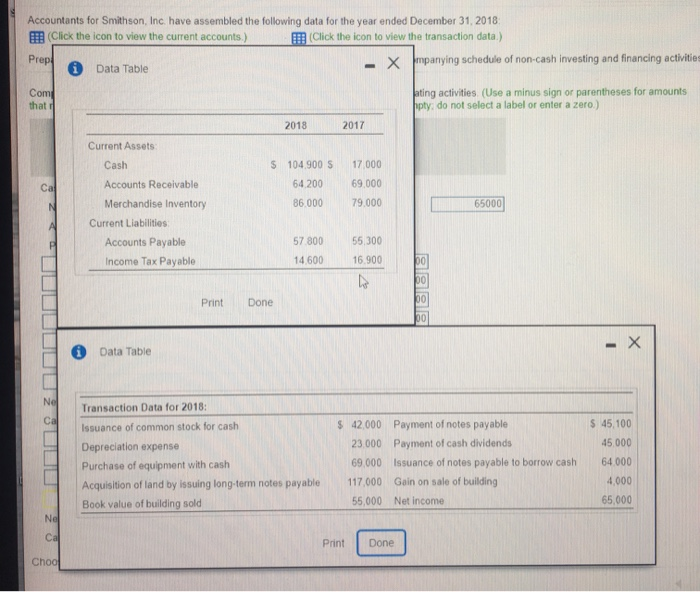

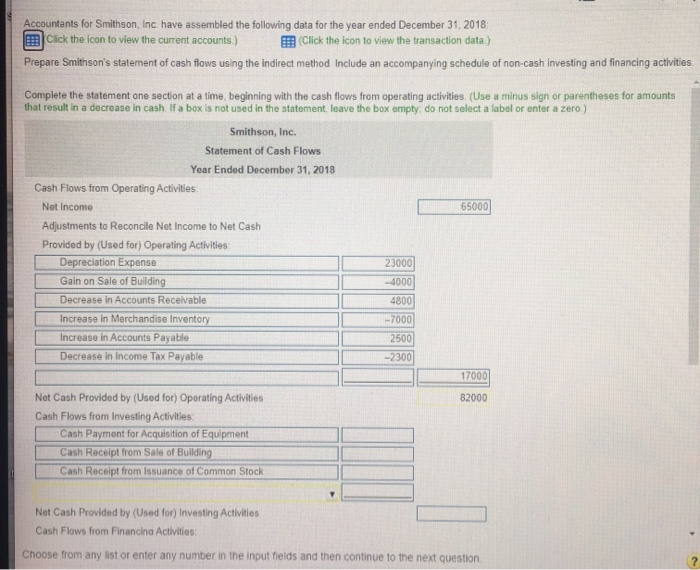

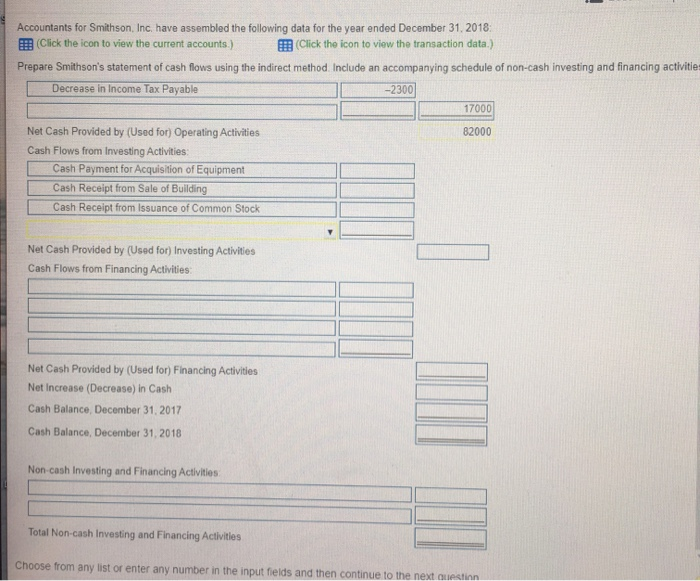

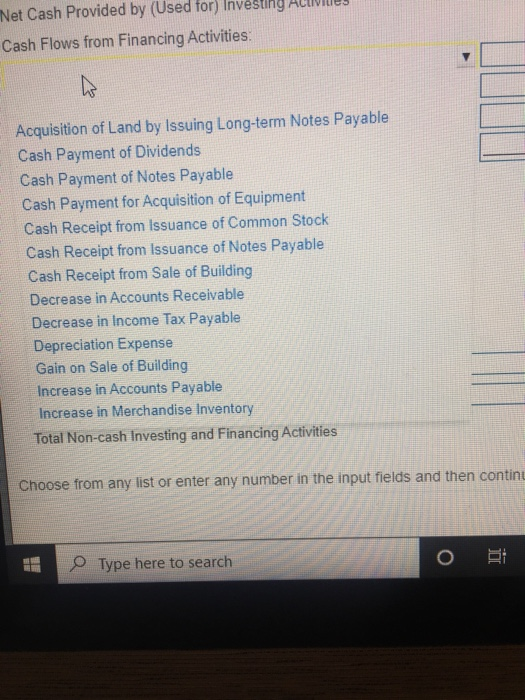

Prep - Com Accountants for Smithson, Inc. have assembled the following data for the year ended December 31, 2018 (Click the icon to view the current accounts.) Click the icon to view the transaction data.) Data Table - xmpanying schedule of non-cash investing and financing activities ating activities (Use a minus sign or parentheses for amounts that fpty do not select a label or enter a zero) 2018 2017 Current Assets Cash $ 104.900 S 17.000 Call Accounts Receivable 64200 69 000 N Merchandise Inventory 86.000 79.000 65000 Current Liabilities Accounts Payable 57 800 55,300 Income Tax Payable 14 600 16.900 po AL 00 Print Done 00 - X Data Table Ne Ca $ 45,100 45 000 Transaction Data for 2018: Issuance of common stock for cash Depreciation expense Purchase of equipment with cash Acquisition of land by issuing long-term notes payable Book value of building sold $ 42,000 Payment of notes payable 23.000 Payment of cash dividends 69.000 Issuance of notes payable to borrow cash 117.000 Gain on sale of building 55,000 Net income 64 000 4.000 65,000 Ne Cal Print Done Choo Accountants for Smithson, Inc have assembled the following data for the year ended December 31, 2018 Click the icon to view the current accounts.) Click the icon to view the transaction data.) Prepare Smithson's statement of cash flows using the Indirect method Include an accompanying schedule of non-cash investing and financing activities Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use a minus sign or parentheses for amounts that result in a decrease in cash. If a box is not used in the statement, leave the box empty do not select a label or enter a zero.) Smithson, Inc. Statement of Cash Flows Year Ended December 31, 2018 Cash Flows from Operating Activities Net Income 65000 Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities Depreciation Expense 23000 Gain on Sale of Building -4000 Decrease in Accounts