Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PREPARATION OF 10 COLUMN WORKSHEET Activity title : Preparation of the worksheet Learning Target: Prepare a 10 - column worksheet Reference title : Accounting Principles

PREPARATION OF 10 COLUMN WORKSHEET

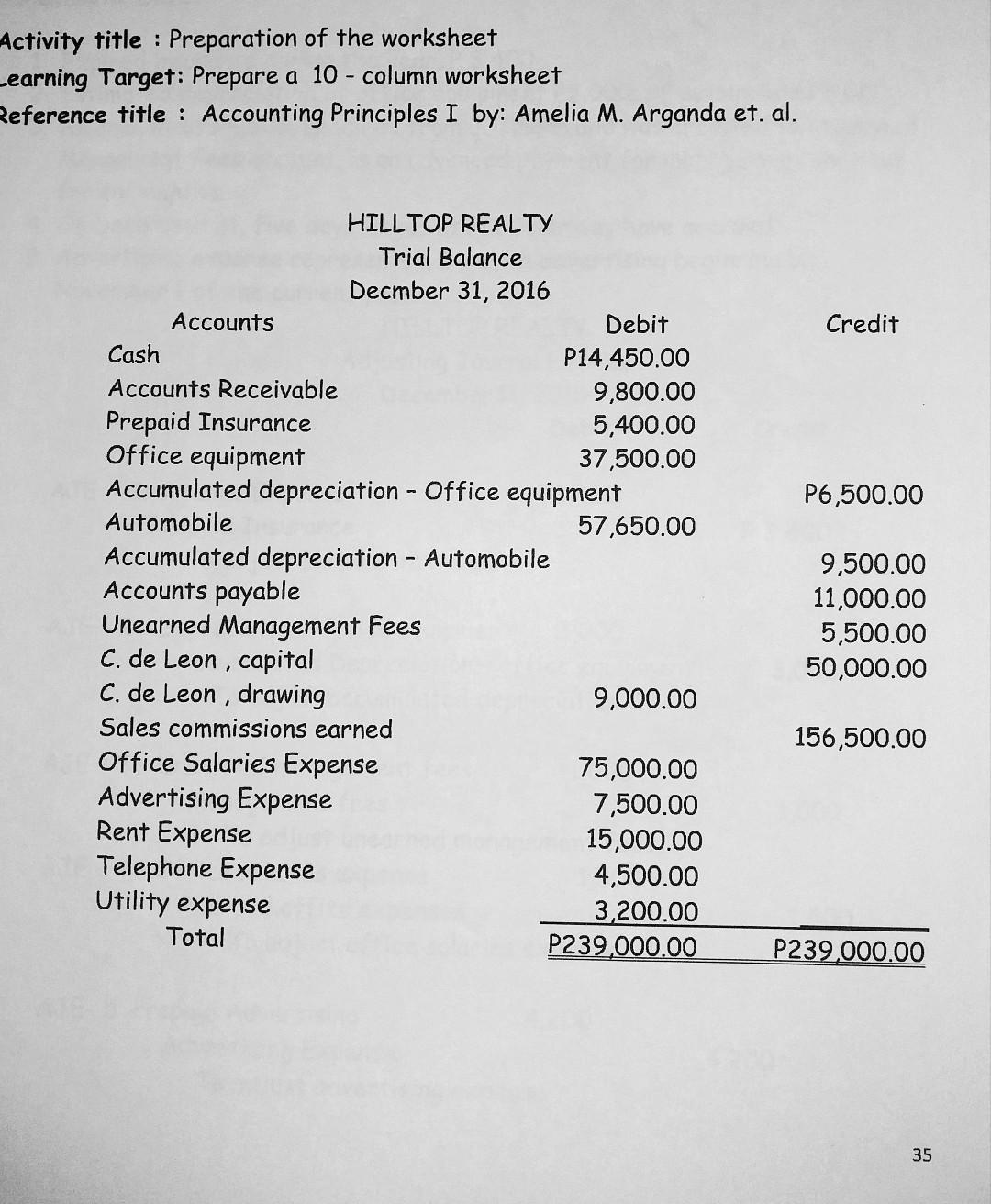

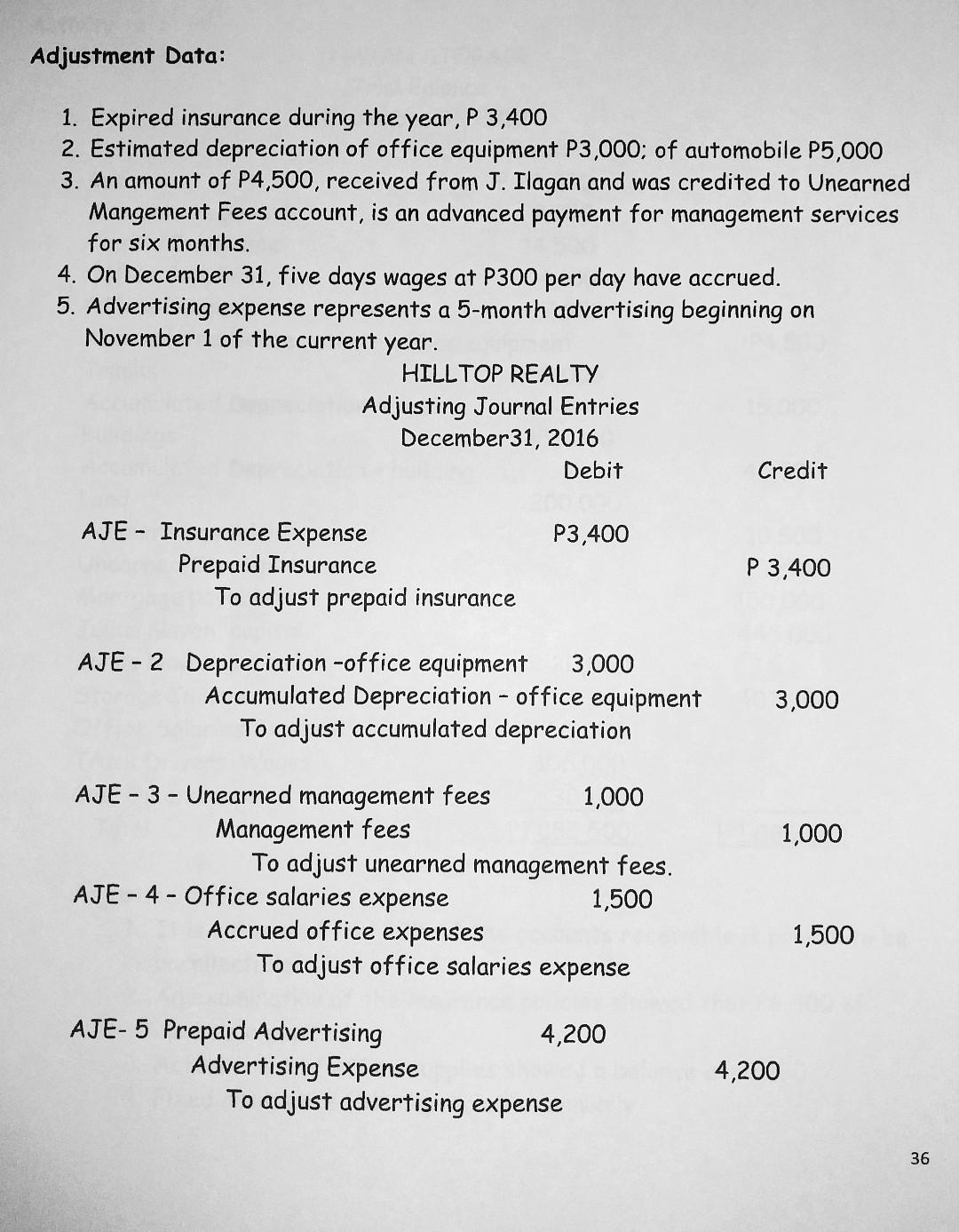

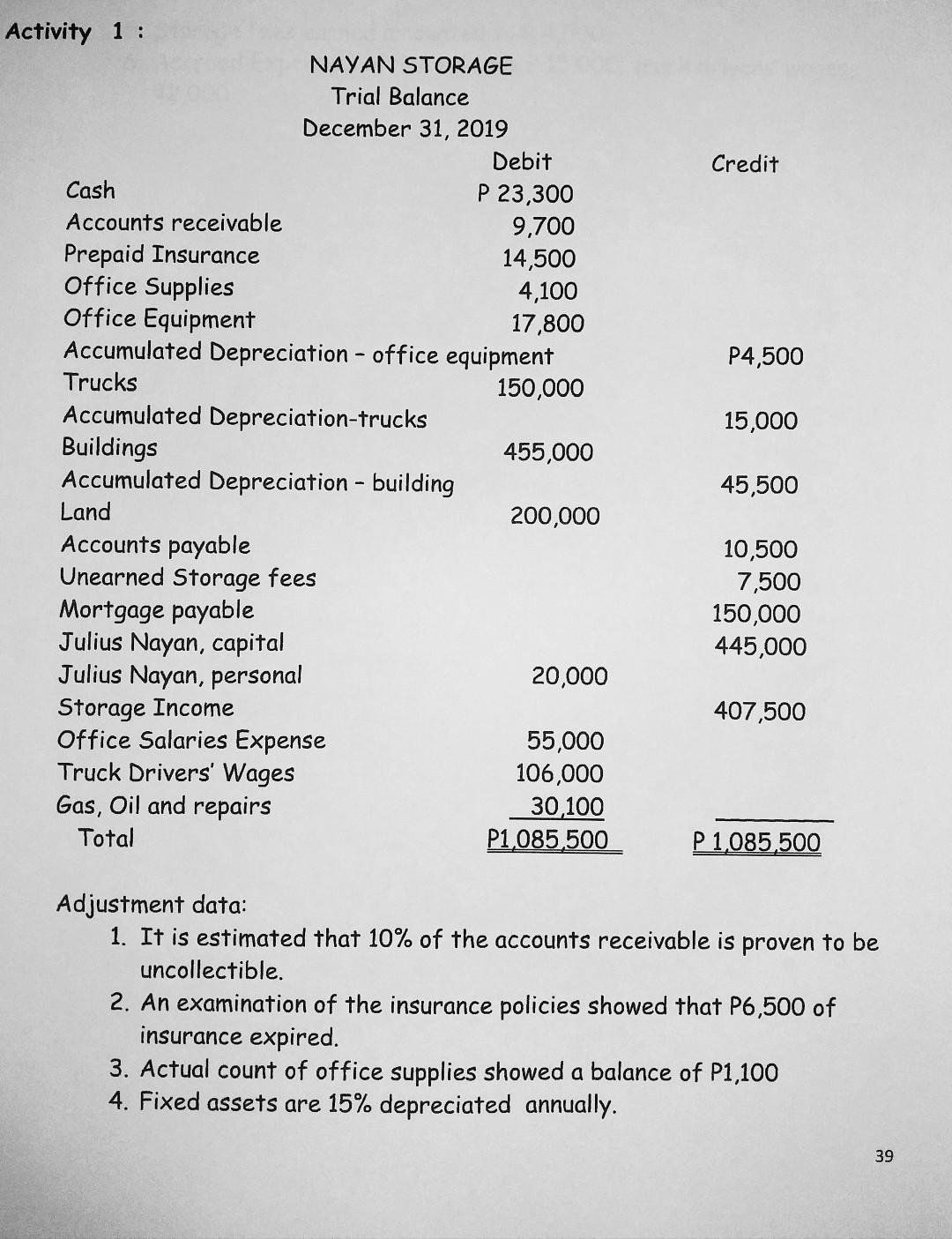

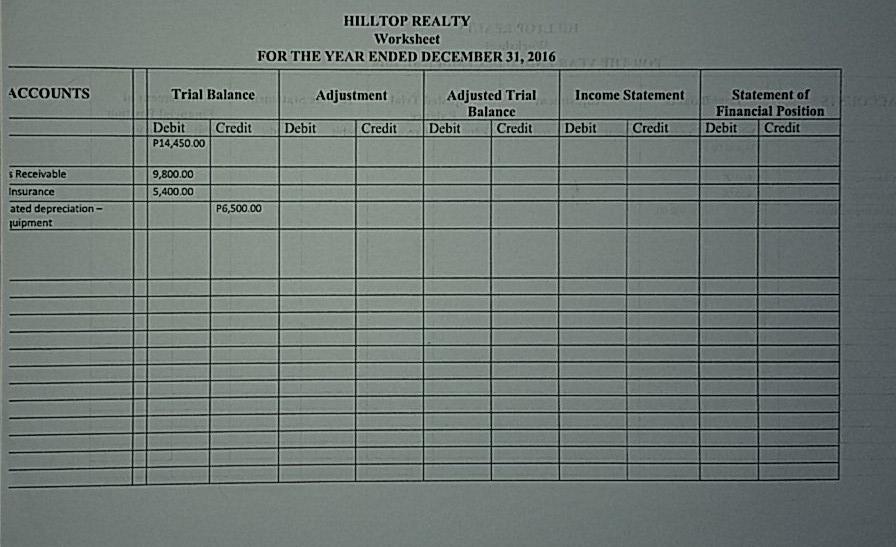

Activity title : Preparation of the worksheet Learning Target: Prepare a 10 - column worksheet Reference title : Accounting Principles I by: Amelia M. Arganda et. al. Credit P6,500.00 HILLTOP REALTY Trial Balance Decmber 31, 2016 Accounts Debit Cash P14,450.00 Accounts Receivable 9,800.00 Prepaid Insurance 5,400.00 Office equipment 37,500.00 Accumulated depreciation - Office equipment Automobile 57,650.00 Accumulated depreciation - Automobile Accounts payable Unearned Management Fees C. de