Answered step by step

Verified Expert Solution

Question

1 Approved Answer

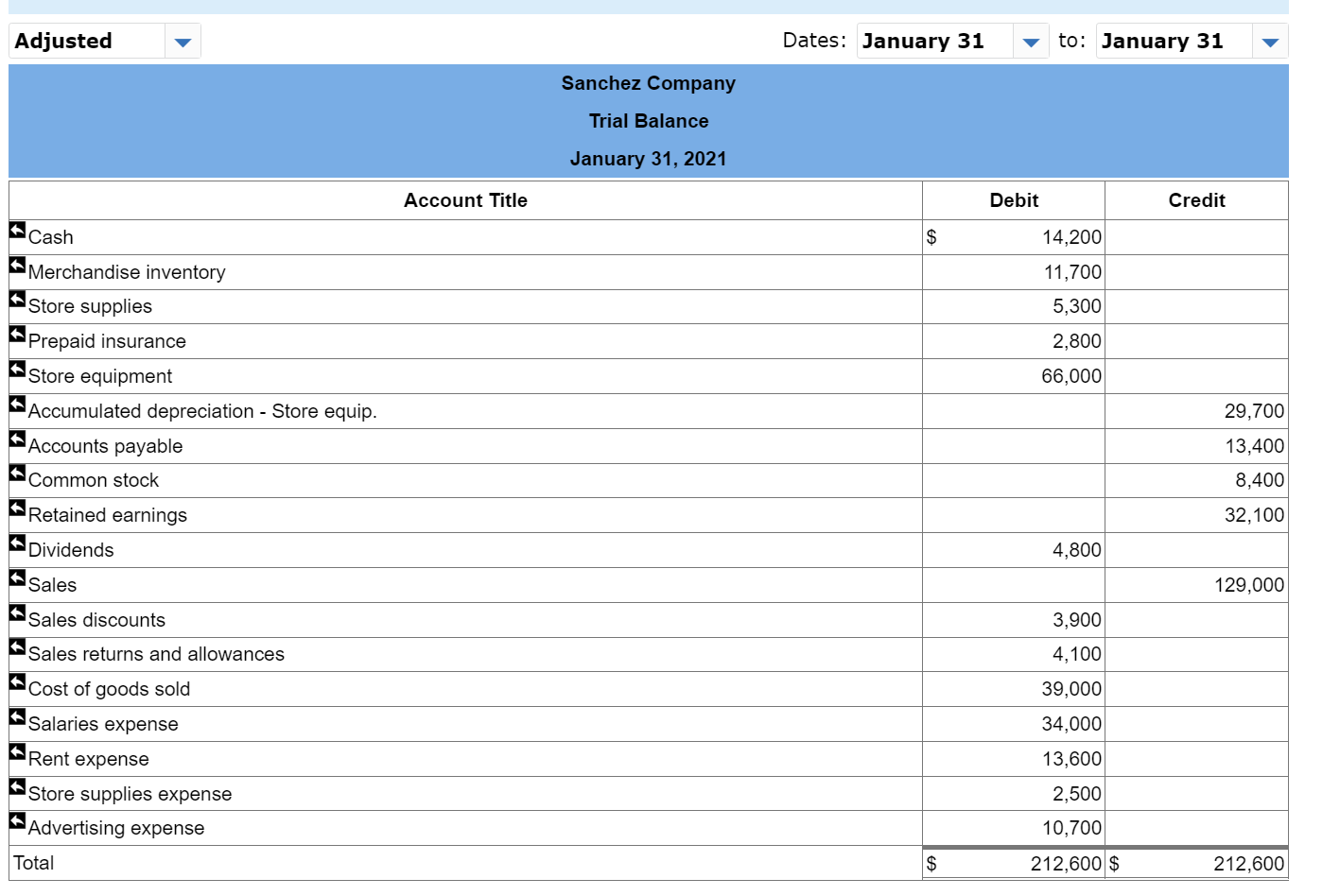

