Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepaid expenses (supplies) of NZ$18,000 were on hand when Phi acquired Stu. Other operating expenses include NZ$8,000 of these supplies that were used in

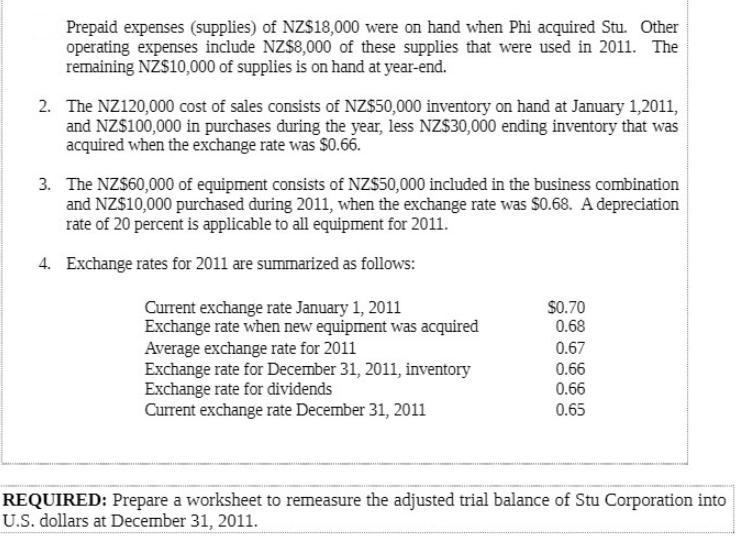

Prepaid expenses (supplies) of NZ$18,000 were on hand when Phi acquired Stu. Other operating expenses include NZ$8,000 of these supplies that were used in 2011. The remaining NZ$10,000 of supplies is on hand at year-end. 2. The NZ120,000 cost of sales consists of NZ$50,000 inventory on hand at January 1,2011, and NZ$100,000 in purchases during the year, less NZ$30,000 ending inventory that was acquired when the exchange rate was $0.66. 3. The NZ$60,000 of equipment consists of NZ$50,000 included in the business combination and NZ$10,000 purchased during 2011, when the exchange rate was $0.68. A depreciation rate of 20 percent is applicable to all equipment for 2011. 4. Exchange rates for 2011 are summarized as follows: Current exchange rate January 1, 2011 Exchange rate when new equipment was acquired Average exchange rate for 2011 Exchange rate for December 31, 2011, inventory Exchange rate for dividends Current exchange rate December 31, 2011 $0.70 0.68 0.67 0.66 0.66 0.65 REQUIRED: Prepare a worksheet to remeasure the adjusted trial balance of Stu Corporation into U.S. dollars at December 31, 2011.

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Worksheet for Remeasuring Stu Corporations Adjusted Trial Balance into US Dollars December 31 2011 N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started