Question

Premier plans to purchase land for $25,000 cash in June. The company also declares dividends of $12,000 per quarter. The dividend is declared in the

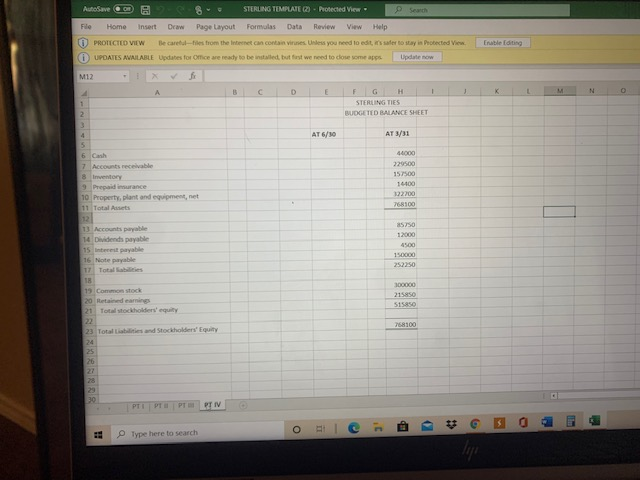

Premier plans to purchase land for $25,000 cash in June. The company also declares dividends of $12,000 per quarter. The dividend is declared in the last month of the quarter and paid in the first month of the following quarter. At the end of each quarter, Premier makes a tax payment equal to 20% of budgeted income before tax. For purposes of this project, you may assume that the payment is debited to income tax expense. At the beginning of the year, Premier borrowed $150,000 on a five-year 12% note payable with interest to be paid annually at December 31. The divisions balance sheet at March 31 is as follows: STERLING TIES BALANCE SHEET At March 31 ASSETS Cash $ 44,000 Accounts receivable 229,500 Inventory 157,500 Prepaid insurance 14,400 Property, plant and equipment, net 322,700 Total Assets $768,100 LIABILITIES AND STOCKHOLDERS EQUITY Accounts payable $ 85,750 Dividends payable 12,000 Interest payable 4,500 Note payable 150,000 Common stock, no par 300,000 Retained earnings 215,850 Total Liabilities and Stockholders Equity $768,100 REQUIREMENTS

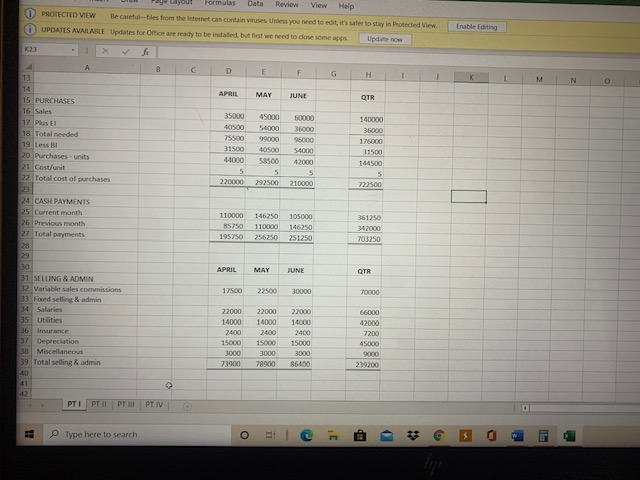

PART 2 1) Prepare a budgeted income statement for the quarter only using the contribution format. List each cost separately. 2) At the bottom of your worksheet, answer the questions below. Use operating income (income before interest and taxes) in your calculations. Round your answers to the nearest whole unit, dollar or one percent as necessary. Be sure to label your answers. a. What is the division contribution margin ratio? b. What is the quarterly budgeted break-even point in units? c. What is the margin of safety in units for the quarter? d. What is operating leverage for the quarter? e. If the division wants to earn income before interest and taxes of $350,000 for the quarter, how many units must it sell?

PART 2 1) Prepare a budgeted income statement for the quarter only using the contribution format. List each cost separately. 2) At the bottom of your worksheet, answer the questions below. Use operating income (income before interest and taxes) in your calculations. Round your answers to the nearest whole unit, dollar or one percent as necessary. Be sure to label your answers. a. What is the division contribution margin ratio? b. What is the quarterly budgeted break-even point in units? c. What is the margin of safety in units for the quarter? d. What is operating leverage for the quarter? e. If the division wants to earn income before interest and taxes of $350,000 for the quarter, how many units must it sell?

PART 3 Prepare a cash budget by month and for the quarter, listing each category of payment separately. (HINT: Ending cash balance at April 30 should be $24,125.)

PART 4 1) The balance sheet information provided in the project data has been entered on a spreadsheet in your workbook. Prepare a comparative budgeted balance sheet at June 30 next to the first quarter balance sheet. If you cannot get your second quarter balance sheet to balance, enter the amount necessary to get it to balance as a separate line item and label this amount plug. 2) At the bottom of your worksheet, answer the questions below. Round your answers to the nearest whole unit, dollar or one percent as necessary. a. What is the budgeted ROI for the quarter? b. If Menswear, International has established a minimum required rate of return of 18% for all divisions, what is budgeted residual income for the quarter? c. If the division vice president has set a target ROI of 25% for the division, how many units will the company have to sell for the quarter?

