Question

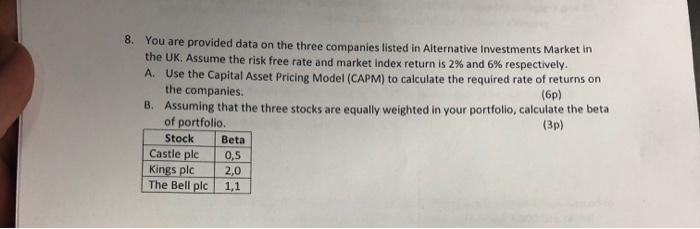

8. You are provided data on the three companies listed in Alternative Investments Market in the UK. Assume the risk free rate and market

8. You are provided data on the three companies listed in Alternative Investments Market in the UK. Assume the risk free rate and market index return is 2% and 6% respectively. A. Use the Capital Asset Pricing Model (CAPM) to calculate the required rate of returns on the companies. (6p) B. Assuming that the three stocks are equally weighted in your portfolio, calculate the beta of portfolio. (3p) Stock Beta Castle plc 0,5 Kings plc 2,0 The Bell plc 1,1

Step by Step Solution

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer A To calculate the required rate of return using the Capital Asset Pricing Model CAPM we can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations Of Finance

Authors: Arthur J. Keown, John D. Martin, J. William Petty

9th Global Edition

1292155132, 9781292155135

Students also viewed these Banking questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App