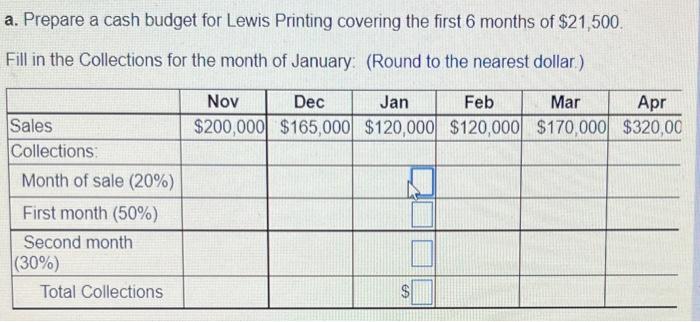

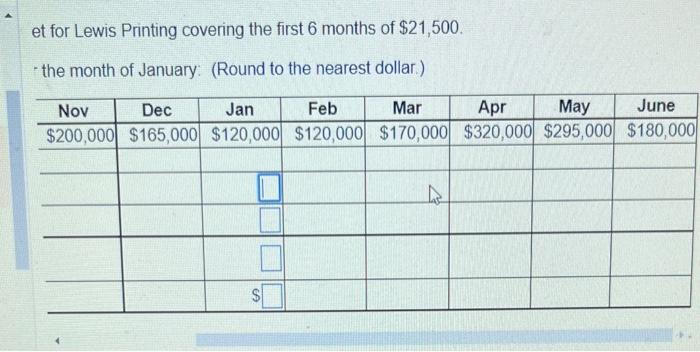

(Preparation of a cash budget) Lewis Printing has projected its sales for the first 8 months of 2016 as follows: Lewis collects 20 percent of its sales in the month of the sale, 50 percent in the month following the sale, and the remaining 30 percent 2 months following the sale. During November and December of 2015, Lewis's sales were $200,000 and $165,000, respectively. Lewis purchases raw materials 2 months in advance of its sales. These purchases are equal to 70 percent of its final sales. The supplier is paid 1 month after delivery. Thus, purchases for April sales are made in February and payment is made in March. In addition, Lewis pays $14,000 per month for rent and $20,000 each month for other expenditures. Tax prepayments of $21,500 are made each quarter beginning in March. The company's cash balance as of December 31,2015 , was $28,000; a minimum balance of $20,000 must be maintained at all times to satisfy the firm's bank line of a. Prepare a cash budget tor Lewis Printing coverng the tirst 6 months of $21,500 Fill in the Collections for the month of January (Round to the nearest dollar.) a. Prepare a cash budget for Lewis Printing covering the first 6 months of $21,500. Fill in the Collections for the month of January: (Round to the nearest dollar) et for Lewis Printing covering the first 6 months of $21,500. the month of January: (Round to the nearest dollar.) (Preparation of a cash budget) Lewis Printing has projected its sales for the first 8 months of 2016 as follows: Lewis collects 20 percent of its sales in the month of the sale, 50 percent in the month following the sale, and the remaining 30 percent 2 months following the sale. During November and December of 2015, Lewis's sales were $200,000 and $165,000, respectively. Lewis purchases raw materials 2 months in advance of its sales. These purchases are equal to 70 percent of its final sales. The supplier is paid 1 month after delivery. Thus, purchases for April sales are made in February and payment is made in March. In addition, Lewis pays $14,000 per month for rent and $20,000 each month for other expenditures. Tax prepayments of $21,500 are made each quarter beginning in March. The company's cash balance as of December 31,2015 , was $28,000; a minimum balance of $20,000 must be maintained at all times to satisfy the firm's bank line of a. Prepare a cash budget tor Lewis Printing coverng the tirst 6 months of $21,500 Fill in the Collections for the month of January (Round to the nearest dollar.) a. Prepare a cash budget for Lewis Printing covering the first 6 months of $21,500. Fill in the Collections for the month of January: (Round to the nearest dollar) et for Lewis Printing covering the first 6 months of $21,500. the month of January: (Round to the nearest dollar.)