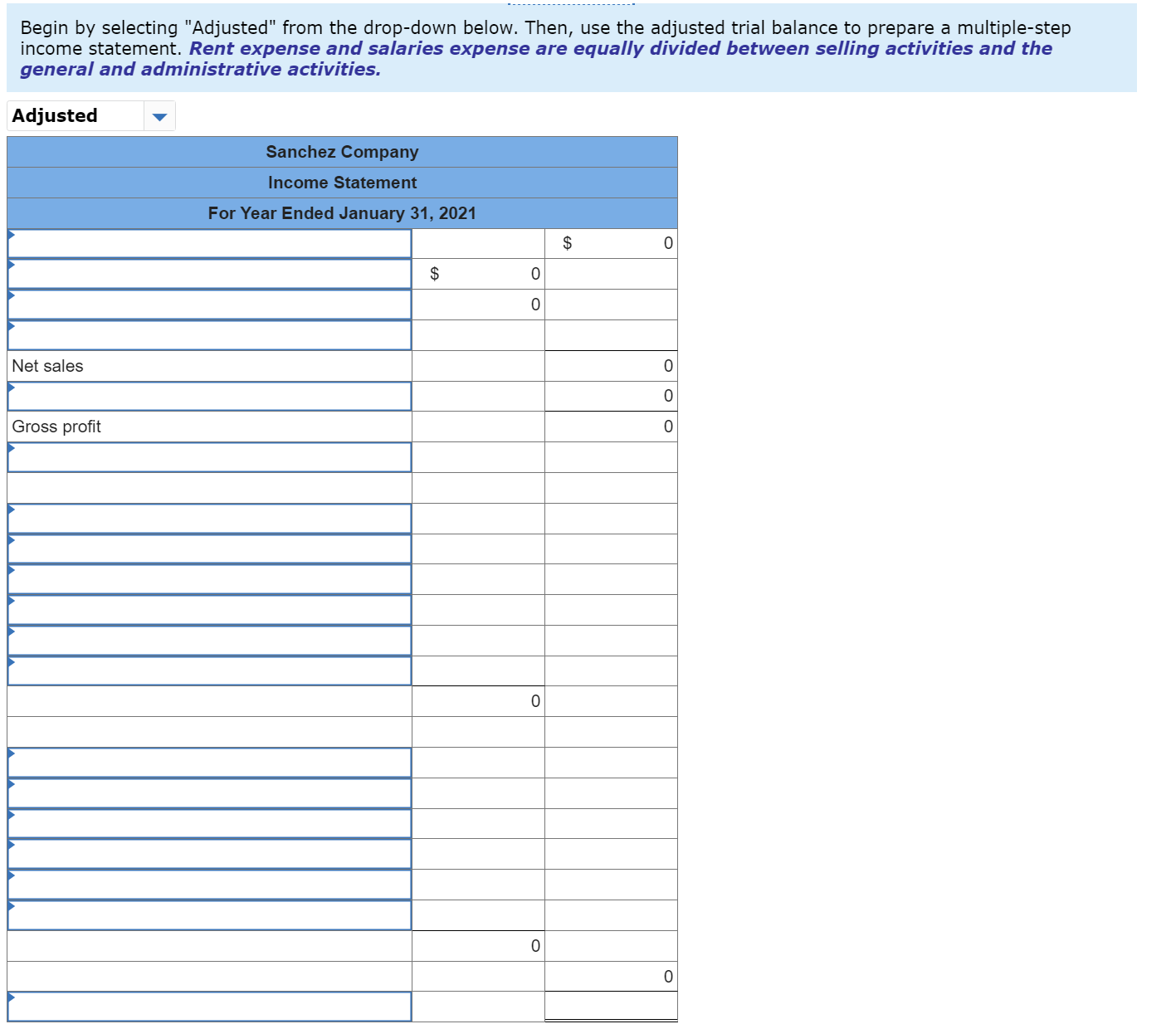

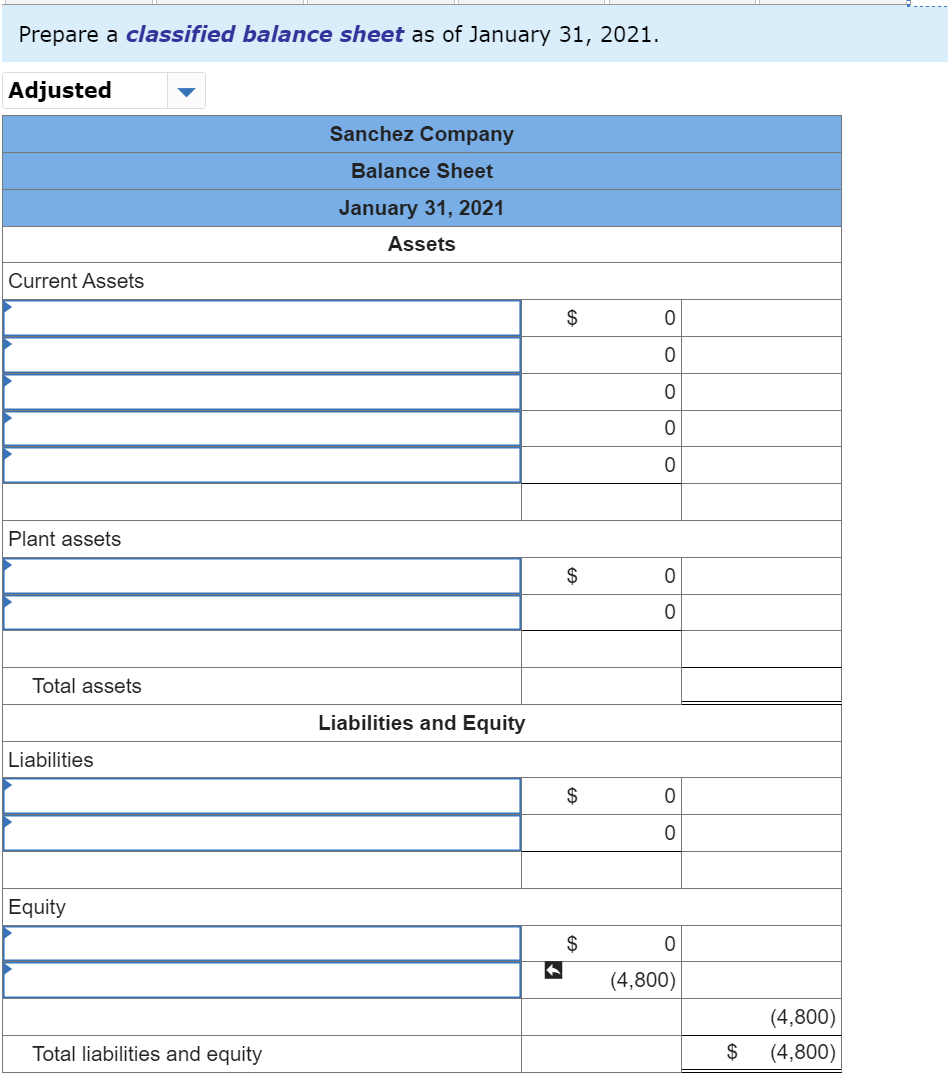

Prenare a classified balance sheet as of lanuarv 31.20>1. Begin by selecting Adjusted from the drop-down below. Then, use the adjusted trial balance to prepare

