Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Preferably in excel P3.17 Acquisition with Bargain Gain In 2016, Tesla, Inc. acquired all of the outstanding stock of SolarCity Corporation. Tesla issued 0.110 shares

Preferably in excel

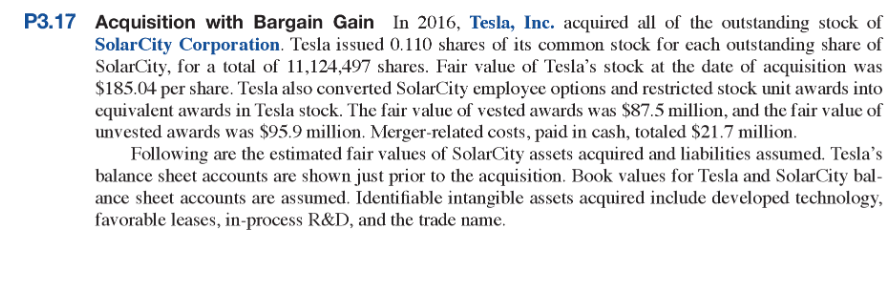

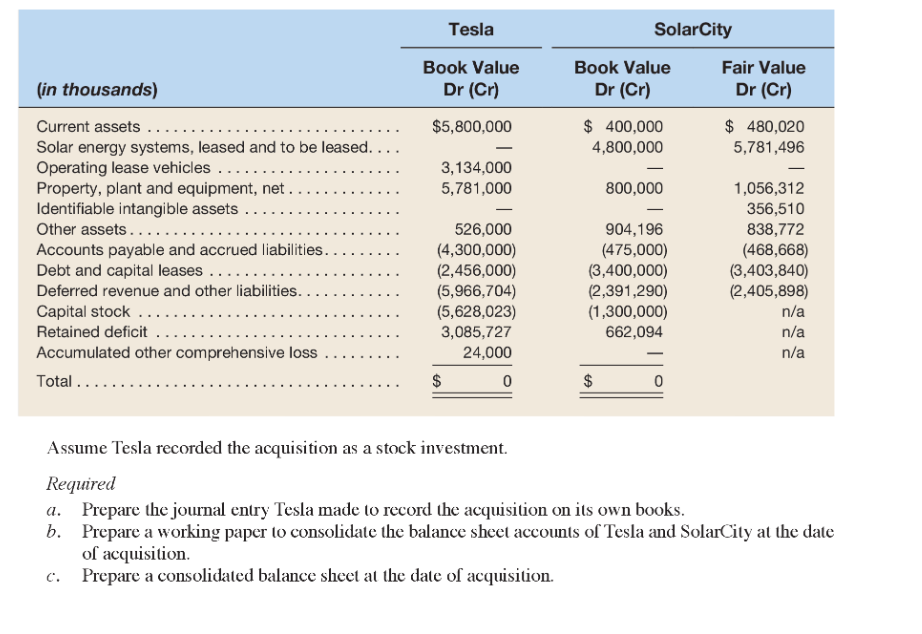

P3.17 Acquisition with Bargain Gain In 2016, Tesla, Inc. acquired all of the outstanding stock of SolarCity Corporation. Tesla issued 0.110 shares of its common stock for each outstanding share of SolarCity, for a total of 11,124,497 shares. Fair value of Tesla's stock at the date of acquisition was $185.04 per share. Tesla also converted SolarCity employee options and restricted stock unit awards into equivalent awards in Tesla stock. The fair value of vested awards was $87.5 million, and the fair value of unvested awards was $95.9 million. Merger-related costs, paid in cash, totaled $21.7 million. Following are the estimated fair values of SolarCity assets acquired and liabilities assumed. Tesla's balance sheet accounts are shown just prior to the acquisition. Book values for Tesla and SolarCity bal- ance sheet accounts are assumed. Identifiable intangible assets acquired include developed technology, favorable leases, in-process R&D, and the trade name. Tesla SolarCity Book Value Dr (Cr) Book Value Dr (Cr) (in thousands) Fair Value Dr (Cr) $5,800,000 $ 400,000 4,800,000 $ 480,020 5,781,496 3,134,000 5,781,000 800,000 Current assets Solar energy systems, leased and to be leased. Operating lease vehicles ......... Property, plant and equipment, net .. Identifiable intangible assets .......... Other assets. ... Accounts payable and accrued liabilities. Debt and capital leases .. Deferred revenue and other liabilities... Capital stock ..... Retained deficit Accumulated other comprehensive loss .... Total ........ 526,000 (4,300,000) (2,456,000) (5,966,704) (5,628,023) 3,085,727 24,000 0 904,196 (475,000) (3,400,000) (2,391,290) (1,300,000) 662,094 1,056,312 356,510 838,772 (468,668) (3,403,840) (2,405,898) n/a n/a n/a $ 0 Assume Tesla recorded the acquisition as a stock investment. Required a. Prepare the journal entry Tesla made to record the acquisition on its own books. b. Prepare a working paper to consolidate the balance sheet accounts of Tesla and SolarCity at the date of acquisition c. Prepare a consolidated balance sheet at the date of acquisition. P3.17 Acquisition with Bargain Gain In 2016, Tesla, Inc. acquired all of the outstanding stock of SolarCity Corporation. Tesla issued 0.110 shares of its common stock for each outstanding share of SolarCity, for a total of 11,124,497 shares. Fair value of Tesla's stock at the date of acquisition was $185.04 per share. Tesla also converted SolarCity employee options and restricted stock unit awards into equivalent awards in Tesla stock. The fair value of vested awards was $87.5 million, and the fair value of unvested awards was $95.9 million. Merger-related costs, paid in cash, totaled $21.7 million. Following are the estimated fair values of SolarCity assets acquired and liabilities assumed. Tesla's balance sheet accounts are shown just prior to the acquisition. Book values for Tesla and SolarCity bal- ance sheet accounts are assumed. Identifiable intangible assets acquired include developed technology, favorable leases, in-process R&D, and the trade name. Tesla SolarCity Book Value Dr (Cr) Book Value Dr (Cr) (in thousands) Fair Value Dr (Cr) $5,800,000 $ 400,000 4,800,000 $ 480,020 5,781,496 3,134,000 5,781,000 800,000 Current assets Solar energy systems, leased and to be leased. Operating lease vehicles ......... Property, plant and equipment, net .. Identifiable intangible assets .......... Other assets. ... Accounts payable and accrued liabilities. Debt and capital leases .. Deferred revenue and other liabilities... Capital stock ..... Retained deficit Accumulated other comprehensive loss .... Total ........ 526,000 (4,300,000) (2,456,000) (5,966,704) (5,628,023) 3,085,727 24,000 0 904,196 (475,000) (3,400,000) (2,391,290) (1,300,000) 662,094 1,056,312 356,510 838,772 (468,668) (3,403,840) (2,405,898) n/a n/a n/a $ 0 Assume Tesla recorded the acquisition as a stock investment. Required a. Prepare the journal entry Tesla made to record the acquisition on its own books. b. Prepare a working paper to consolidate the balance sheet accounts of Tesla and SolarCity at the date of acquisition c. Prepare a consolidated balance sheet at the date of acquisitionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started