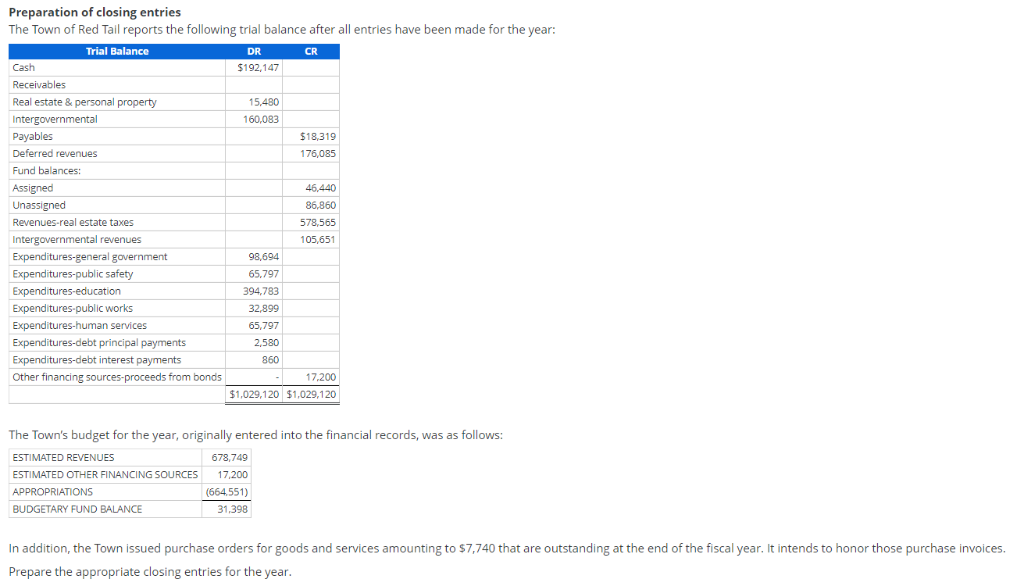

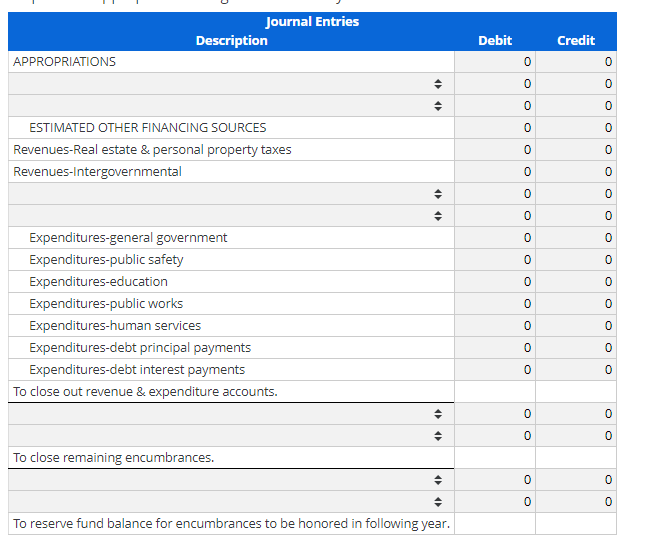

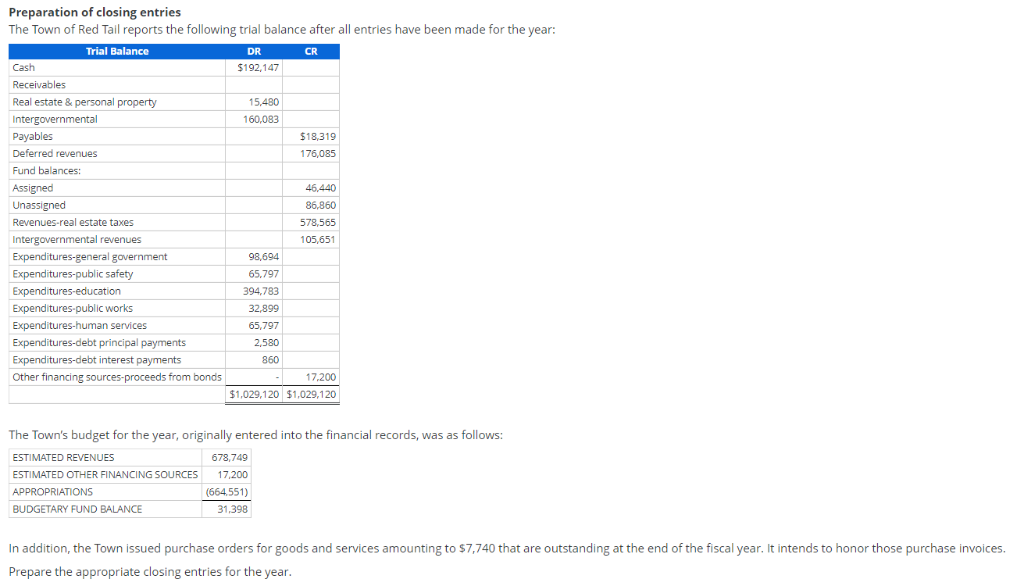

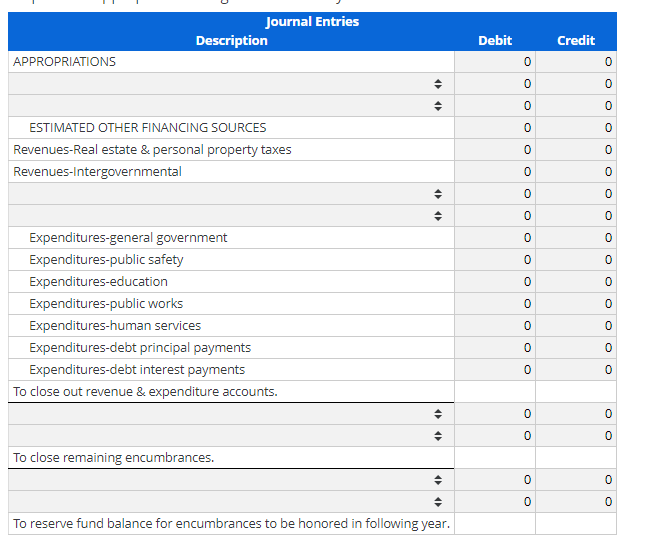

Preparation of closing entries The Town of Red Tail reports the following trial balance after all entries have been made for the year: Trial Balance DR CR Cash $192,147 Receivables Real estate & personal property 15480 Intergovernmental 160,083 Payables $18,319 Deferred revenues 176,085 Fund balances: Assigned 46,440 Unassigned 86.860 Revenues-real estate taxes 578.565 Intergovernmental revenues 105.651 Expenditures-general government 98,694 Expenditures-public safety 65.797 Expenditures-education 394,783 Expenditures-public works 32,899 Expenditures-human services 65,797 Expenditures-debt principal payments 2.580 Expenditures-debt interest payments 860 Other financing sources-proceeds from bonds 17,200 $1,029,120 $1.029.120 The Town's budget for the year, originally entered into the financial records, was as follows: 678,749 ESTIMATED REVENUES 17,200 ESTIMATED OTHER FINANCING SOURCES (664 551) APPROPRIATIONS 200 31,398 BUDGETARY FUND BALANCE In addition, the Town issued purchase orders for goods and services amounting to $7,740 that are outstanding at the end of the fiscal year. It intends to honor those purchase invoices. Prepare the appropriate closing entries for the year. Journal Entries Description Debit Credit APPROPRIATIONS 0 0 0 0 0 ESTIMATED OTHER FINANCING SOURCES 0 0 Revenues-Real estate & personal property taxes 0 0 Revenues-Intergovernmental 0 0 0 0 Expenditures-general government 0 Expenditures-public safety 0 0 Expenditures-education 0 0 Expenditures-public works 0 Expenditures-human services 0 0 Expenditures-debt principal payments 0 C Expenditures-debt interest payments 0 0 To close out revenue & expenditure acc ccounts. 0 0 0 0 To close remaining encumbrances. 