Answered step by step

Verified Expert Solution

Question

1 Approved Answer

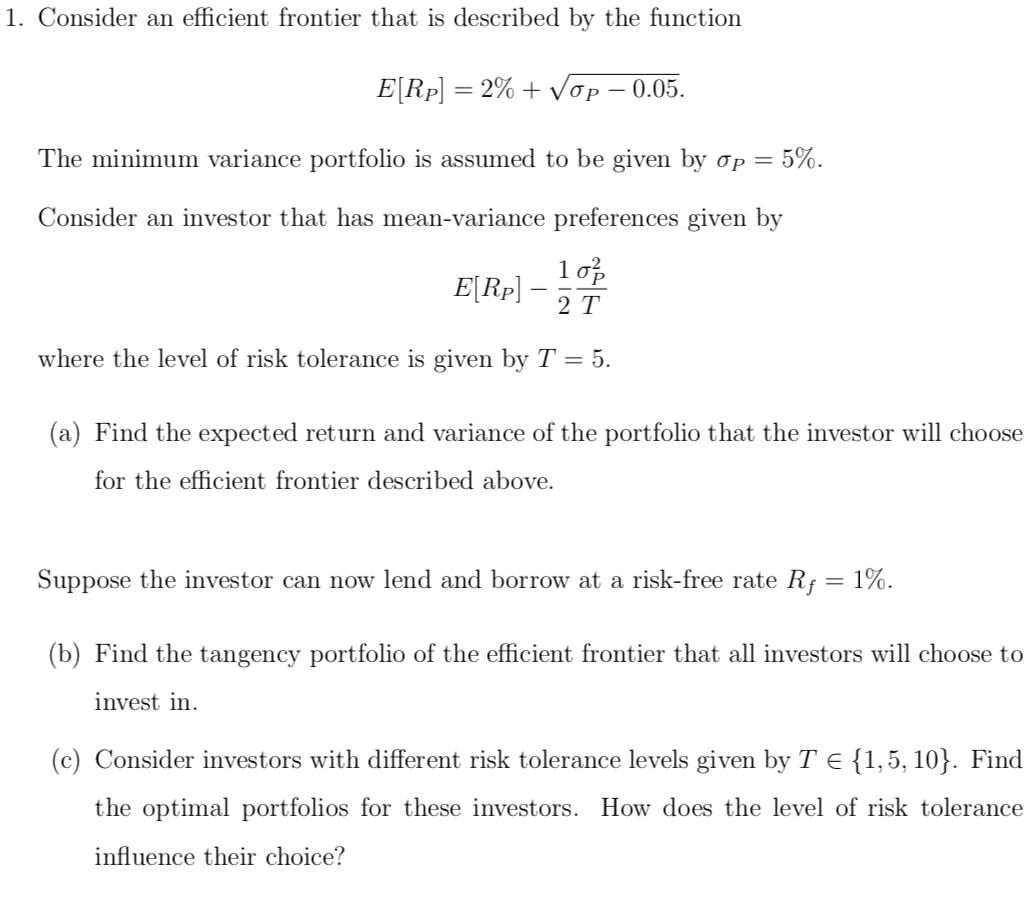

1. Consider an efficient frontier that is described by the function E[RP] = 2% +op -0.05. The minimum variance portfolio is assumed to be

1. Consider an efficient frontier that is described by the function E[RP] = 2% +op -0.05. The minimum variance portfolio is assumed to be given by p = 5%. Consider an investor that has mean-variance preferences given by 10% E[RP] 2 T where the level of risk tolerance is given by T = 5. (a) Find the expected return and variance of the portfolio that the investor will choose for the efficient frontier described above. = Suppose the investor can now lend and borrow at a risk-free rate R = 1%. (b) Find the tangency portfolio of the efficient frontier that all investors will choose to invest in. (c) Consider investors with different risk tolerance levels given by T = {1,5, 10}. Find the optimal portfolios for these investors. How does the level of risk tolerance influence their choice?

Step by Step Solution

★★★★★

3.36 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Answer Based on the information provided in the image the following are the answers to the questi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started