Receivable 4800 Increase in Merchandise Inventory -7000 Increase in Accounts Payable 2500 Decrease in Income Tax Payable -2300 17000 Net Cash Provided by (Used for) Operating Activities 82000 Cash Flows from Investing Activities Cash Payment for Acquisition of Equipment Cash Receipt from Sale of Building Cash Receipt from Issuance of Common Stock Net Cash Provided by (Used for) Investing Activities Cash Flows from Financina Activities: Choose from any list or enter any number in the input fields and then continue to the next question Accountants for Smithson, Inc. have assembled the following data for the year ended December 31, 2018 Click the icon to view the current accounts.) (Click the icon to view the transaction data.) Prepare Smithson's statement of cash flows using the indirect method Include an accompanying schedule of non-cash investing and financing activitie: Decrease in Income Tax Payable --2300 17000 82000 Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Cash Payment for Acquisition of Equipment Cash Receipt from Sale of Building Cash Receipt from Issuance of Common Stock Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 2017 Cash Balance, December 31, 2018 Non-cash Investing and Financing Activities Total Non-cash Investing and Financing Activities Choose from any list or enter any number in the input fields and then continue to the next question Net Cash Provided by (Used for) Investing Cash Flows from Financing Activities: w Acquisition of Land by Issuing Long-term Notes Payable Cash Payment of Dividends Cash Payment of Notes Payable Cash Payment for Acquisition of Equipment Cash Receipt from Issuance of Common Stock Cash Receipt from Issuance of Notes Payable Cash Receipt from Sale of Building Decrease in Accounts Receivable Decrease in Income Tax Payable Depreciation Expense Gain on Sale of Building Increase in Accounts Payable Increase in Merchandise Inventory Total Non-cash Investing and Financing Activities Choose from any list or enter any number in the input fields and then continu Type here to search o gi