AutoSave GO STERLING TEMPLATEQ - Protected View - File Home Insert Draw Page Layout Formulas Data Review View Help (1) PROTECTED VIEW Be care-iles from the Internet can contain Viruses. Unless you need to edit safe to stay in Protected View UPDATES AVAILABLE Updates for Once are ready to be installed, but first we need to close some apps Update now Enable ting M12 A B D E K N F G STERLING TIES BUDGETED BALANCE SHEET 1 2 3 4. AT 6/10 AT 5/31 4400 5 16 Canh 17 Accounts receivable 8 Inventory 9 Prepaid murance 10 Property, plant and equipment, net 11 Total Assets 229500 157500 14100 122700 768100 14 Dividends payable 15 Interest payable 16 Note payabile 2570 12000 4500 10000 252250 100000 2118 515850 18 19 Common stock 20 Retained earnings 21 Total stockholders' equity 22 23 Totalities and Stockholders' Equity 24 268100 26 227 28 PT PT PT RT IV ** O Type here to search Formulas Data Review View Help D PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit it's safe to stay in Protected View UPDATES AVAILABLE Updates for Office are ready to be installed, but first we need to close some apps Update Enable Editing 3 C. D E G H 1 M N APRIL MAY JUNE QTR 50000 36000 13 14 15 PURCHASES 16 Sales 17 Plus El 18 Total needed 19 Less BI 20 Purchases units 21 Cost/unit 22 Total cost of purchases 23 24 CASH PAYMENTS 25 Current month 26 Previous month 27 Total payments 28 35000 40500 75500 31500 44000 5 220000 45000 54000 99000 40500 58500 5 292500 54000 42000 s 210000 140000 36000 176000 31500 144500 5 722500 110000 15750 195750 146250 110000 256250 105000 146250 251250 361250 342000 703250 30 APRIL MAY JUNE GTR 31 SELLING & ADMIN 32 Variable sales commissions 33 Fixed selling & admin 17500 22500 30000 20000 35 Utilities 36 Insurance 37 Depreciation 38 Miscellaneous 39 Total selling & admin 22000 14000 2400 15000 3000 73900 22000 16000 2400 15000 3000 78900 22000 14000 2400 15000 3000 86400 66000 42000 7200 45000 9000 239200 41 PTI PTI PT III PT IV Type here to search - G O > E AutoSave GO STERLING TEMPLATEQ - Protected View - File Home Insert Draw Page Layout Formulas Data Review View Help (1) PROTECTED VIEW Be care-iles from the Internet can contain Viruses. Unless you need to edit safe to stay in Protected View UPDATES AVAILABLE Updates for Once are ready to be installed, but first we need to close some apps Update now Enable ting M12 A B D E K N F G STERLING TIES BUDGETED BALANCE SHEET 1 2 3 4. AT 6/10 AT 5/31 4400 5 16 Canh 17 Accounts receivable 8 Inventory 9 Prepaid murance 10 Property, plant and equipment, net 11 Total Assets 229500 157500 14100 122700 768100 14 Dividends payable 15 Interest payable 16 Note payabile 2570 12000 4500 10000 252250 100000 2118 515850 18 19 Common stock 20 Retained earnings 21 Total stockholders' equity 22 23 Totalities and Stockholders' Equity 24 268100 26 227 28 PT PT PT RT IV ** O Type here to search Formulas Data Review View Help D PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit it's safe to stay in Protected View UPDATES AVAILABLE Updates for Office are ready to be installed, but first we need to close some apps Update Enable Editing 3 C. D E G H 1 M N APRIL MAY JUNE QTR 50000 36000 13 14 15 PURCHASES 16 Sales 17 Plus El 18 Total needed 19 Less BI 20 Purchases units 21 Cost/unit 22 Total cost of purchases 23 24 CASH PAYMENTS 25 Current month 26 Previous month 27 Total payments 28 35000 40500 75500 31500 44000 5 220000 45000 54000 99000 40500 58500 5 292500 54000 42000 s 210000 140000 36000 176000 31500 144500 5 722500 110000 15750 195750 146250 110000 256250 105000 146250 251250 361250 342000 703250 30 APRIL MAY JUNE GTR 31 SELLING & ADMIN 32 Variable sales commissions 33 Fixed selling & admin 17500 22500 30000 20000 35 Utilities 36 Insurance 37 Depreciation 38 Miscellaneous 39 Total selling & admin 22000 14000 2400 15000 3000 73900 22000 16000 2400 15000 3000 78900 22000 14000 2400 15000 3000 86400 66000 42000 7200 45000 9000 239200 41 PTI PTI PT III PT IV Type here to search - G O > EStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started