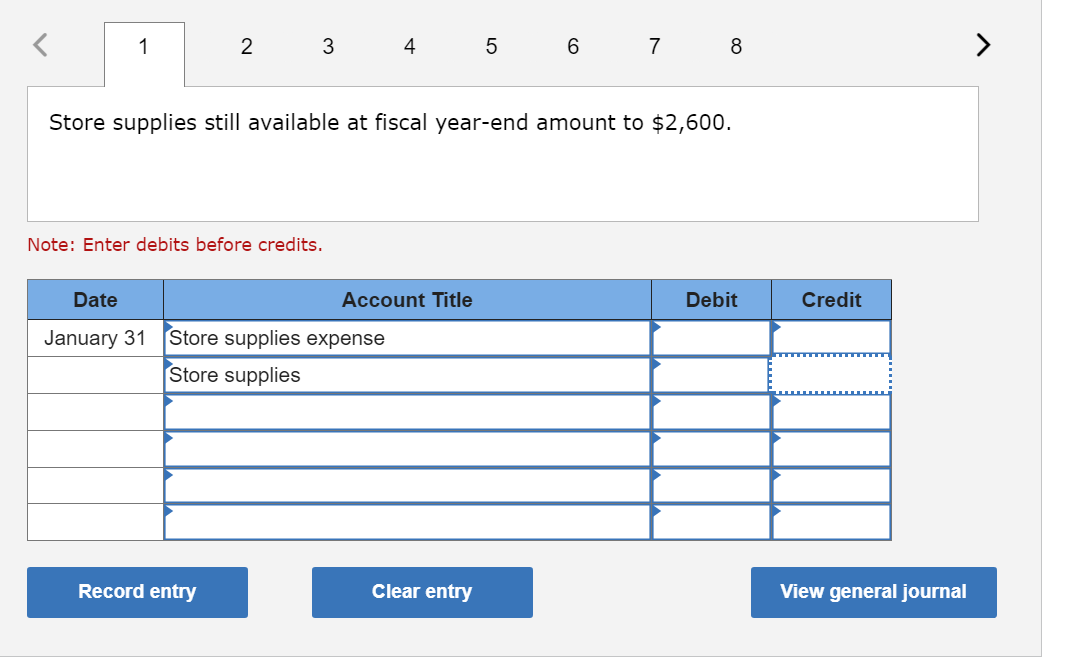

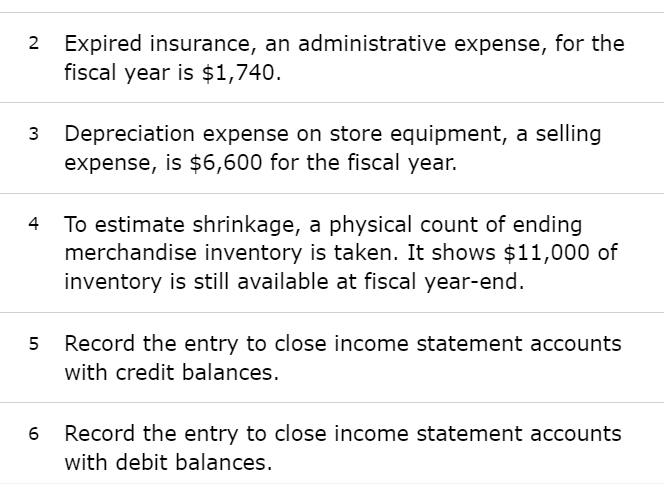

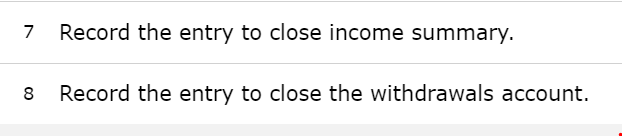

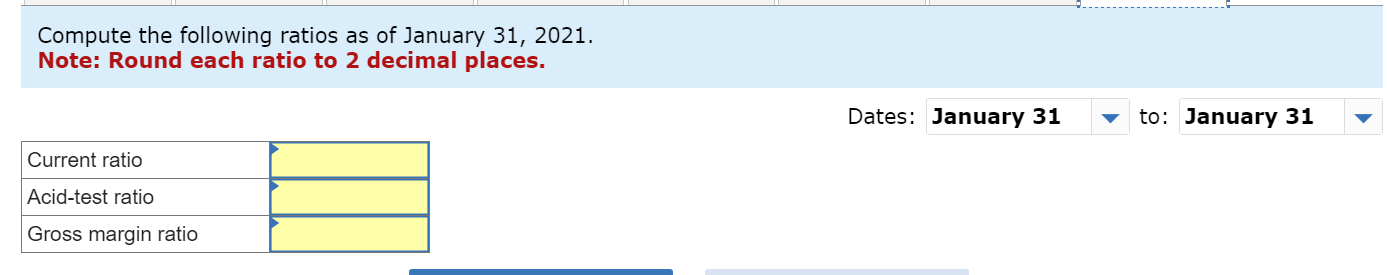

Prenare a classified balance sheet as of lanuarv 31.20>1. Begin by selecting "Adjusted" from the drop-down below. Then, use the adjusted trial balance to prepare a multiple-step income statement. Rent expense and salaries expense are equally divided between selling activities and the general and administrative activities. 2 Expired insurance, an administrative expense, for the fiscal year is $1,740. 3 Depreciation expense on store equipment, a selling expense, is $6,600 for the fiscal year. 4 To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $11,000 of inventory is still available at fiscal year-end. 5 Record the entry to close income statement accounts with credit balances. 6 Record the entry to close income statement accounts with debit balances. 7 Record the entry to close income summary. 8 Record the entry to close the withdrawals account. Store supplies still available at fiscal year-end amount to $2,600. Note: Enter debits before credits. Compute the following ratios as of January 31, 2021. Note: Round each ratio to 2 decimal places

Prenare a classified balance sheet as of lanuarv 31.20>1. Begin by selecting "Adjusted" from the drop-down below. Then, use the adjusted trial balance to prepare a multiple-step income statement. Rent expense and salaries expense are equally divided between selling activities and the general and administrative activities. 2 Expired insurance, an administrative expense, for the fiscal year is $1,740. 3 Depreciation expense on store equipment, a selling expense, is $6,600 for the fiscal year. 4 To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $11,000 of inventory is still available at fiscal year-end. 5 Record the entry to close income statement accounts with credit balances. 6 Record the entry to close income statement accounts with debit balances. 7 Record the entry to close income summary. 8 Record the entry to close the withdrawals account. Store supplies still available at fiscal year-end amount to $2,600. Note: Enter debits before credits. Compute the following ratios as of January 31, 2021. Note: Round each ratio to 2 decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started