Answered step by step

Verified Expert Solution

Question

1 Approved Answer

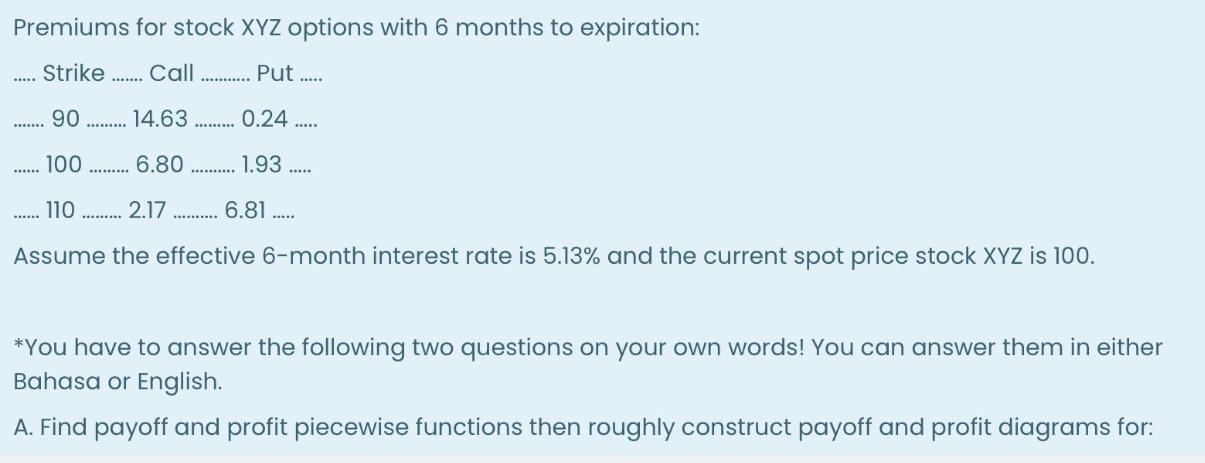

Premiums ***** Strike Call ............. Put ..... 90......... 14.63 0.24.... 100 6.80 1.93 ..... ******* for stock XYZ options with 6 months to expiration:

Premiums ***** Strike Call ............. Put ..... 90......... 14.63 0.24.... 100 6.80 1.93 ..... ******* for stock XYZ options with 6 months to expiration: 2.17.......... Assume the effective 6-month interest rate is 5.13% and the current spot price stock XYZ is 100. ................ 6.81..... *You have to answer the following two questions on your own words! You can answer them in either Bahasa or English. A. Find payoff and profit piecewise functions then roughly construct payoff and profit diagrams for: Sale of both 100-strike call and 100-strike put options and at the same time purchase of a 90-strike put and purchase of a 110-strike call. Show your work! B. What is the purpose of implementing this portfolio? Justify your answer! You need to submit your OWN work as an attachment.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A Payoff and Profit Diagrams for Combined Options Strategy Payoff Function If S 90 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started