Leon , capital C. de Leon , drawing 9,000.00 Sales commissions earned Office Salaries Expense 75,000.00 Advertising Expense 7,500.00 Rent Expense 15,000.00 Telephone Expense 4,500.00 Utility expense 3,200.00 Total P239,000.00 9,500.00 11,000.00 5,500.00 50,000.00 156,500.00 P239,000.00 35 Adjustment Data: 1. Expired insurance during the year, P 3,400 2. Estimated depreciation of office equipment P3,000; of automobile P5,000 3. An amount of P4,500, received from J. Ilagan and was credited to Unearned Mangement Fees account, is an advanced payment for management services for six months. 4. On December 31, five days wages at P300 per day have accrued. 5. Advertising expense represents a 5-month advertising beginning on November 1 of the current year. HILLTOP REALTY Adjusting Journal Entries December 31, 2016 Debit Credit P3,400 AJE - Insurance Expense Prepaid Insurance To adjust prepaid insurance P 3,400 AJE - 2 Depreciation -office equipment 3,000 Accumulated Depreciation - office equipment To adjust accumulated depreciation 3,000 1,000 AJE - 3 - Unearned management fees 1,000 Management fees To adjust unearned management fees. AJE - 4 - Office salaries expense 1,500 Accrued office expenses To adjust office salaries expense 1,500 AJE-5 Prepaid Advertising 4,200 Advertising Expense To adjust advertising expense 4,200 36 Credit P4,500 Activity 1 : NAYAN STORAGE Trial Balance December 31, 2019 Debit Cash P 23,300 Accounts receivable 9,700 Prepaid Insurance 14,500 Office Supplies 4,100 Office Equipment 17,800 Accumulated Depreciation - office equipment Trucks 150,000 Accumulated Depreciation-trucks Buildings 455,000 Accumulated Depreciation - building Land 200,000 Accounts payable Unearned Storage fees Mortgage payable Julius Nayan, capital Julius Nayan, personal 20,000 Storage Income Office Salaries Expense 55,000 Truck Drivers' Wages 106,000 Gas, Oil and repairs 30,100 Total P1,085,500 15,000 45,500 10,500 7,500 150,000 445,000 407,500 P 1,085,500 Adjustment data: 1. It is estimated that 10% of the accounts receivable is proven to be uncollectible. 2. An examination of the insurance policies showed that P6,500 of insurance expired. 3. Actual count of office supplies showed a balance of P1,100 4. Fixed assets are 15% depreciated annually. 39 5. Storage fees earned amounted to P 4,500. 6. Accrued Expenses; office salaries P 15,000; truck drivers' wages, 42,000 HILLTOP REALTY Worksheet FOR THE YEAR ENDED DECEMBER 31, 2016 ACCOUNTS Trial Balance Adjustment Income Statement Adjusted Trial Balance Debit Credit Statement of Financial Position Debit Credit Credit Debit P14,450.00 Debit Credit Debit Credit s Receivable Insurance ated depreciation - quipment 9,800.00 5,400.00 P6,500.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started