0 0 0 To reserve fund balance for encumbrances to be honored in following year. Preparation of closing entries The Town of Red Tail reports the following trial balance after all entries have been made for the year: Trial Balance DR CR Cash $192,147 Receivables Real estate & personal property 15480 Intergovernmental 160,083 Payables $18,319 Deferred revenues 176,085 Fund balances: Assigned 46,440 Unassigned 86.860 Revenues-real estate taxes 578.565 Intergovernmental revenues 105.651 Expenditures-general government 98,694 Expenditures-public safety 65.797 Expenditures-education 394,783 Expenditures-public works 32,899 Expenditures-human services 65,797 Expenditures-debt principal payments 2.580 Expenditures-debt interest payments 860 Other financing sources-proceeds from bonds 17,200 $1,029,120 $1.029.120 The Town's budget for the year, originally entered into the financial records, was as follows: 678,749 ESTIMATED REVENUES 17,200 ESTIMATED OTHER FINANCING SOURCES (664 551) APPROPRIATIONS 200 31,398 BUDGETARY FUND BALANCE In addition, the Town issued purchase orders for goods and services amounting to $7,740 that are outstanding at the end of the fiscal year. It intends to honor those purchase invoices. Prepare the appropriate closing entries for the year. Journal Entries Description Debit Credit APPROPRIATIONS 0 0 0 0 0 ESTIMATED OTHER FINANCING SOURCES 0 0 Revenues-Real estate & personal property taxes 0 0 Revenues-Intergovernmental 0 0 0 0 Expenditures-general government 0 Expenditures-public safety 0 0 Expenditures-education 0 0 Expenditures-public works 0 Expenditures-human services 0 0 Expenditures-debt principal payments 0 C Expenditures-debt interest payments 0 0 To close out revenue & expenditure acc ccounts. 0 0 0 0 To close remaining encumbrances. 0 0 0 To reserve fund balance for encumbrances to be honored in following year