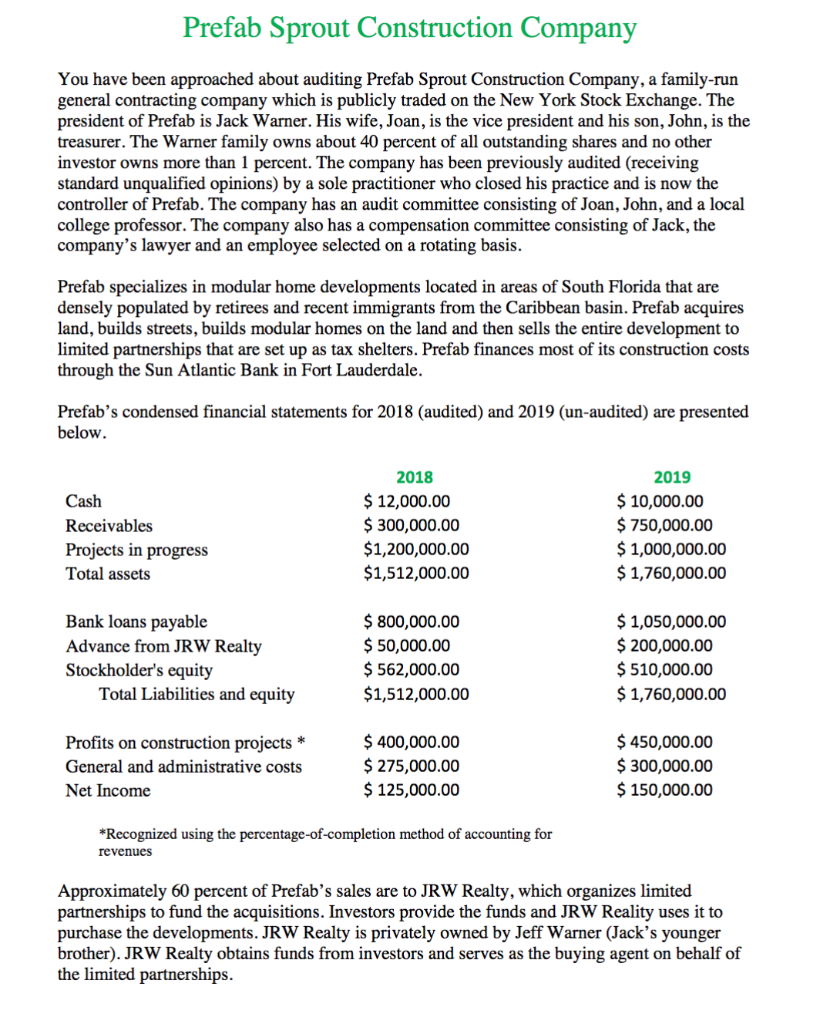

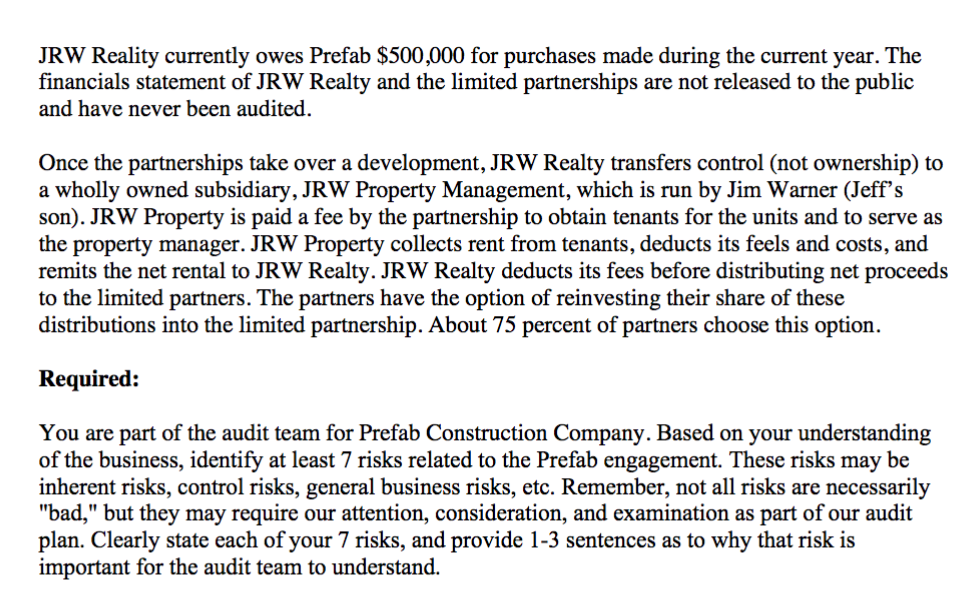

Prefab Sprout Construction Company You have been approached about auditing Prefab Sprout Construction Company, a family-run general contracting company which is publicly traded on the New York Stock Exchange. The president of Prefab is Jack Warner. His wife, Joan, is the vice president and his son, John, is the treasurer. The Warner family owns about 40 percent of all outstanding shares and no other investor owns more than 1 percent. The company has been previously audited (receiving standard unqualified opinions) by a sole practitioner who closed his practice and is now the controller of Prefab. The company has an audit committee consisting of Joan, John, and a local college professor. The company also has a compensation committee consisting of Jack, the company's lawyer and an employee selected on a rotating basis. Prefab specializes in modular home developments located in areas of South Florida that are densely populated by retirees and recent immigrants from the Caribbean basin. Prefab acquires land, builds streets, builds modular homes on the land and then sells the entire development to limited partnerships that are set up as tax shelters. Prefab finances most of its construction costs through the Sun Atlantic Bank in Fort Lauderdale. Prefab's condensed financial statements for 2018 (audited) and 2019 (un-audited) are presented below. Cash Receivables Projects in progress Total assets 2018 $ 12,000.00 $ 300,000.00 $1,200,000.00 $1,512,000.00 2019 $ 10,000.00 $ 750,000.00 $ 1,000,000.00 $ 1,760,000.00 Bank loans payable Advance from JRW Realty Stockholder's equity Total Liabilities and equity $ 800,000.00 $ 50,000.00 $ 562,000.00 $1,512,000.00 $ 1,050,000.00 $ 200,000.00 $ 510,000.00 $ 1,760,000.00 Profits on construction projects * General and administrative costs Net Income $ 400,000.00 $ 275,000.00 $ 125,000.00 $ 450,000.00 $ 300,000.00 $ 150,000.00 * Recognized using the percentage-of-completion method of accounting for revenues Approximately 60 percent of Prefab's sales are to JRW Realty, which organizes limited partnerships to fund the acquisitions. Investors provide the funds and JRW Reality uses it to purchase the developments. JRW Realty is privately owned by Jeff Warner (Jack's younger brother). JRW Realty obtains funds from investors and serves as the buying agent on behalf of the limited partnerships. JRW Reality currently owes Prefab $500,000 for purchases made during the current year. The financials statement of JRW Realty and the limited partnerships are not released to the public and have never been audited. Once the partnerships take over a development, JRW Realty transfers control (not ownership) to a wholly owned subsidiary, JRW Property Management, which is run by Jim Warner (Jeff's son). JRW Property is paid a fee by the partnership to obtain tenants for the units and to serve as the property manager. JRW Property collects rent from tenants, deducts its feels and costs, and remits the net rental to JRW Realty. JRW Realty deducts its fees before distributing net proceeds to the limited partners. The partners have the option of reinvesting their share of these distributions into the limited partnership. About 75 percent of partners choose this option. Required: You are part of the audit team for Prefab Construction Company. Based on your understanding of the business, identify at least 7 risks related to the Prefab engagement. These risks may be inherent risks, control risks, general business risks, etc. Remember, not all risks are necessarily "bad," but they may require our attention, consideration, and examination as part of our audit plan. Clearly state each of your 7 risks, and provide 1-3 sentences as to why that risk is important for the audit team to understand